Regional Seasonality Brings a Slight Decline

Welcome to the week of April 18th edition of the Transfix Take! Gear up for the latest updates and trends in the trucking industry. In this issue, we're revving up with industry news, sprinting through regional breakdown highlights, and putting the spotlight on what's on the logistics horizon.

Industry Insights: Unpacking the Road Ahead

In this week's edition of Transfix Take, we bring you the latest updates and insights from the world of freight. Co-hosts Justin Maze and Jenni Ruiz will return next week with an all new episode of the Transfix Take but until then, here are some notable highlights and updates:

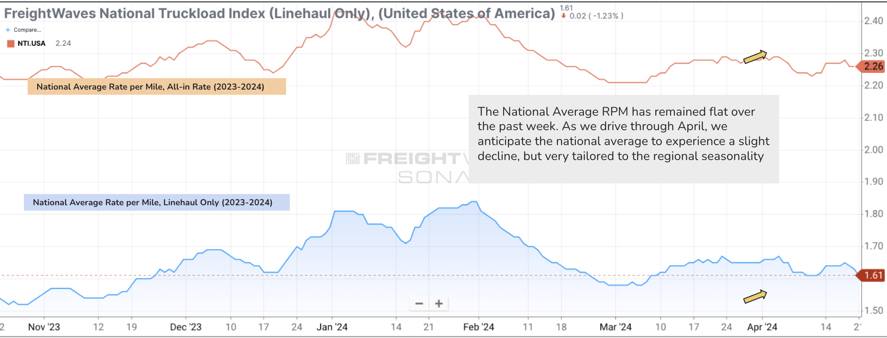

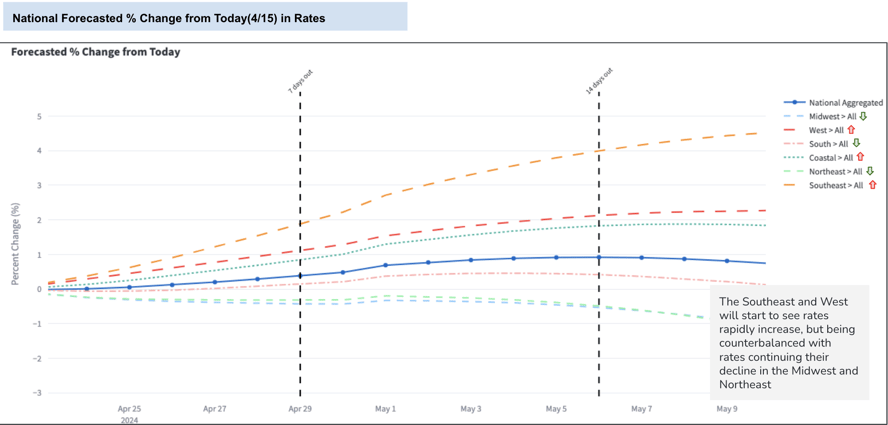

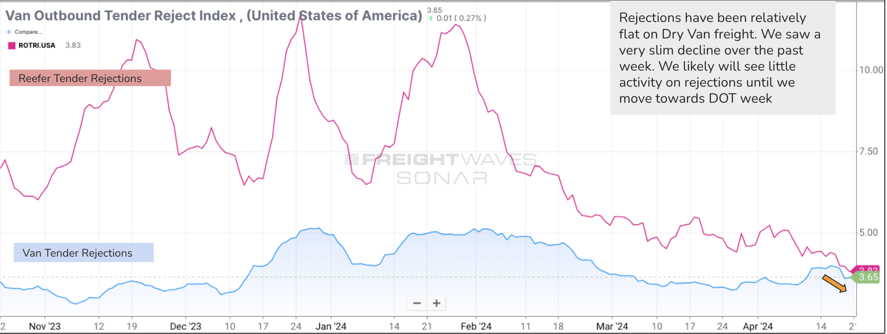

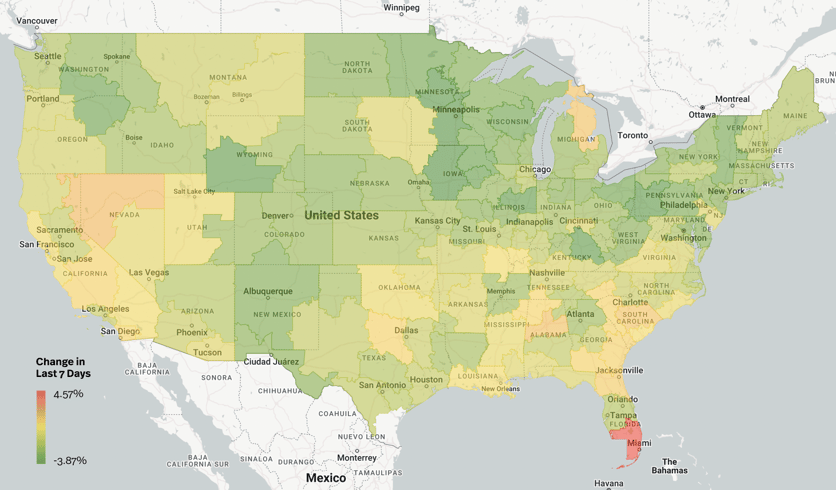

A National Average Decline by Regional Seasonality: The last seven days demonstrated a slim decline, although as Justin Maze predicted at the top of the month, this decline is to be expected. Currently sitting at $1.61/linehaul only, we anticipate a drop by another cent or two as we close the month out next week. Regions forecasted to have the biggest gains include the Southeast to Coastal, Northeast, and Midwest. Tender rejections have been relatively flat on dry van freight, with a slim decline over the past week at about 3.65%, while reefer rejections continue to take a nose dive. We’ll likely see little activity on rejections until we get closer to DOT Week on May 14-16.

Source: Freightwaves

Source: Transfix Internal Data

Source: Freightwaves

Produce Season Down the Road: May is a busy month. Not only are we anticipating a two-day spike in carriers keeping off the road but the season brings the start of produce season mainly along the West Coast and Southeast regions. California is home to strawberries, cherries, cantaloupes, asparagus, and leafy greens while Florida produces watermelon, bell peppers, and tomatoes. And we’re anticipating a robust produce season this year–not to mention, some healthy recipes.

Regional Roadmap: Where the Rubber Meets the Road

Below is a regional breakdown of the freight industry, uncovering nuances and trends in various regions across the nation.

Source: Transfix Internal Data

Source: Transfix Internal Data

Midwest: Rates out of the Midwest managed to fall yet another week across all lengths of hauls. Average losses at 1.37% with city and local runs and cross country taking the biggest hit. Some pressure may accrue in the Midwest from the South and West regions but we’ll likely continue to see a dip through the end of the month.

