Our Last Episode of ‘23 Comes with Good News Ahead

Welcome to the week of December 14th edition of the Transfix Take! Gear up for the latest updates and trends in the trucking industry. In this issue, we're revving up with industry news, sprinting through regional breakdown highlights, and putting the spotlight on what's on the horizon for truckers.

Listen to the Transfix Take Podcast here:

Industry Insights: Unpacking the Road Ahead

In the last edition of the Transfix Take for 2023, we bring you the latest updates and insights from the world of freight. Co-hosts Justin Maze and Jenni Ruiz share the following highlights and updates:

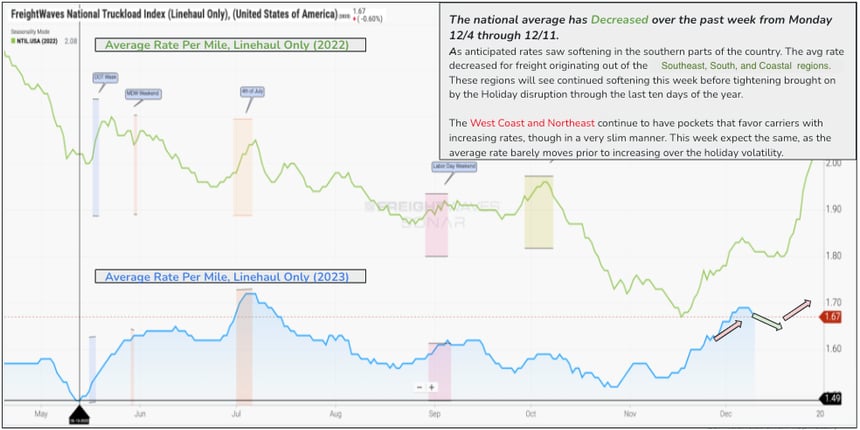

National Average Rate per Mile: While there was a slight decrease in the national average rate per mile to $1.67/per mile, line haul only on December 11, it sets the stage for potential volatility in the upcoming weeks. The trends are shaping up to look a lot like last year with a brief decrease nationally and at the regional level in early December, but the big surprise was the Midwest, which took on a slimmer decline than originally anticipated. The West Coast becomes the standout heading out of the region and the Northeast continues to be a region to watch.

Source: Freightwaves

Christmas Tree Fun Facts: Did you know around 35 million Christmas trees are harvested in the US annually? A staggering 95% of these trees are transported by trucks. Our first TransFIX My Rig winner, Debbie Desiderato, transported the iconic Rockefeller Center Christmas tree in her impressive trucking career.

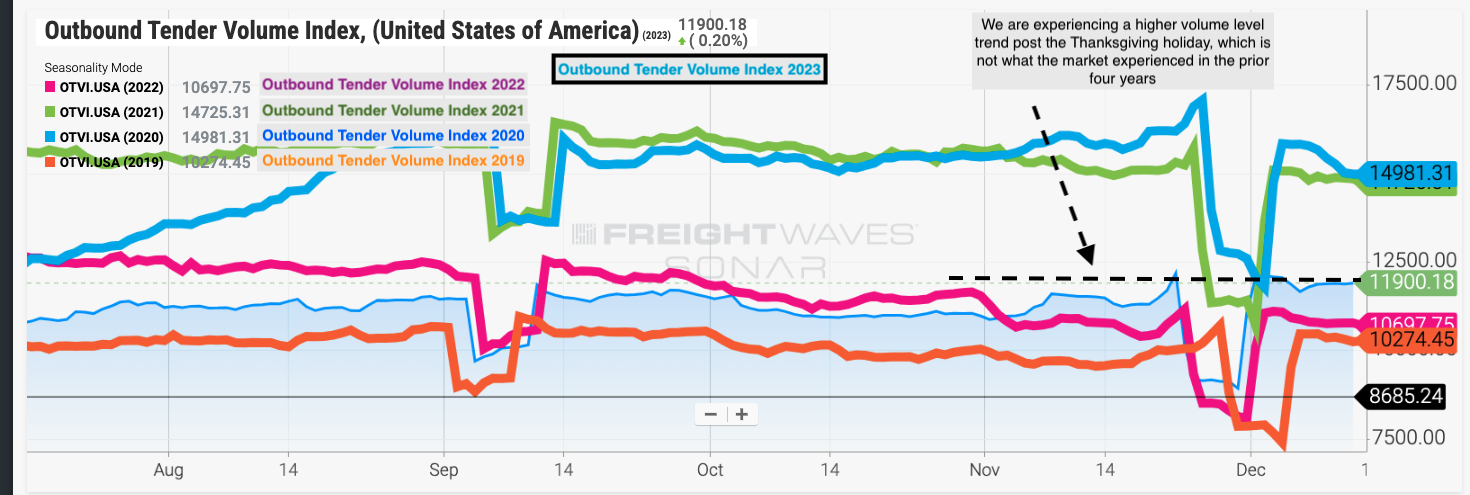

Tender Volumes: Tender volumes post-Thanksgiving defied traditional trends, showing continued strength in the market. Notably, an increase in longer haul freight after Thanksgiving indicated a shift in shippers' behavior, potentially driven by right-sized inventory levels. This shift raises intriguing questions about the dynamics of the current freight market and how factors like inventory management could influence tender trends for the rest of the holiday season.

