As a part of our on-going COVID-19 coverage, we’ll be providing breaking news, resources, and insight into the pandemic’s impact on the industry.

President Trump signing the CARES Act on Friday. Photo Credit: AP Images

President Trump signing the CARES Act on Friday. Photo Credit: AP Images

On Friday afternoon the Coronavirus Aid, Relief, and Economic Security (CARES) Act was signed into law by President Trump. The stimulus package will directly impact shippers and carriers across the country, particularly as it relates to their workforces. The CARES Act will allocate $350 billion into an employee retention fund for small businesses. This legislation was drafted to help prevent workers from losing their jobs and small businesses from going under due to economic losses caused by COVID-19. The Paycheck Protection Program will provide eight weeks of cash-flow assistance through 100-percent federally guaranteed loans to small employers who maintain their payroll during this emergency. Additionally, this will expand eligibility for entities suffering economic harm due to COVID-19 to access Small Business Administration’s (SBA) Economic Injury Disaster Loans ( EIDL), while also giving SBA more flexibility to process and disperse small-dollar loans. It would also require SBA to pay all principal, interest, and fees on all existing SBA loan products for a period of up to six months.

To see if you qualify for SBA’s Economic Injury Disaster Loan Program, click here.

ATA President and CEO Chris Spear says the bill will provide critical assistance to small and midsize motor carriers. The cash infusion will specifically help carriers maintain payrolls, keep the economy’s supply lines active and ensure the movement of essential goods that all Americans rely upon.

“At its core, trucking is an industry of small business. More than 90% of motor carriers in this country have fewer than six trucks, and it is critically important for the health of our nation’s supply chain that small and midsize carriers have accesses to liquidity so they can keep their drivers paid, trucks running, stores restocked and hospitals supplied,” Spear said last week.

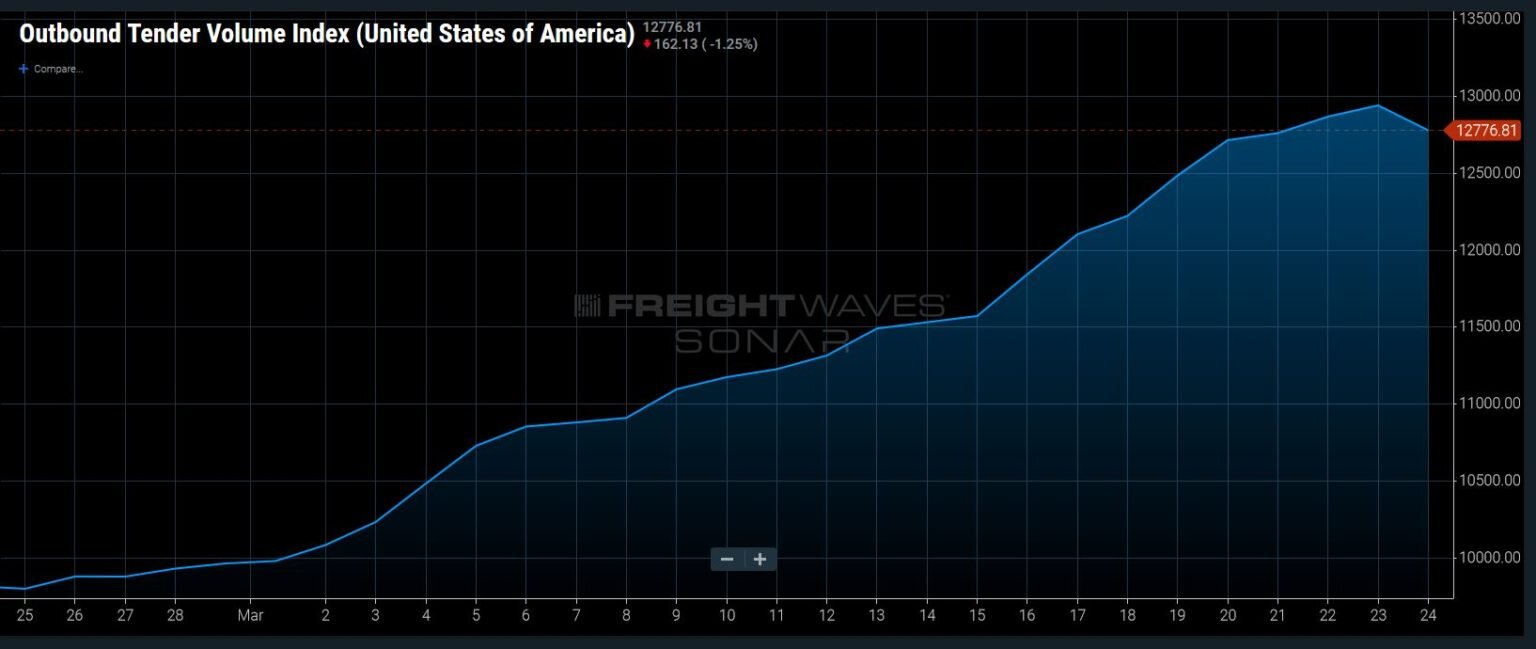

Has The Volume Surge Peaked?

The Outbound Tender Volume Index (OTVI) dropped to 12,776.81 on Wednesday, the first one-day decline since late January.

“We may have seen the peak frenzy in domestic freight volumes,” FreightWaves’ Andrew Cox, a member of the FreightWaves Research team, wrote in the Daily Pickup for SONAR subscribers. “It has only been one day, but the outbound tender volume index fell almost 1.5% yesterday. As of Monday [March 25], OTVI was up 30% year-over-year and up over 15% above the 2018 peak (a record year for freight).”

Jonathan Rojas, Transfix’s Director of Carrier Management and Development, has noted an emerging trend as carriers attempt to keep grocery stores, pharmacies, hospitals and clinics stocked with essential and in some cases life-saving supplies.

We continue to observe heavy volume across the country as shippers attempt to move essential goods. The shippers we work with on a daily basis are doing everything possible to keep facilities open by changing their operating procedures to abide by social distancing standards (reducing the number of employees, cleaning regularly, etc) while keeping up with escalating volume. Interestingly, we are seeing shippers request more drop service at either pickup or delivery because they are backed up and have limited live appointments available. Drop requests increased for our NE customers by 27% week over week and we anticipate that indicator to remain high next week.

In addition to the impact of COVID-19, our team is monitoring the upcoming produce seasons in Southern California, Texas and South Florida. Peak harvesting of strawberries in Southern California, peaches in Texas, and watermelons in South Florida will impact available capacity in these regions in the short term.

The Transfix team remains committed to providing critical services to our customers during this crucial time. For more on COVID-19’s impact on the freight market, please refer to our website, blog, social channels and via email.