Northeast: Yet another week of declines for this region, the 60-day delta shows a 9% decrease. Capacity is generally staying away from this region and we anticipate the same behavior over the next 7 days. Keep an eye out for gains in the first week of May specifically with freight heading to the Midwest and South.

Coastal Region: While the change over the last week has been minimal in the Coastal Region, markets like Columbia, Greenville, and North Charleston saw some gains. As we inch closer to May and June, expect some tightening especially for South Carolina who is the #2 producer of peaches behind Califonia.

West Coast: Rates remained relatively flat on the West Coast despite seasonality. California will be the first state in the West to feel capacity tighten with the first harvest of crops in early May through the summer months. Markets that broke out with gains were Fresno, Ontario, Reno, Salt Lake City, San Diego, and San Francisco.

South: Rates are down by 0.60% over the past seven days. Border markets such as El Paso and Laredo have gained some of the capacity that was taken from the region in early April. Outside of Texas, produce shipping out of Oklahoma, Louisiana, and Arkansas is rather mild, and rate increases will stay minimal.

Southeast: While rate increases took a slight dip, we’re still at an overall gain of 0.12%. Midhauls had the biggest increase at 2.17% with the Miami market being the biggest breakout gain at near 5%. Carriers will continue to see gains in this area heat up as heavy produce fluctuations should continue throughout the summer.

The Road Ahead: An Update on the Baltimore Bridge

Great news in light of the Baltimore Bridge collapse last month. The U.S. Coast Guard announced a wider, deeper channel to the Port of Baltimore will open on April 25th, 2024. This limited access channel offers a 35-foot depth and 300-foot width. Deep draft vessels will require a state pilot and tug escorts for safe transit. This development significantly improves access for large container ships waiting to access the port.

Next week, we’ll be back with an all-new episode of the Transfix Take Podcast. Until then, drive safely.

To make sure you never miss an episode of the Transfix Take podcast, subscribe on Spotify or Apple Music.

DISCLAIMER: All views and opinions expressed in this podcast are those of the speakers and do not necessarily reflect the views or positions of Transfix, Inc., or any parent companies or affiliates or the companies with which the participants are affiliated and may have been previously disseminated by them. The views and opinions expressed in this podcast are based upon information considered reliable but neither Transfix Inc. nor its affiliates nor the companies with which the participants are affiliated warrant its completeness or accuracy, and it should not be relied upon. As such, all views and opinions are subject to change.