Goods need to move faster than ever, but trucking isn’t keeping up. From supply chain experts to media, everyone’s blaming a record-high driver shortage. But it’s not that simple. In this original whitepaper, Transfix pulls back the curtain on an assumption that’s holding back best-in-class shipping—and an entire industry.

Trucking Matters, but There Are Pressing Industry Challenges

Trucking is the undisputed backbone of the American economy—the $700 billion industry moves nearly 70% of the country’s freight tonnage, and for financial experts, it’s a leading indicator of the country’s economic health. The baseline assumption has long been the same: if trucks are moving more freight, companies are producing more goods, and consumers have more spending power. But there’s another key economic concept at play: supply and demand fundamentals. With higher consumer expectations around shipping speeds, increased global competition and omni-channel retailing, shippers nationwide face imposing challenges. Confounding this is a record-high shortage of current and prospective drivers, a top-of-mind problem for most shippers as freight demand continues to surpass supply, and transportation costs rise in response.

THE DIMINISHING TRUCK DRIVER POOL

The average truck driver is 55 years old, with most soon approaching retirement. The American Transportation Research Institute projects 175,000 open spots by 2026, and given lifestyle and values concerns, few Millennials are in the pipeline for the profession.

Capacity Crunch: More than Meets the Eye

Tales of the direct impact the driver shortage has on shippers abound in the media: Companies like General Mills (Haagen-Dazs, Cheerios) attributed cutting 625 jobs by the end of 2019 to rising commodity and freight expenses.3 According to The Wall Street Journal and Fox Business, major food giants—Mondelez International (Cadbury, Nabisco, Trident), Hershey Co, Nestle SA, and Coca-Cola Co—all planned to hike 2019 North American prices, passing the burden of rising ingredient and transportation costs onto retailers and consumers. Reliance on last-minute, higher-cost shipping has also significantly increased. Last summer, Freightwaves reported that General Mills had to quadruple its spot freight in just one quarter.

While the impact of the shortage is felt industry-wide, the problem is more complex than it seems. In fact, adding more drivers is just one piece of the solution. It’s also crucial to address the inefficiencies throughout the supply chain that impede the smart utilization of existing drivers and their trucks.

“While we were climbing the hill, the grade steepened and now we are estimating the full-year impact to be roughly $250 million. {We} cannot subsidize the increased freight.” -Thomas Hayes, Former CEO of Tyson Foods

Solve a Complex Problem with Better Experiences and Data

Taking a deeper look, it’s clear that there’s more to the shortage than meets the eye. First, rampant lifestyle and work issues significantly reduce drivers’ satisfaction, health and productivity. Without addressing the driver experience, adding more headcount won’t solve anything, especially for potential Millennial truckers, who place a high premium on employee engagement and experience.

Shippers also don’t typically have access to the actionable data that would allow them to significantly improve productivity and reduce costs, even with a shortage of drivers. Low adoption of the right technology limits network visibility and reduces efficiency at facilities. It also stands in the way of solving common driver pain points.

Shippers are singularly poised to drive change in the marketplace, but without proper insights, many fall short. In order to succeed in this competitive environment, shippers must act now to improve the driver experience and build trust, in turn improving their own performance. The answer lies in a combination of human and data-based insights, with new capabilities employed to improve this relationship on both sides. When drivers win, shippers share in the victory.

Truckers Talk: Hear Firsthand from Drivers

Listening to the direct experience of drivers is the first key to incisively addressing the current industry problems. At Transfix, we’re partnering with thousands of carriers, and innovating to solve their most pressing concerns. Wasted miles is another issue that is particularly catastrophic for the industry. Too often, deliveries are made with no return consideration, leaving the driver with empty miles and no compensation for time, fuel, or vehicle wear and tear. Nearly 15-20% of miles are driven with empty trailers, or “dead-head.” According to Transfix, this adds up to 65 billion empty miles annually.

TOP DRIVER CHALLENGES

- Reduced Income Potential: Average salary is 45,000 – 50% lower than they were in the 1970s when adjusted for inflation.

- Highway Congestion: Highway delays equate 1.2 billion hours of lost productivity, which equates to 425,533 commercial truck drivers sitting idle for a working year.

- High Wait Times: 63% of drivers are detained three or more hours at shipper docks each time they arrive to load and unload.

- Lack of Accessible & Safe Parking: Truck drivers are often forced to park at unsafe locations, such as on the shoulder of the road, exit ramps, or vacant lots.

- Electronic Log Devices (ELDs): 7 out of 10 drivers saw a decrease in hours on the road, and 42% saw a decrease in privacy.

“When they started the ELD aspect, they looked at it from the driver perspective and assumed that all of that time would be spent actually driving. They didn’t consider all of the waiting that actually happens at the facility.” -Sterling, Sterling Lockett Trucking

Drivers and Shippers: Partnered for Success

Shippers who acknowledge where – and how – they can be a better partner to drivers will be the ultimate winners. Best-in-class shippers like Unilever are starting to raise the bar, offering experience-enhancing amenities like break rooms and on-site parking. Implementing these type of improvements involves thinking about truckers’ holistic journey: What obstacles do they face throughout the course of a shift? Which changes can be operationalized to ensure real impact?

