A Spot Spike That Won’t Last for Thanksgiving

Welcome to the week of November 8th edition of the Transfix Take! Gear up for the latest updates and trends in the trucking industry. In this issue, we're revving up with industry news, sprinting through regional breakdown highlights, and putting the spotlight on what's on the horizon for truckers.

Industry Insights: Unpacking the Road Ahead

In this week's edition of Transfix Take, we bring you the latest updates and insights from the world of freight. Our market expert, Justin Maze, and Jenni Ruiz, share the following highlights and updates:

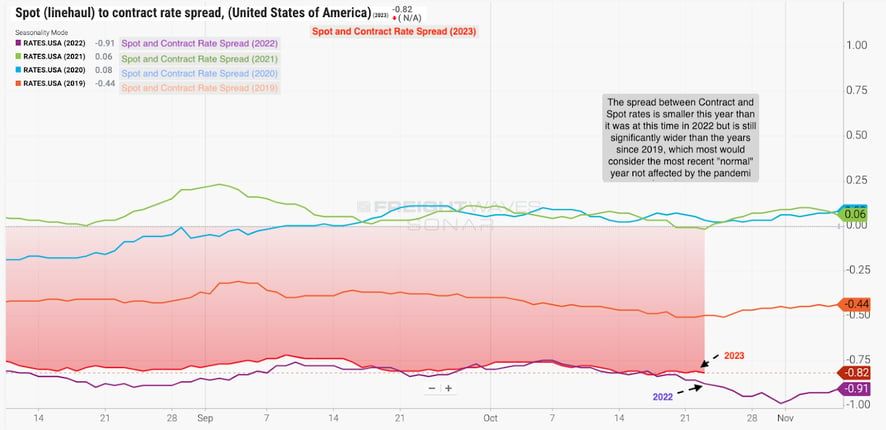

Market Rate Overview: As of this week, the national average rate per mile is holding steady at approximately $1.50 per mile for line haul only. The market continues to show signs of stagnation.

Source: Freightwaves

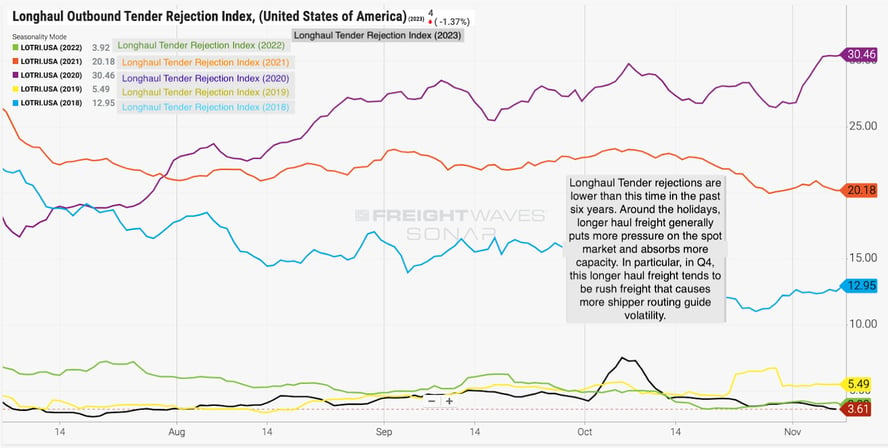

Tender Rejections & Length of Haul: Tender rejections continue to decrease, with rates at just over 3% (3.1%), and there's a possibility of them dropping below 3% soon. Another crucial insight provided by Maze is the importance of monitoring volume by length of haul. As rail prices decrease, shippers are increasingly choosing rail transport for longer hauls to cut costs. This decision leads to a surplus of capacity in the market because truck drivers spend less time on each shipment, allowing them to handle multiple shorter hauls within the same timeframe it takes for a cross-country delivery. Consequently, shippers may experience favorable conditions for shorter hauls as carriers seek to fill the gap left by rail transport. This shift in trend has the potential to affect capacity, favoring shorter hauls, as the available capacity can move more freight over longer distances.

Source: Freightwaves

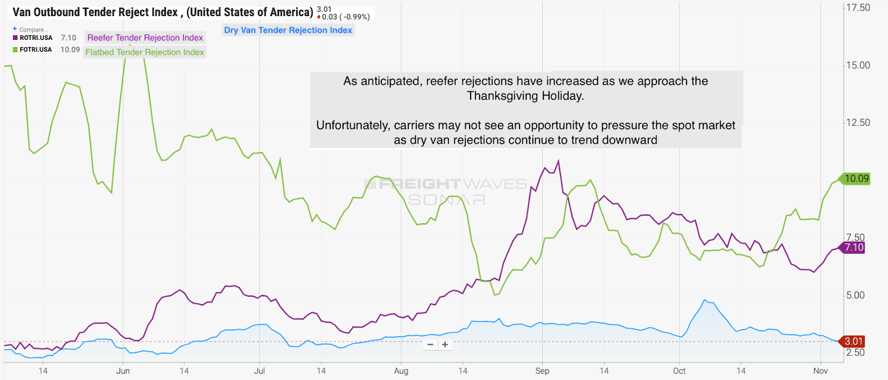

Reefer Volatility: The holiday season is fast approaching, and one noteworthy trend to watch is reefer volatility. Reefer rejections are increasing, and this could lead to cost increases, especially around Thanksgiving, due to high demand for reefer capacity during the holidays.

