Nearly a decade ago, digital freight brokerages began automating old manual processes of matching trucks to loads using spreadsheets and phone calls. But in the worlds of technology, culture, and consumer behavior, plenty can change in a decade.

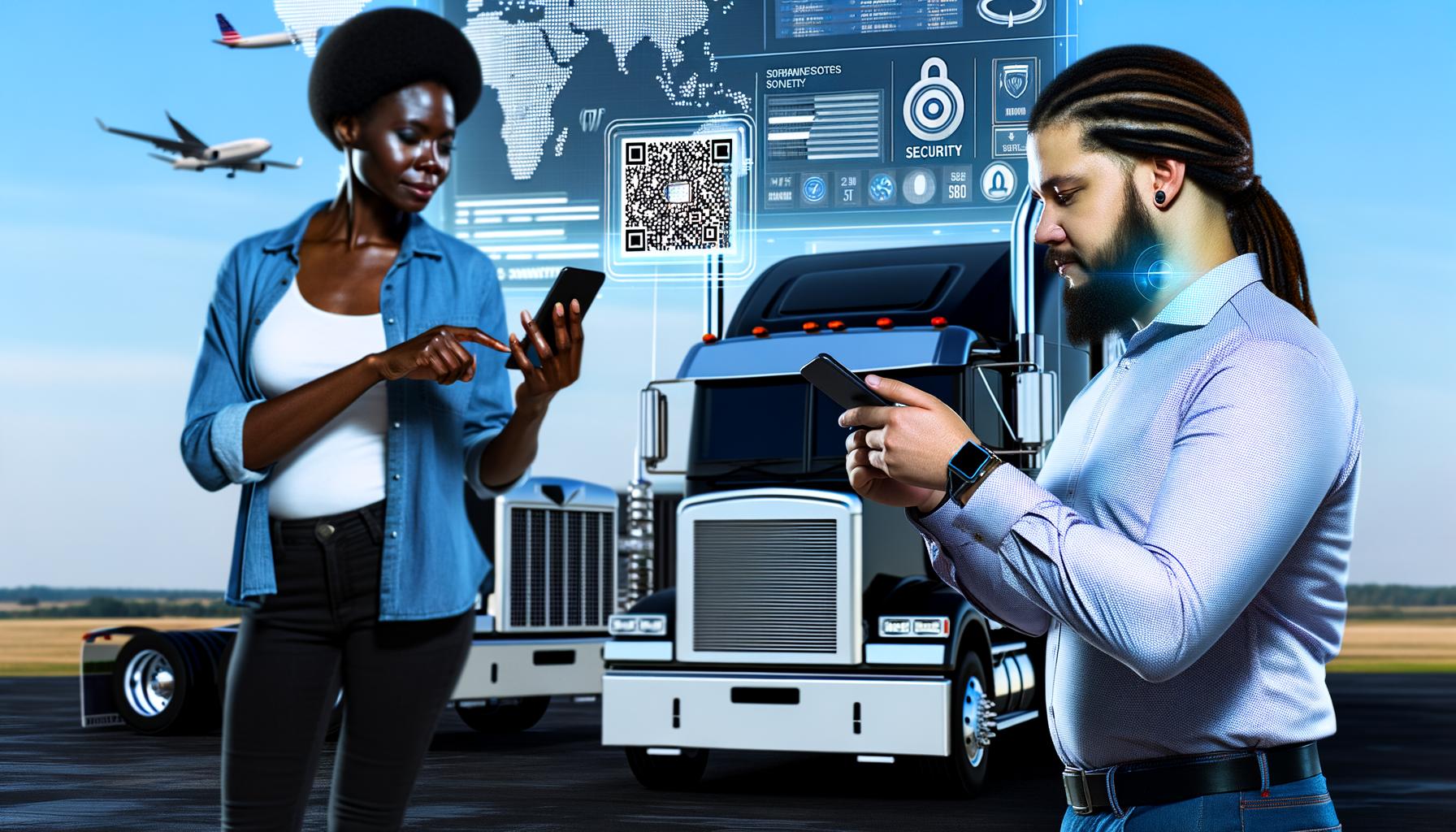

Take the word “digital.” In 2011, a survey from Pew Research Center revealed that only 35% of Americans owned a smartphone. In 2021, that percentage leapt to 85%. Digitization influences how we bank, shop, date, and – yes – move freight. In 2021 alone, $41.3 billion of venture capital was pumped into supply chain tech companies in North America and Europe – more than doubling the investments made in 2020. Digitization is now transcending the automation of individual tasks, as it moves into the transformation of entire industries.

