Big Bets for the Next Two Weeks Ahead

Welcome to the week of November 29th edition of the Transfix Take! Gear up for the latest updates and trends in the trucking industry. In this issue, we're revving up with industry news, sprinting through regional breakdown highlights, and putting the spotlight on what's on the horizon for truckers.

Industry Insights: Unpacking the Road Ahead

In this week's edition of Transfix Take, we bring you the latest updates and insights from the world of freight. Co-hosts Justin Maze and Jenni Ruiz share the following highlights and updates:

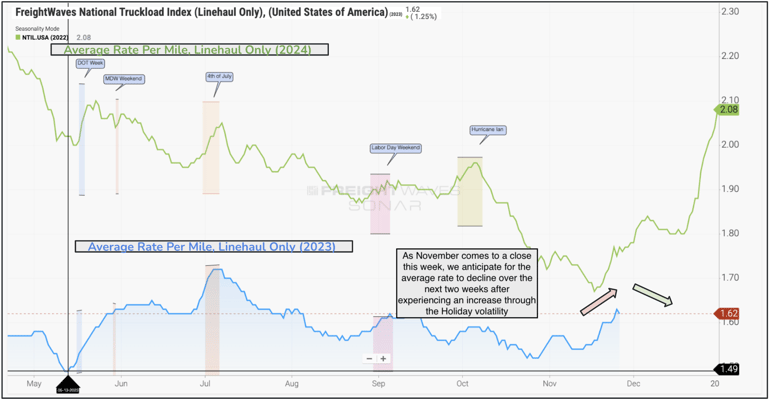

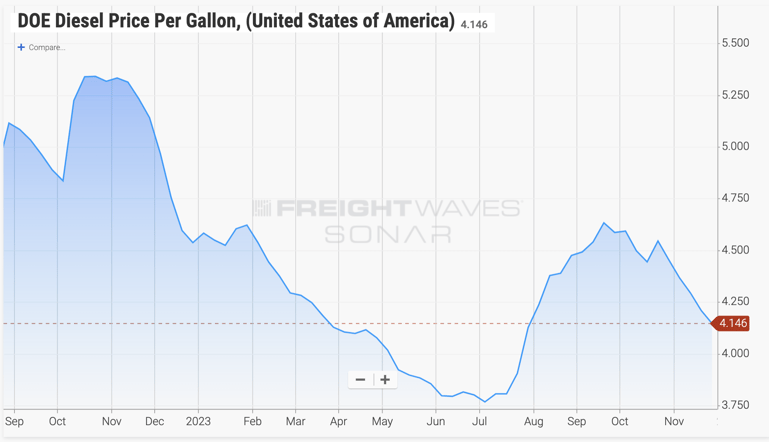

Thanksgiving Reflections: As the Thanksgiving holiday wrapped up, Maze highlighted the overall pressure on rates, with an average rate increase to $1.62 per mile linehaul. The optimistic note was the decline in fuel prices, providing relief for both carriers and shippers.

Source: Freightwaves

Source: Freightwaves

Black Friday and Consumer Spending: Discussion around Black Friday and consumer sentiment revealed a mixed picture. While 70% of respondents in our LinkedIn poll anticipated a rush for Black Friday sales, Maze cautioned that the demand might not significantly impact the truckload market due to abundant capacity.

Reefer Tender Rejections: A spotlight on reefer tender rejections indicated a potential slowdown in the coming weeks, with expectations of a slower decline compared to the dry van market.

Regional Roadmap: Where the Rubber Meets the Road

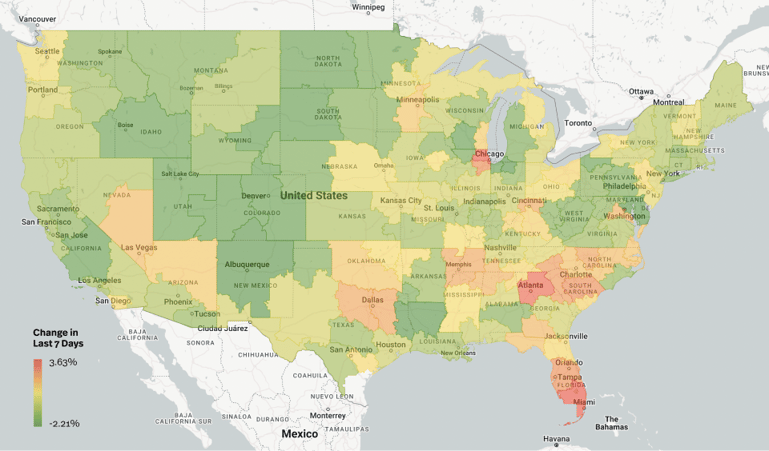

Below is a regional breakdown of the freight industry, uncovering nuances and trends in various regions across the nation.

Source: Transfix Internal Data

Pacific Northwest: Despite recent tightness, the Pacific Northwest is anticipated to experience a shift with rates likely to decline as Christmas approaches. The shift from produce season and reduced Christmas tree movements are expected contributors.

The West Coast: The West Coast saw a slight increase in average rates, with longer hauls experiencing more significant rises. This region is predicted to maintain stability in the coming weeks, especially as import volumes steadily rise ahead of the Lunar Year.

The Midwest: The Midwest observed a modest increase, with Chicago and Juliet markets showing the most significant rise. A snowstorm in Chicago may impact rates, but overall, the Midwest is expected to display mixed trends in the following weeks.

The Northeast: Snowfall in upstate New York triggered rate increases, with the entire New England region expected to see continued pressure. Harrisburg, Pennsylvania, might tighten and spread from Northern New Jersey and Allentown, Pennsylvania.

Coastal Region: While the Coastal Region experienced an increase, declines are anticipated, especially in North and South Carolina. Markets in these areas are expected to show a noticeable decline.

The Southeast: There was a noticeable upward shift in average rates, particularly in the higher volume Miami, Florida, and Atlanta, Georgia markets. However, Maze predicts a significant decline in the Southeast in the next week.

The South: This region witnessed an overall decrease in rates, while higher-volume markets like Dallas, Fort Worth, and Houston experienced increases. In the next weeks, a decline is expected in these areas but not as pronounced as in the Southeast.

On the Horizon: What Lies Ahead in the Trucking Terrain

Maze's insights into the next two weeks foresee a reversal in rates, with declines expected, particularly in the Southeast. While rates may not return to pre-Thanksgiving levels, a notable decrease is anticipated. Greater declines are expected in the Southeast and South, returning closer to pre-Thanksgiving levels. The Midwest and Northeast may experience continued pressure, especially with the onset of snowfall. Keep an eye on regional variations and weather-related developments.

Stay tuned for more insights and updates in our next newsletter. Drive safely!

DISCLAIMER: All views and opinions expressed in this podcast are those of the speakers and do not necessarily reflect the views or positions of Transfix, Inc., or any parent companies or affiliates or the companies with which the participants are affiliated and may have been previously disseminated by them. The views and opinions expressed in this podcast are based upon information considered reliable but neither Transfix Inc. nor its affiliates nor the companies with which the participants are affiliated warrant its completeness or accuracy, and it should not be relied upon. As such, all views and opinions are subject to change.