Source: Freightwaves

Fuel Costs: On a positive note, there was a noticeable decrease in fuel costs for shippers and carriers. This is a significant win for both sides, given that fuel costs are among the highest operating expenses.

Regional Roadmap: Where the Rubber Meets the Road

Below is a regional breakdown of the freight industry, uncovering nuances and trends in various regions across the nation.

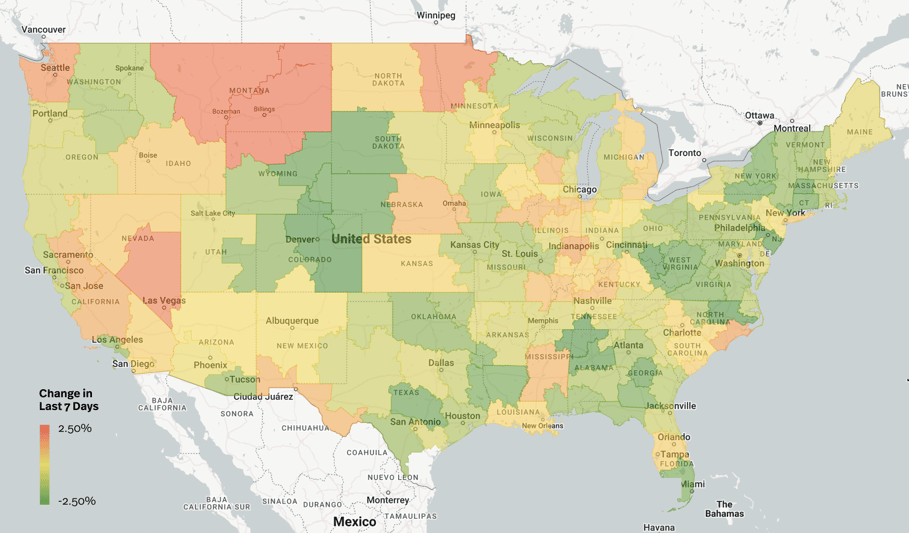

Source: Transfix Internal Data

West Coast: The West Coast stands out as the only region with rate increases--in aggregate about 1% from last Monday to this Monday and a 6% increase over the last 60 days highlighting the upward trend. The higher volume markets like Los Angeles, Phoenix, and Portland, however, are not driving these increases

Midwest Region: The Midwest is showing some signs of pressure with shippers having difficulty sourcing capacity for freight going to the South and Southeast giving carriers a bit more negotiating power.

Northeast: Freight originating from the Northeast continues to experience minimal change, with Philadelphia being an exception as rates decline at a rapid rate.

Coastal Region: The Coastal region is experiencing some modest increases, primarily for local and city freight. However, these increases are not substantial.

Southeast Region: Rates are decreasing in most markets in the Southeast, with only a couple of exceptions such as Jackson, Mississippi, and Lakeland, Florida, where rates have increased slightly.

The South: Similar to other regions, the Southern region is also experiencing a consistent decrease in rates. Some remote markets have seen slight increases, primarily for local freight.West Coast: The West Coast stands out as the only region with rate increases--in aggregate about 1% from last Monday to this Monday and a 6% increase over the last 60 days highlighting the upward trend. The higher volume markets like Los Angeles, Phoenix, and Portland, however, are not driving these increases

On the Horizon: What Lies Ahead in the Trucking Terrain

Looking ahead, several important factors and trends were discussed:

Thanksgiving Trends: While Thanksgiving usually brings about volatility in the market, this year might be an exception. Previous holidays, like Labor Day, did not significantly impact rates or tender rejections. The market remains stagnant, and substantial changes may not occur during Thanksgiving.

Q1 and Beyond: If carriers are unable to exert pricing power in the spot market over the holidays, the prospects for Q1 do not appear much brighter. Historically, Q1 is a low-volume period, and with the Lunar New Year causing a reduction in imports, it could be challenging for carriers.

The Next Transfix Take On: The upcoming Transfix Take On episode will feature Bill Cassidy from the Journal of Commerce. The discussion will revolve around his outlook on the market, what's happening in other segments of the industry, such as LTL (Less-Than-Truckload), and provide valuable insights into what's ahead.

Stay tuned for our next newsletter for more in-depth insights and discussions on the trucking industry's current state and what we can expect in the coming weeks and months. We'll be back next week with more insights and updates to keep you informed.

Drive safely!

DISCLAIMER: All views and opinions expressed in this podcast are those of the speakers and do not necessarily reflect the views or positions of Transfix, Inc., or any parent companies or affiliates or the companies with which the participants are affiliated and may have been previously disseminated by them. The views and opinions expressed in this podcast are based upon information considered reliable but neither Transfix Inc. nor its affiliates nor the companies with which the participants are affiliated warrant its completeness or accuracy, and it should not be relied upon. As such, all views and opinions are subject to change.