Carrier Capacity Continues to Outweigh Demand

Welcome to the week of October 4th edition of the Transfix Take! Gear up for the latest updates and trends in the trucking industry. In this issue, we're revving up with industry news, sprinting through regional breakdown highlights, and putting the spotlight on what's on the horizon for truckers.

Industry Insights: Unpacking the Road Ahead

Carrier Capacity: A Balancing Act

The state of carrier capacity remains a pivotal focal point in the current freight landscape. As discussed by our market expert, Justin Maze, the industry finds itself in a delicate equilibrium where carrier capacity significantly outweighs demand. Traditionally, the final quarter of the year often ushers in anticipated volatility, but this year, it's a different story.

The overwhelming surplus of carrier capacity has left market experts and industry players grappling with a unique set of challenges. There are no immediate signs of this situation changing anytime soon. This imbalance continues to shape the strategies and decisions of shippers and carriers alike, reshaping the dynamics of the market. Simply put: We continue to watch how this will play out, on rates, volume, capacity, and the ecosystem.

Q4 Spot Market: A Departure from Tradition

In this unprecedented year, the Q4 spot market appears to be taking a different trajectory compared to what we would typically expect should we compare to more normal seasonality with 2019 numbers in mind. Unlike the traditional ramp-up in volatility, this year, things have diverged significantly from the norm. While this quarter typically witnesses heightened market activity, 2023 offers a stark contrast. Rates continue to remain stable (though quite low), yet uncertainty prevails as we enter the final quarter of the year.

A Look at Average Rate Per Mile & Tender Rejections

Source: Freightwaves

There was a slight but notable increase in the average national rate per mile. It moved from $1.55 per mile at the lowest point last week to $1.58 per mile this week. This shift reflects an increase of approximately 1.9% over the course of the week. The industry has been operating within a tight five-cent radius, showcasing remarkable rate stability. Note that there continues to be an ongoing decline in national average tender rejections. This trend has persisted since the Labor Day holiday weekend. As of the latest analysis, tender rejections continued their downward trajectory, indicating a decrease in unaccepted offers by carriers.

Source: Freightwaves

Regional Roadmap: Where the Rubber Meets the Road

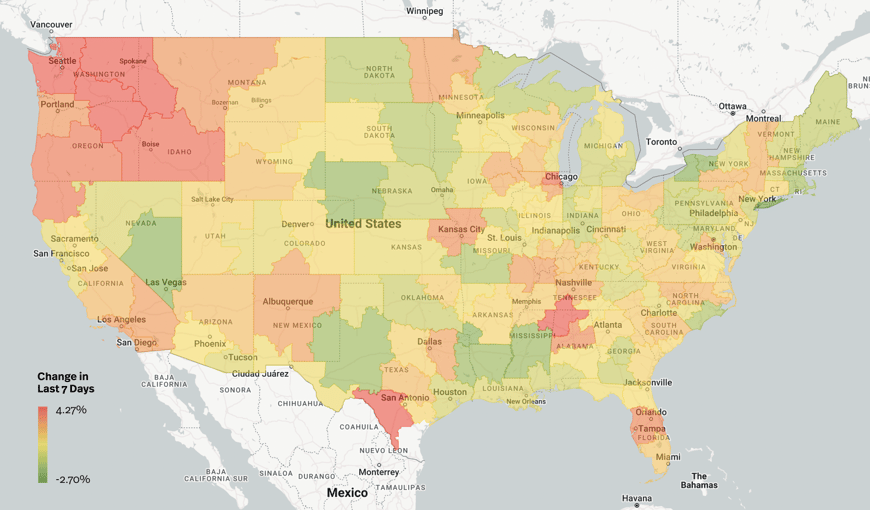

Below is an in-depth regional breakdown of the freight industry, uncovering nuances and trends in various regions across the nation.

Source: Transfix Internal Data

West Coast: The West Coast, particularly the Pacific Northwest, has witnessed significant rate increases over the past week. Specific markets, including Washington—Seattle, and Spokane, have experienced impressive growth, with rate increases of over 4% in just one week. Markets like Los Angeles and Ontario, known for high volumes, have also seen meaningful growth, with rates increasing by more than 2% from the previous week.

The Midwest: Maze's analysis uncovers a slight increase in freight rates in the Midwest. Specific markets, including Chicago, Illinois; Juliet, Illinois; and Kansas City, Missouri, are commanding higher rates, with an average increase of over 2%.

The Northeast: The Northeast region remains relatively stagnant, with larger volume markets, such as Harrisburg, Pennsylvania, and Elizabeth, New Jersey, experiencing minimal week-over-week changes.

Coastal and Southeast Regions: These regions have seen slight rate increases over the past week, although it is expected that these gains will be absorbed by shippers in the coming week.

The South: Similar to the Coastal and Southeast regions, the South experienced gains, particularly in markets like Laredo, Texas. However, larger volume markets, including Houston and Dallas, are anticipated to revert to shippers in the next week.

On the Horizon: What Lies Ahead in the Trucking Terrain

As we look ahead, it's important to consider potential disruptions in the trucking terrain. Weather events, such as hurricanes, can significantly impact freight markets in the South and Southeast. Additionally, while snow events are not yet on the radar, they can disrupt freight movement in the Midwest and Northeast, affecting rates and capacity.

The holiday seasonality, particularly Thanksgiving, Christmas, and New Year, is expected to influence rates and demand. However, the ongoing United Automotive Workers Union strike is also a significant factor to watch, as it could lead to more favorable conditions for shippers by putting more capacity into the spot market so as to avoid strike-affected regions.

That's the wrap for this edition of the Transfix Take Newsletter. We'll continue to keep you in the driver's seat with the latest news, trends, and insights in the supply chain. Until the next pit stop, drive safe and stay ahead of the curve!

Drive safely!

DISCLAIMER: All views and opinions expressed in this podcast are those of the speakers and do not necessarily reflect the views or positions of Transfix, Inc., or any parent companies or affiliates or the companies with which the participants are affiliated and may have been previously disseminated by them. The views and opinions expressed in this podcast are based upon information considered reliable but neither Transfix Inc. nor its affiliates nor the companies with which the participants are affiliated warrant its completeness or accuracy, and it should not be relied upon. As such, all views and opinions are subject to change.