Temperatures Start to Rise Along with Tender Rejections & Rates

Welcome to the week of January 31st edition of the Transfix Take! Gear up for the latest updates and trends in the trucking industry. In this issue, we're revving up with industry news, sprinting through regional breakdown highlights, and putting the spotlight on what's on the horizon for truckers.

Industry Insights: Unpacking the Road Ahead

In this week's edition of Transfix Take, we bring you the latest updates and insights from the world of freight. Co-hosts Justin Maze and Jenni Ruiz share the following highlights and updates:

Severe Weather Delays on the West Coast: In the western part of the country, weather disruptions are impacting 14 out of the top 53 lanes, particularly in states like California, Utah, Colorado, and Washington. According to Scott Pecoriello, the CEO of WeatherOptics, these areas are expected to experience high or extreme weather conditions over the next seven days.

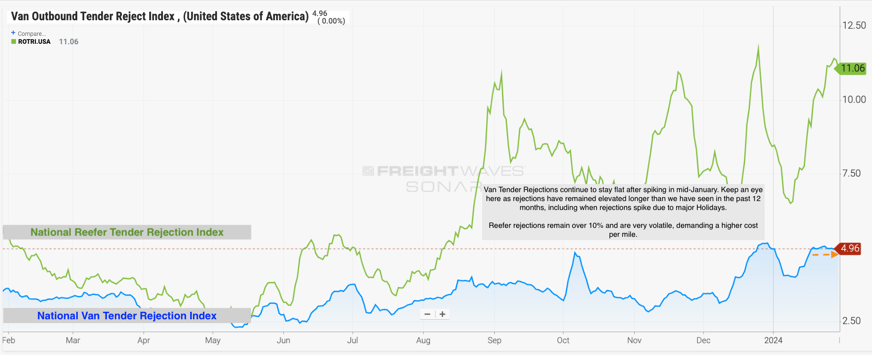

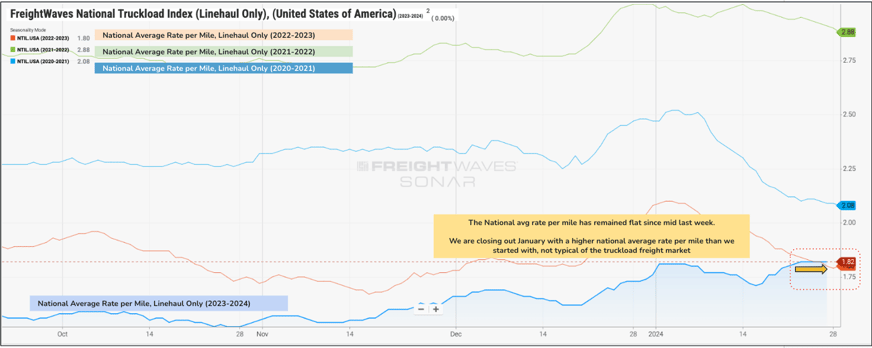

National Average Rate Per Mile and Tender Rejections Holding Steady: Despite a general easing of capacity, Justin Maze notes that tender rejections and the national average rate per mile haven't seen a proportional decrease. Tender rejections for vans are just under 5%, while reefer rejections remain over 10%. Notably, this sustained high level of tender rejections over the past 12 months is uncommon, including the national average rate per mile sitting at $1.82.

Source: Freightwaves

Source: Freightwaves

Regional Roadmap: Where the Rubber Meets the Road

Below is a regional breakdown of the freight industry, uncovering nuances and trends in various regions across the nation.

