Weathering the Freight Market

The freight market is starting to hit slippery roads already in 2021 — literally and figuratively. While we usually look to tender volume and tender rejections to explain trends in the major freight markets, all eyes for the past week have been on the weather. Weather events from Ontario, California, to Elizabeth, New Jersey, are affecting capacity.

“With capacity already being tight across the country, recent weather events are exacerbating capacity constraints in the days that follow them,” says Justin Maze, Transfix’s senior manager of carrier account management. “The majority of markets in the U.S. — even as far south as Dallas — have been getting hammered with brutal weather conditions, including snow, ice and frigid temps. This is pushing rates away from the traditional trends we had only just started seeing recently. Although tender volume and rejections continue to slowly fall, rates and capacity have only gotten tighter during the past 10 or so days.”

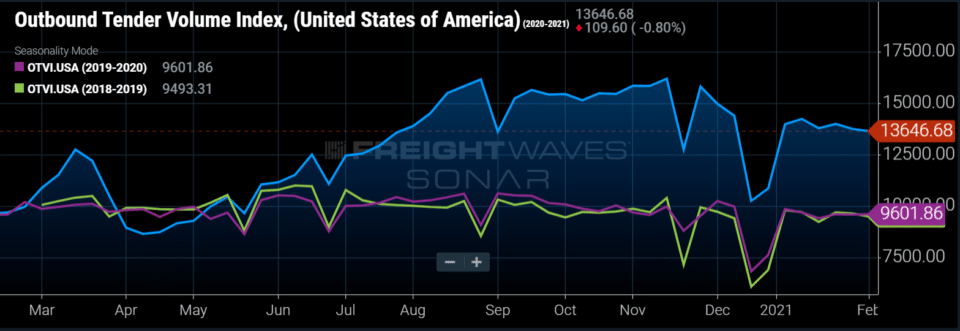

The Outbound Tender Volume Index (OTVI) fell slightly this week, down 1.2% to 13,647. Freight volumes have been relatively flat since the first week of January, following a usual seasonal pattern, albeit at a very high level.

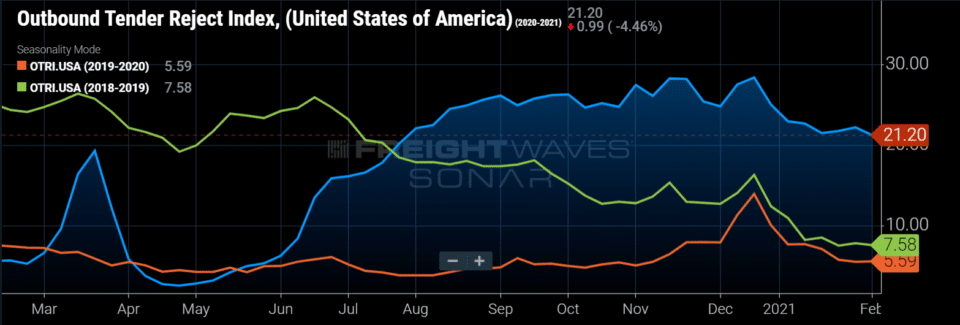

The Outbound Tender Reject Index (OTRI), also fairly flat during the past month, declined slightly to 21.2%. “The current rejection rate is more than 1,500 basis points higher than year-ago levels and nearly 1,400 basis points higher than 2019 levels,” Seth Holm writes for FreightWaves. “The extraordinary tightness in the truckload market is resulting in truckload contract rates being negotiated higher.”

National average rates have climbed for two consecutive weeks after a steep drop at the beginning of the new year. Load-to-truck ratios, one of the leading indicators for trucking capacity, continue to rise in most major markets.

“Following the repricing we discussed last week, more freight is flowing through shippers’ routing guides successfully,” Maze says. “However, we are still experiencing tight markets and higher week-over-week rates. This is likely due to weather events, but we are keeping an eye on broader trends and potential impacts.”

Monthly Records Expected for Retail Imports in Coming Months

Retail imports logged a record year in 2020, and the largest retail container ports are expected to set new monthly volume records through summer 2021, according to the Global Port Tracker report released Feb. 8 by the National Retail Federation and Hackett Associates. U.S. retailers are projecting that imports during the first half of 2021 will increase 22.1% year-over-year.

“Regardless of whether it’s in-store or on retailers’ websites, the record holiday season and numbers for 2020 show consumers are buying again and have been for a while,” NRF Vice President for Supply Chain and Customs Policy Jonathan Gold says. “This surge has been going on for months, and retailers are importing merchandise faster than ever.”

February is usually the slowest month of the year for imports, marking a lull between the holiday season and spring, as well as the East Asian Lunar New Year, when factories in Asia typically close. But this year, many Asian factories stayed open to meet demand, and the ports of Los Angeles and Long Beach are experiencing incredible congestion delays, with more than 30 ships still off-shore waiting to dock.

Imports for U.S. ports for February 2021 are forecast at 1.91 million TEU (Twenty-Foot Equivalent Units), up 26.3% YoY. March is forecast at 1.93 million TEU, up 41% from March 2020, when factories in China closed due to the coronavirus. April is forecast at 1.82 million TEU, up 13.3% YoY; May at 1.9 million TEU, up 23.8%; and June at 1.9 million TEU, up 18.2%. These would all set monthly records.

“These forecasts send a message to ports, carriers, terminal operators, railroads, truckers and equipment providers who are struggling to handle today’s volumes that they will have to improve productivity in order to handle the import volumes that are expected in the coming months,” Bill Mongelluzzo wrote for JOC.com.

With the uncertainty and volatility surrounding the U.S. economic recovery, shippers need a partner that can help them adapt and excel — no matter the circumstance. Shippers turn to Transfix for our leading technology and reliable carrier network. As volumes drive higher, we are here to help: Learn more about our Core Carrier program and Dynamic Lane Rates. As part of our ongoing market coverage, we’ll continue to provide breaking news, resources and insight into emerging trends and the pandemic’s impact on the transportation industry.