The Key to BTS Success Requires Proactively Securing Capacity Ahead of the Holiday Seasons Ahead

Back-to-school usually marks the beginning of a peak freight season. Summer freight volumes continue to stay at their highest levels, with markets in the Northeast and Midwest heating up much sooner than expected. Imports on both U.S. coasts are repeatedly setting records, and the West Coast is still digging out from its widely reported backlog. All that freight coming into the ports likely contains an abundance of back-to-school (BTS) supplies and related items. They need to move — if they’re sitting at the ports, they are not on store shelves and the back-to-school season is quickly approaching.

Shoppers with kids in elementary through high school are projected to spend an average of $850 on BTS supplies, according to the National Retail Federation (NRF). College BTS spending is expected to reach $1,200 per family.

High spending, low inventory

“All our retail and CPG-related shippers are showing marked load increases to support BTS demand,” says Shane Duncan, vice president of shipper solutions at Transfix. “This is similar across the industry, as product must be on the shelf for consumers to get what they need. With many schools and colleges starting in person this year, the demand is even higher for school supplies and dorm essentials.”

Shoppers with kids in elementary through high school are projected to spend an average of $850 on BTS supplies, according to the National Retail Federation (NRF). College BTS spending is expected to reach $1,200 per family. But this increased demand is coming up against global shipping delays, which translates to shortages on store shelves — both physical and digital. The delayed shipments will continue to affect retailers’ ability to replenish inventory later in the season.

“While we are unlikely to see apocalyptic shortages, the continued pressure on supply chains means that not all retailers will get an optimal amount of supply,” Neil Saunders, managing director of consultancy GlobalData Retail, told USA TODAY. “What this means is consumers will have less choice, and some may not be able to get exactly what they want, especially toward the end of the back-to-school season.”

The most popular BTS spending categories, according to the NRF, are electronics, clothing and shoes. These items are facing additional supply-chain roadblocks, including pandemic-induced factory closures in Asia that are fueling both sneaker and semiconductor shortages.

Deloitte’s 2021 survey of 1,200 parents who have at least one child attending school in grades K–12 this fall reports that BTS shopping is expected to rise 16% year over year.

Accelerated peak season

Deloitte’s 2021 survey of 1,200 parents who have at least one child attending school in grades K–12 this fall reports that BTS shopping is expected to rise 16% year over year. Among the findings is a decided acceleration of the BTS shopping season — traditionally early July through early September — more families have finished their shopping before August, due to anticipation of pandemic disruptions that may cause stock-outs if they wait. In 2021, 59% of total back-to-school spend was expected to be completed by the end of July; that number was 45% in 2020.

What’s a retailer to do?

Bottlenecks from an accelerated BTS season are likely to flow into upcoming holidays. Savvy retailers are already working to entice holiday consumers to shop pre-peak, so they can better manage their supply chain — and avoid peak premiums, surcharges and even caps that may be imposed down the road.

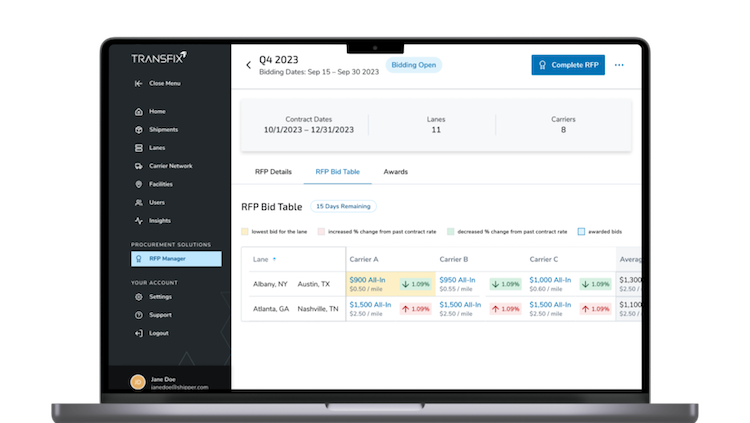

“The holiday season has already started — we’ll see a surge in early Q4 and then expect it to taper off in December,” Duncan says. “This creates pressure on capacity, which pushes shippers to rely on the spot market versus negotiated contract rates. The past 18 months have seen some of the highest tender-rejection rates, as carriers look for better paying loads on the spot market. This can render a routing guide ineffective and put added pressure on logistics teams to find capacity without breaking the budget. Shippers should work with their freight partners and carriers to ensure there is available capacity to get the orders off the dock and headed toward their destinations.”

“To maximize transportation options at this point, it’s all about consolidation and looking at multi-stop scenarios with existing capacity,” says Carly Gunby, enterprise sales director for Transfix. “The key to shipping success right now is being able to partner with a 3PL, such as Transfix, which has a vast network of existing capacity already moving around the country. Retailers can take advantage of that and hop onto our network.

“Forecasting is going to be key for shippers to understand what they have, what’s sitting where and how to prioritize getting it to where they need it. For back-to-school through the end of the year, consolidations and partnerships are what will keep everything moving for carriers, shippers and consumers.”