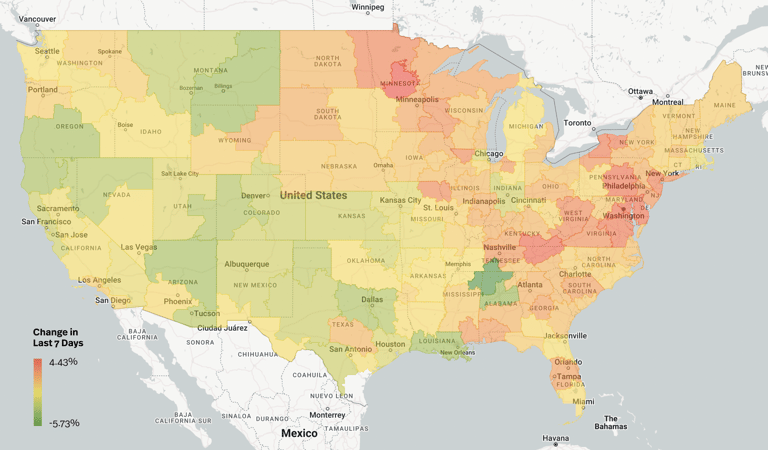

Source: Transfix Internal Data

Source: Transfix Internal Data

The Northeast: The Northeast is still feeling the aftermath of Winter Storm Heather, causing continued pressure on capacity. Markets such as Harrisburg and Elizabeth, New Jersey, have seen significant rate increases. However, as winter weather conditions clear up, rates are expected to rapidly decrease, especially for lanes going to the Midwest and staying within the Northeast.

The Midwest: The Midwest is experiencing more open capacity, with states like Wisconsin, Indiana, and Michigan showing increased availability. The backlog from the past three weeks is gradually clearing, leading to easier freight movement. Volume-driving markets in the Midwest are witnessing significant decreases in tender rejections and rates.

Coastal Region: The Coastal Region is exhibiting a divide, with the Carolinas starting to experience some softening while Virginia and Maryland remain tight. The influence of the Northeast's demand is causing fluctuations in this region, and rates are expected to see the most significant decrease in the coming week.

West Coast: The West Coast continues to see a downward trend in rates, particularly out of California, where shippers are paying less than the previous week. The Pacific Northwest, which experienced tightness due to winter storms, is now loosening up. However, potential disruptions in California, Utah, and Colorado due to severe weather conditions may impact capacity.

The Southeast: As Valentine's Day approaches, the Southeast, especially South Florida, is heating up with increased rates, particularly for freight staying within the state. Rates are expected to continue their upward momentum for the next couple of weeks. The rest of the Southeast, including Atlanta, may see a decline in rates and capacity easing after the end of the month.

The South: Rates across all lengths of hauls in the South are decreasing, with markets like Dallas and Fort Worth experiencing downward pressure. The trend is expected to continue, driven by the winter storms that initially raised rates. Freight originating in the South and going to the Midwest and Northeast will likely see the most significant rate decreases.

Big Bets: What We Predicted for January and Where We Landed

Despite the initial prediction of a significant fall in rates throughout January, unexpected winter weather conditions resulted in rates ending the month higher than anticipated. The impact of the Great Carrier Purge has not been strongly felt yet, with carrier exits remaining relatively unchanged. The upcoming weeks will reveal whether rates continue on a flat line or start to decrease.

When it comes to big bets on the Super Bowl, Justin Maze favors San Francisco, anticipating an exciting game against Kansas City, despite his original rooting for America’s underdog, the Detroit Lions. We’ll see where we land!

Join us next week for an all-new episode where we make some big bets for February. Until then, drive safely.

To make sure you never miss an episode of the Transfix Take podcast, subscribe on Spotify or Apple Music.

DISCLAIMER: All views and opinions expressed in this podcast are those of the speakers and do not necessarily reflect the views or positions of Transfix, Inc., or any parent companies or affiliates or the companies with which the participants are affiliated and may have been previously disseminated by them. The views and opinions expressed in this podcast are based upon information considered reliable but neither Transfix Inc. nor its affiliates nor the companies with which the participants are affiliated warrant its completeness or accuracy, and it should not be relied upon. As such, all views and opinions are subject to change.