“My favorite two places in the world are church and Unilever’s Newville facility. Everybody is very friendly. You’re able to park your truck, use the bathroom… no one is looking at you or questioning you either.” -Ramon, Elias Transport

CREATE A BETTER END-TO-END CARRIER EXPERIENCE

- Educate Staff: Train staff to treat truckers as part of the team, and incorporate driver feedback into performance reviews

- Improve Amenities: Improve facilities with access to bathrooms, water/snacks, WIFI, list of nearby amenities (rest stops, truck parking, hotels, restaurants)

- Share Materials: Leverage purchasing power for truckers’ materials to help them secure/brace loads for transit (e.g., extra cardboard, blankets, bubble/shrink wrap)

- Offer Incentives: Offer gas cards, meal coupons, calling cards, etc. Where relevant, gift product samples, coupons and branded merchandise

- Pay Faster: Shorten payment cycle (either direct or via a company like Transfix that offers carrier quick pay)

Embrace the Transformative Power of Data

A commitment to acknowledge and address day-to-day carrier challenges is the first step to eliminating unnecessary delays and costs. But to go to the next level, shippers also need to leverage data-driven insights that further illuminate broken areas – or black holes – in the transport segment of their supply chain.

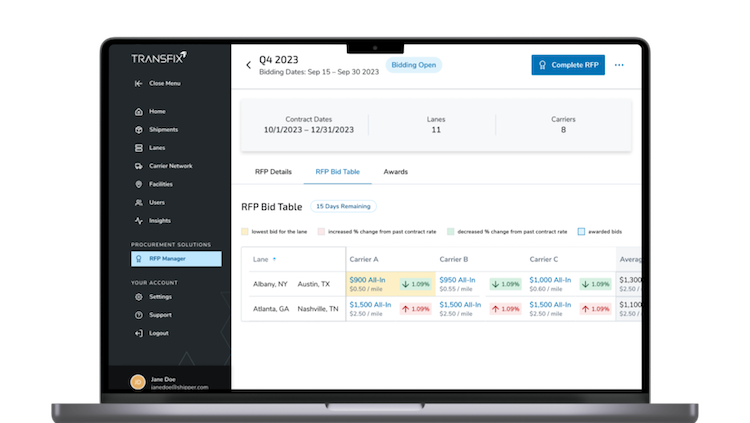

Digital freight companies like Transfix provide this much-needed transparency, so shippers can go even deeper in solving key challenges. With sophisticated technology, shippers receive quantitative and qualitative data points that allow for a deeper level of analysis—and inherently more impactful outcomes. Here are a few examples of how shippers are using data-driven insights to solve for driver pain points.

An Open Call for Best-in-Class Shippers

With all the media buzz and rapidly changing market, the dire shortage of truckers has become an easy scapegoat – and explanation – for increasingly complex industry challenges around supply/ demand, competition and consumer expectations.

The shippers who rise to the top in this environment will be the ones that acknowledge and tackle the crucial root causes. Best-in-class shippers are rebuilding their carrier relationships and creating a “seat at the table” for their drivers’ voices to be heard. They are also committed to adopting technology that captures data about the driver experience and network, then incorporating that feedback into their supply chain strategy.

Ultimately, while this requires a commitment to meaningful operational change, it’s a worthy goal. Shippers who do so will be the ultimate winners.

Transfix is the leading digital freight marketplace inspiring a better future for transportation in the $700 billion U.S. trucking industry. Backed by a best-in- class team of data scientists, artificial intelligence experts, and transportation professionals, we’re fixing manual inefficiencies that lead to frustration and wasted time and money for shippers and carriers.

Our business model is simple – Transfix connects shippers with reliable carriers better than anyone else.

Sources

1 American Trucking Associations (ATA): the trucking industry has over $700 billion in revenue ($700.3 billion in 2017); up 3.5 percent from $676.6 billion in 2016.

2 ATA: Nearly 71% of all the freight tonnage moved in the U.S. goes on trucks.

3 FreightWaves: July 2, 2018; Maria Baker: Citing freight costs, declining sales, General Mills to cut 625 jobs.

4 Wall Street Journal: October 29, 2018; Annie Gasparro: Mondelez Will Raise Prices Next Year.; Fox Business: October 31,2018; Jade Scipioni: Food Prices are Going Up Next Year.

5 FreightWaves: July 2, 2018; Maria Baker: Citing freight costs, declining sales, General Mills to cut 625 jobs.

6 Bureau of Labor Statistics (BLS): The average salary is $45,000 per year.

7 http://atri-online.org/wp-content/uploads/2018/10/ATRI-Top-Industry-Issues-2018.pdf

8 DAT Solutions July 2016: 63% of drivers are actually detained three or more hours at shipper docks every time they arrive.

9 KENCO/CarrierLists State of the Profession in 2018: Impact over electronic logging devices (ELDs).

10 ATRI 2018 Study: Truckers often end up driving empty trailers. Nearly 15-20% of miles are driven with empty trailers, or “dead-head.”