While the rise of the digital freight broker created an initial advantage for those brokerages, that chasm no longer exists. Formerly traditional brokers have pivoted to digitize manual workflows in the same manner as the digital brokers and have even created proprietary load-matching solutions or utilized tech suppliers who have created platforms at a best-in-class level.

“Digital” may now be table stakes in both legacy and digital brokerages. However, what’s increasingly clear is that while investment in technology is becoming common, not all of those investments are actually innovative or working to transform the industry. Additionally, not all brokerages are prioritizing the fundamental features of the brokerage business: service and savings for shippers and carriers.

When Reliance on Technology Goes Too Far: The Transactional Broker

Some digital brokerages have taken “digital’‘ to an extreme, thereby losing the human service element so integral to moving cargo from point A to point B.

“Unlike other industries where an entire transaction can be fully digitized, the movement of goods requires the combination of sophisticated AI and the experts who can manage exceptions, when they inevitably arise,” said Jonathan Salama, co-founder & CTO, Transfix.

Often, exclusively-digital freight brokers are racing to the bottom on pricing, failing to balance the necessary levels of service that give shippers peace of mind. Anna Lee Yee, logistics manager for top paper exporter CNG, spoke candidly about one of the more prominent tech-focused digital freight brokers.

“They can manage a lot of volume, but if something has gone wrong with the delivery and an alert is sent because the load is outside of the predetermined parameters, it’s already too late,” said Yee. “Their system only works when everything goes well, but we all know that’s not how this industry works.”

Besides an overly narrow focus on volume and price, another common misstep digital brokers can make is building out a supply network made primarily of small fleets or single-truck carriers. While these carriers are important to supplement and fill in the gaps of a shipper’s network, they alone can’t solve the big challenges in freight.

“Smaller fleets – or single-truck operators – have a place in many shippers’ networks, but because they are the most vulnerable to volatility, a diverse carrier network is a much safer bet when capacity is tight and you’re looking for a back-up truck,” said Salama.

The more strategic freight broker will build the foundation of its carrier network with mid-sized carriers who have scale and operational wherewithal to provide shippers a consistent level of service. A dedicated-like or managed service model brings shippers reliability and trust. It’s a win for the mid-sized carriers, too, as they seek consistency for their own growth and asset utilization.

When Tech Investment Doesn’t Go Far Enough: The Traditional Broker

Shippers across the board are looking for forward-thinking partners who have invested in the right tech to drive efficiency and sustainability. To compete with digital start-ups, legacy brokers have been actively investing in technology solutions to digitize their operations and processes.

However, brokerages whose operational structures were built on top of manual processes – and whose brokers were incentivized to be as opaque as possible – have a harder time making that sharp U-turn.

Shippers should be looking for that strategic freight broker whose organization is built equally upon strong carrier relationships and data science. Reliable matching and predictive pricing solutions pave the way for shippers to scale and thrive amid market volatility.

Antiquated Pricing Models: Spot, Contract, and Cost-Plus

Contract & Spot

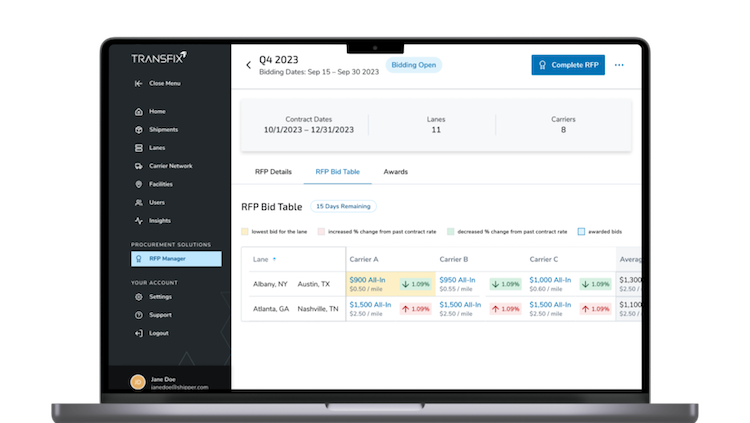

Spot freight offers shippers with less consistent volumes a one-off or ad-hoc access to capacity. Meanwhile, shippers going through the RFP process for contract freight often commit 30-60 days for a lane-by-lane analysis, whether once or a few times a year.

