March Rates Are Heating Up, But In Which Markets?

Welcome to the week of March 13th edition of the Transfix Take! Gear up for the latest updates and trends in the trucking industry. In this issue, we're revving up with industry news, sprinting through regional breakdown highlights, and putting the spotlight on what's on the logistics horizon.

Industry Insights: Unpacking the Road Ahead

In this week's edition of Transfix Take, we bring you the latest updates and insights from the world of freight. Co-hosts Justin Maze and Jenni Ruiz share the following highlights and updates:

Recovering from Snow & Freezing Temperatures: In collaboration with WeatherOptics, this episode highlights the Top 5 Worst Weather Lanes for the week. These include lanes such as Sacramento to Seattle with the highest driver risk and Seattle to Spokane with the highest shipment delay percentage, largely impacted by recent inclement weather conditions. Here are the top 5:

- Sacramento to Seattle with the highest driver risk

- Salt Lake City to Denver

- Denver to Chicago

- Seattle to Spokane with the highest shipment delay percentage

- Las Vegas to Salt Lake City

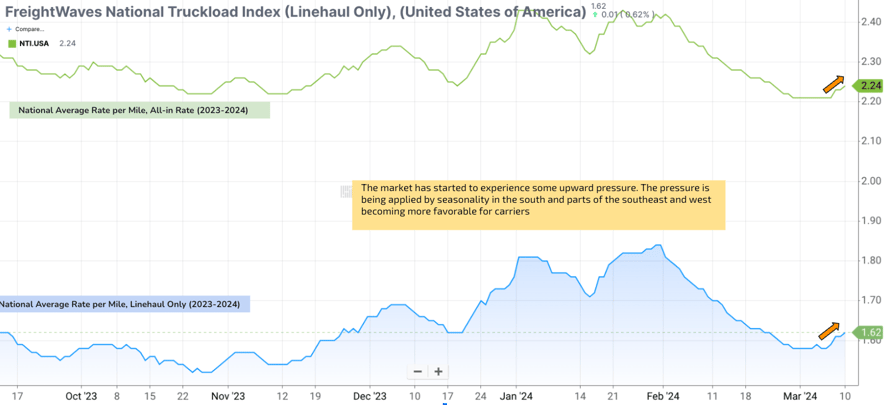

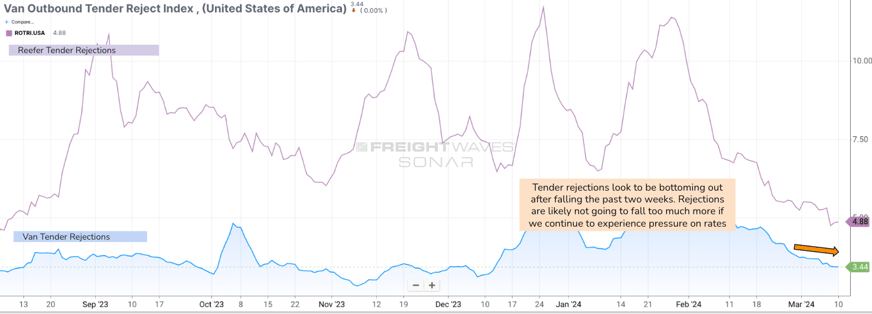

Nationwide Temps Are Heating Up and So Are Markets: Notably, the national average rate per mile is showing an upward trend for the first time since January, now standing at approximately $1.62. While tender rejection rates are decreasing, this trend is expected to slow down as rates start to climb, driven by the onset of produce season. In the Southern region, markets like Dallas and Houston are experiencing increased rates due to rising volumes, particularly in produce shipments.

Source: Freightwaves

Source: Freightwaves

Regional Roadmap: Where the Rubber Meets the Road

Below is a regional breakdown of the freight industry, uncovering nuances and trends in various regions across the nation.

