Transfix Take Podcast | Ep. 44 – Week of March 30

Traditional Market Trends Make a Comeback

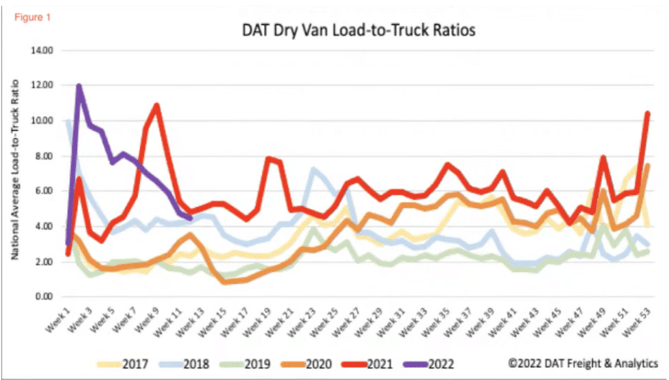

As freight demand continues to decline, both shippers and carriers are seeing a reverse of the supply and demand curve they have not experienced since before COVID-19. As demand falls, so does truckload volume, rates, and tender rejections. DAT’s load-to-truck ratio is also following suit, lowering to 4.4 last week, a decline from 12 at the beginning of January.

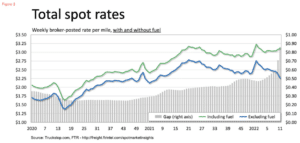

Fuel prices may remain near all-time highs, but falling spot volumes are pulling down rates throughout most of the country, especially in the Midwest. The recent price increase in fuel has masked the decline in line haul rates for carriers as the gap between the all-in rate is expanding.

It’s been nearly two years since we have seen evidence of this traditional three-year freight market cycle. Even though national volumes this March are lower than our usual expectation, seasonality demand looks to be on par as shippers are starting to experience capacity issues and rising spot rates in the Southeast and Coastal regions. Of course, this regional tightening of capacity and rate increases come as a result of produce season heating up all the way from Texas to Florida. Surprisingly, Southern California markets, too, experienced pressure on capacity last week as volume increased, but in all likelihood, these rates will plateau, even as import volumes increase.

Is This The End of a Bull Market?

Everyone in the industry is familiar with the “three-year” freight market cycle from a bull to a bear market. If you aren’t familiar, surely you’ve heard rumors. The cycle repeats itself: when demand outpaces supply, cost goes up. When supply outpaces demand, costs go down. We have been in a historic bull market for nearly two years now, and the impacts of inflation on consumer spending could drive 2022 into a bear market.

The dynamic of trucking capacity supply is changing. More drivers have shifted to running loads for smaller carriers, and a bear market is troubling for smaller carriers – especially in this period of rising fuel costs. Just as supply becomes more abundant, this additional squeeze on small carriers’ margins adds stress. If history repeats itself, we could see many carriers struggle to stay afloat, similar to the last bear market in 2019 when the industry witnessed a large number of carriers go out of business.

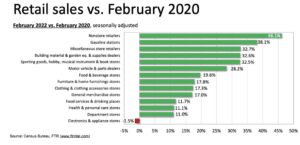

Consumers Nurse a Retail Hangover

Shippers spent most of the pandemic attempting to keep up with consumer demand on durable goods. They battled to get inventory to the U.S. and make sure shelves were stocked. February’s Commerce Department data show that inventory is finally reaching stable levels. Ironically, consumer spending is turning away from durable goods and towards more services, likely due to the removals of COVID-related mandates and the rise of inflation, which weighs heavily in the wallet. Inflation continues to be a pervasive public concern as we endure its impact on daily needs from fuel to food.

It’s almost like we’re coming off our sweet tooth we developed over the pandemic for retail goods, which drove the supply chain into its highest gear, attempting to keep up. The intensified consumer spending on goods combined with increased manufacturing drove freight demand in the U.S. With the shift in this current trend, we could see a long-term impact on the freight markets for months to come.

The movement of freight is changing in every mode, as shippers do their best to keep up with record demand while fighting congestion at multiple points throughout the supply chain. Shippers who think forward, use data and think outside the proverbial box on solutions, while partnering with companies such as Transfix, will come out of this ongoing freight rally in a better position and well ahead of competitors. The one huge win through this pandemic has been speeding up the digital transformation of the transportation industry.

With the uncertainty and volatility surrounding the U.S. economic recovery, shippers need a partner that can help them adapt and excel — no matter the circumstance. Shippers turn to Transfix for our leading technology and reliable carrier network. As volumes drive higher, we are here to help: Learn more about our Core Carrier program and Dynamic Lane Rates. As part of our ongoing market coverage, we’ll continue to provide breaking news, resources and insight into emerging trends and the pandemic’s impact on the transportation industry.

Disclaimer: All views and opinions expressed in this blogpost are those of the author and do not necessarily reflect the views or positions of Transfix, Inc. or any parent companies or affiliates or the companies with which the participants are affiliated, and may have been previously disseminated by them. The views and opinions expressed in this blogpost are based upon information considered reliable, but neither Transfix, Inc. nor its affiliates, nor the companies with which such participants are affiliated, warrant its completeness or accuracy, and it should not be relied upon as such. In addition, the blogpost may contain forward-looking statements that are not statements of historical fact. All such statements are based on current expectations, as well as estimates and assumptions, that although believed to be reasonable, are inherently uncertain, and actual results may differ from those expressed or implied. All views, opinions, and statements are subject to change, but there is no obligation to update or revise these statements whether as a result of new information, future events, or otherwise.