The idea that contract freight is the necessary procurement strategy for securing reliable capacity and service – and that spot freight is evidence of a failed routing guide – is proving itself to be a false and outdated dichotomy.

“RFP is not a panacea and contract rates are not guaranteed,” wrote Chris Caplice, chief scientist at DAT Freight & Analytics.

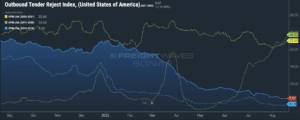

In fact, tight capacity in the hot markets of 2018, 2020, and 2021 (see tender rejection indexes below) proved the spot market a necessary complement to contract freight. While increased transparency and digitalization of the supply chain helps businesses react quickly, there will always be bouts of volatility, whether geopolitical conflicts, natural disasters, or black swan events like COVID-19. Some lanes more than others are naturally exposed to both isolated and pervasive instances of volatility that warrant bespoke strategies with different risk profiles.

Source: FreightWaves SONAR

Source: FreightWaves SONAR

However, flaws persist with both pricing models. Shippers craving that dependable carrier relationship with high service levels often come up short when depending on the spot market for primary coverage. And while contract freight may promise higher service levels, sudden market shifts require frequent repricing, which is often a heavy and time-consuming operational lift.

Traditional Cost-Plus

Spot and contract remain the most popular pricing options for shippers, but brokers and carriers also utilize traditional cost-plus programs: a model where the broker procures capacity and applies a pre-negotiated markup to those costs as a fee for their services to the shipper.

While the traditional cost-plus model might seem like a simple solution for shippers trying to bypass volatility, it provides minimal visibility into carrier performance and cost, which weakens an often already-tenuous link between shippers and carriers.

The apparent simplicity of traditional cost-plus is deceiving, as shippers must reconcile the actual carrier costs for each shipment to an expected market price (elusive in and of itself), a process that leads to operational challenges and additional costs.

Traditional brokers that leverage the traditional cost-plus model for shippers are often creating rates using historical data, which means shippers will not have access to accurate carrier costs at the time of tendering. While basing future rates and carrier costs on historic seasonality might have been a dependable strategy in the past, a modern solution is on the way. Cloud computing has indelibly changed the way we forecast rates, making it easier to run thousands of different models every day. Most brokers, however, have not caught up to speed.

Market Volatility Disrupts Logistics Teams

It’s a well-told story. Pandemic-spurred volatility shoved the supply chain into the mainstream news and dinner table conversations. Novel bottlenecks, like plant closures, supply constraints, panic-buying, and unusually high port congestion piled on top of old ones: industry fragmentation, lack of transparency, and reliance on antiquated systems and processes. Naturally, this caused an intense strain on the supply chain ecosystem. The irony of volatility like this is that it exposed and exacerbated supply chain fragility without giving anyone time to do anything about it.

When increased volumes tighten capacity, carriers will often either look to the spot market for higher rates or consult with their broker to reprice contracted rates. In a market downturn, shippers with pricing power will find carriers in the spot market that will take lower rates than the agreed-upon contract rates or attempt a big repricing exercise. The cycle goes on creating pain and mistrust on both sides.

In 2021, Ernst & Young surveyed 200 senior-level supply chain leaders about their preparedness for COVID-19. A mere 2% reported having been ready for such an onslaught of disruption. But that’s all changing now, as the industry is entering a new phase of its digital maturity: one that equally leverages best-in-class data, artificial intelligence, and the creativity and expertise of people to navigate supply chain complexity.

Shippers are not all the same and shouldn’t be treated as such by purely digital solutions. Relying on transactional interactions with shippers ultimately underserves all parties. When it comes to trucking, there will always be exceptions; so too will there always be a need for nimble solutions and trusted relationships.

For nearly a decade, Transfix has strategically consulted with shippers and carriers to create an intelligent freight ecosystem fueled by artificial intelligence. And that momentum only continues. In the coming weeks, Transfix’s next product iteration will launch: a solution that will undoubtedly help insulate shippers against pricing volatility and provide a dynamic and modern option beyond contract and spot.

Stay tuned for our next installment: Future of the Freight Ecosystem.