Source: Freightwaves

Regional Roadmap: Where the Rubber Meets the Road

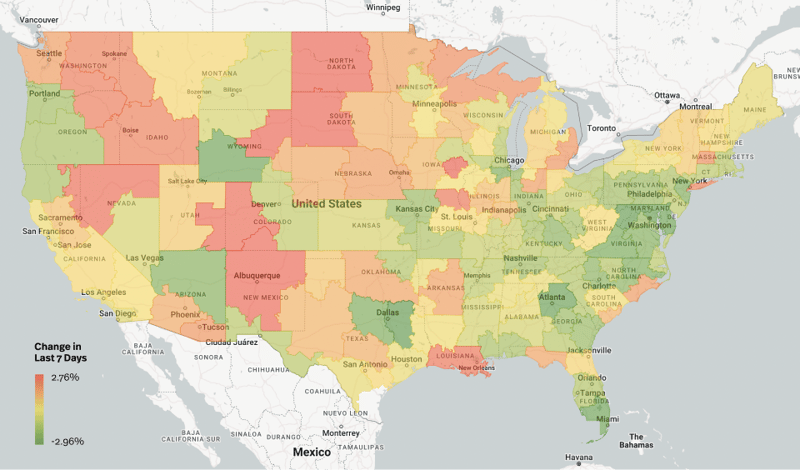

Below is a regional breakdown of the freight industry, uncovering nuances and trends in various regions across the nation.

Source: Transfix Internal Data

Source: Transfix Internal Data

West Coast: While there were some declines within the West Coast itself, the volume on longer lengths of haul has remained high, leading to an overall rate increase.

Northeast: The Northeast saw a modest increase, driven by upstate New York due to weather conditions. However, major volume-driving markets in the Northeast experienced a slim rate decline. Keep an eye on this region as winter weather could play a crucial role in the coming weeks.

Midwest: This region was a mixed bag of tightening and loosening markets. Larger volume-driving markets, including Chicago and Indianapolis, experienced rate decreases. However, remote markets in the Dakotas and parts of Wisconsin and Montana saw increases. Expect a potential slim decrease in rates to continue in the Midwest before a rise during the holiday season.

Southeast: The Southeast region experienced a notable week-over-week decrease in rates, with Atlanta, one of the largest markets by volume, seeing a substantial decline of just under 3%. This decline extended across almost every market in the region, highlighting a consistent downward trend. However, regions along ports such as Jacksonville, Savannah, Norfolk, and others may see bigger rate decreases as shippers are moving more of their imports over to the West Coast.

Coastal Region: Similar to the Southeast, the Coastal region witnessed significant rate decreases across the board. Notably, key volume-driving markets within the region experienced even greater declines.

South: While the South did not witness the decreases observed in the Southeastern and Coastal regions, the average outbound rate decreased. Pockets of tightening in Texas, Arkansas, and Louisiana rural areas hint at nuanced regional variations.

On the Horizon: What Lies Ahead in the Trucking Terrain

Diesel Insights: Continued lower fuel costs have been a gift for carriers and shippers alike. Fuel prices have dropped below $4/gallon, providing some relief for carriers amid a challenging year marked by volatility and oversupply in the freight market. Lower fuel rates should continue through the rest of the year.

Sneak Peek into 2024: As we bid farewell to 2023, Maze gives us a glimpse into the first episode of 2024. We'll dive into the aftermath of the holiday season, exploring rates, volatility, and a crucial shift toward imports and volume expectations for Q1.

Stay tuned for more insights and updates in our next newsletter on January 3rd. Have a great holiday, happy new year and as always - drive safely!

DISCLAIMER: All views and opinions expressed in this podcast are those of the speakers and do not necessarily reflect the views or positions of Transfix, Inc., or any parent companies or affiliates or the companies with which the participants are affiliated and may have been previously disseminated by them. The views and opinions expressed in this podcast are based upon information considered reliable but neither Transfix Inc. nor its affiliates nor the companies with which the participants are affiliated warrant its completeness or accuracy, and it should not be relied upon. As such, all views and opinions are subject to change.