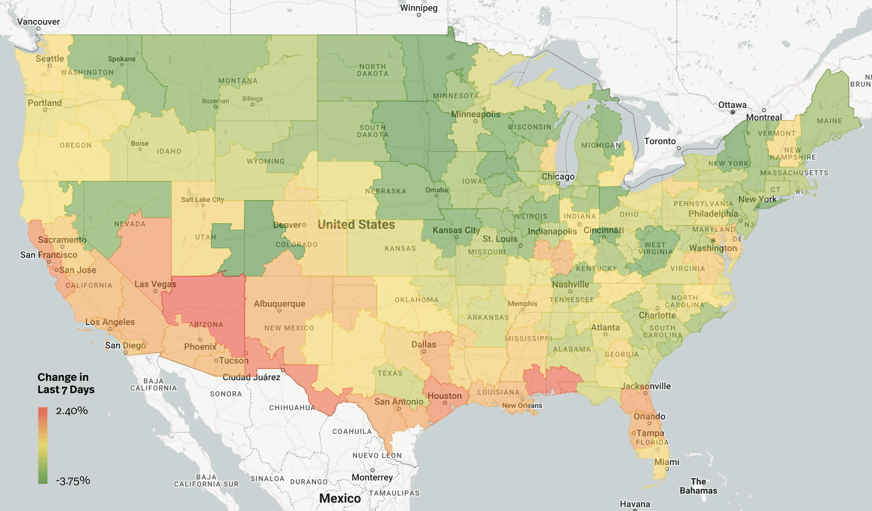

Source: Transfix Internal Data

Source: Transfix Internal Data

South: Markets in the South, especially border markets like Dallas and Houston, are witnessing an upward momentum in rates driven by increased produce volumes. This trend is expected to continue as produce season unfolds and seasonality takes center stage in forthcoming discussions.

West Coast: Despite still relatively low rates, markets such as Los Angeles and Las Vegas are showing signs of improvement. Higher volume markets like Phoenix are also witnessing increased rates, suggesting a gradual tightening of capacity across the region.

Midwest: The Midwest continues to experience declining rates across most lanes, attributed to desirable freight movements towards the South and Southeast. However, reefer rejections are steadily decreasing, indicating limited reefer volume impact on dry van rates in the region.

Southeast: Lakeland and Miami are key markets to watch as they signal the upward momentum in the Southeast. While Florida is experiencing a rise in rates, it remains less attractive for carriers due to comparatively low outbound rates but will certainly be a region to watch as we drive through March.

Northeast: The Northeast is seeing a slowdown in rate declines, particularly in high-volume markets like Harrisburg and Allentown. However, significant upward pressure is not expected until April, following a similar trend to the Midwest.

Coastal Region: Declining rates persist in the coastal region, largely influenced by neighboring market dynamics in the Southeast and Northeast. As capacity shifts towards regions with higher rates, such as the South, rates are expected to stabilize in the coastal region.

The Road Ahead: The MOVE Act Gains Momentum

The introduction of the MOVE Act proposes flexibility in truck weight limits during emergencies, potentially expediting relief efforts during crises like weather events and wildfires. Justin Maze sees this as a positive step for the industry, reminiscent of the relaxation of hours of service regulations during the pandemic, which proved beneficial in alleviating supply chain bottlenecks. While acknowledging the need for broader industry reforms, Maze believes the MOVE Act could provide significant aid in times of need, if passed.

Join us next week for an all-new episode as we drive our way through March. Until then, drive safely.

To make sure you never miss an episode of the Transfix Take podcast, subscribe on Spotify or Apple Music.

DISCLAIMER: All views and opinions expressed in this podcast are those of the speakers and do not necessarily reflect the views or positions of Transfix, Inc., or any parent companies or affiliates or the companies with which the participants are affiliated and may have been previously disseminated by them. The views and opinions expressed in this podcast are based upon information considered reliable but neither Transfix Inc. nor its affiliates nor the companies with which the participants are affiliated warrant its completeness or accuracy, and it should not be relied upon. As such, all views and opinions are subject to change.