Transfix Take Podcast | Ep. 47 – Week of April 20

Pendulum Swings Towards Shippers: What’s the Fallout?

The wild ride commencing in 2020 that sent volumes, rates, and rejections on a rapid climb is now declining – and quickly. Last week’s data showed that 12% of contract loads were getting rejected – a very different market than the one we became accustomed to during the past 18 months, where the pressure of tender rejections consistently hovered around 20% and shippers struggled to keep up with demand. Contracted rates are the current go-to for carriers, since last month, contract loads began paying more than loads on the spot market.

After weeks of declining spot volume and rates, it is tough for carriers to find markets where they have pricing power. Only if they head to the West Coast are they likely able to negotiate with an advantage, but they are out of luck when leaving that market.

Rising imports in the Gulf region have kept truckload rates steady, while produce season has done the same in markets along the border and in the Southeast. In and around major metro areas, shippers are gaining pricing power. Due to the cost of fuel and minimal load options, carriers are less willing to pick up or carry loads in remote markets.

Pulse Check Across Modes

Surprisingly, reefer volume has remained weak even with the start of produce season. In the coming weeks, we will start to see volume in this sector increase, potentially bringing an advantage for carriers through increased rates out of specific markets.

Dry van volume will continue a downward trend through the month, as demand slows and April is traditionally a slower month for freight movement. Peaking into intermodal – volume remains steady as shippers are no longer in a rush to move freight via truckload.

If you are a flatbed carrier or a shipper in need of flatbed service, then all of the above does not apply. Flatbed markets are an anomaly in this market. After missing out on the skyrocketing rate increases through COVID-19, the flatbed sector finally has its time to shine through the beginning of this year. Flatbed tender rejections have consistently sat between 30 and 40% through the first quarter and as high as 43%.

The Current State of Supply & Demand

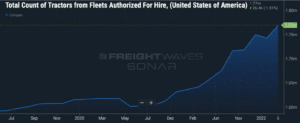

March set simultaneous records for both new carrier entrants, as well as carrier deactivations. In fact, the number of available trucks with a driver is up approximately 10% since the start of the pandemic.

With the changing markets, however, it’s more difficult for smaller and newer carriers to stay in the business, causing some supply to leave the market or at least work under a larger fleet.

The latest company to announce significant driver pay increases is Walmart, where drivers now have the potential to make $110,000 in their first year. For context, over the past two years, most carriers’ operating costs like insurance premiums to equipment have increased, heavily impacting a driver’s ability to operate profitably even if rates remain inflated. In the year leading up to COVID-19, the industry was weathering repeated carrier closures, as rates declined from a bull market in 2018. Even though fuel prices slightly decreased last week, diesel costs will continue to impact carriers’ ability to operate profitably and decide which loads to take.

Consumer spending on durable goods is one of the most significant factors on freight demand. According to Mastercard sales data from March, we did not see a drop in consumer retail spending that most of us expected. Still, the future remains rocky, with inflation and fuel costs sitting in the forefront of consumers’ minds. However, retailers are reporting stronger inventories after 18 months of pressure to keep shelves stocked. Finally, they can manage their supply chains more efficiently.

As we continue to navigate fluctuating freight markets, having the right partner is essential. Rather than working together, the pricing power in freight markets shifts back and forth between shippers and carriers, where one side of the pendulum wins until the next takes power. Running the most efficient business will mean aligning with the right partners no matter the market condition.

The movement of freight is changing in every mode, as shippers do their best to keep up with record demand while fighting congestion at multiple points throughout the supply chain. Shippers who think forward, use data and think outside the proverbial box on solutions, while partnering with companies such as Transfix, will come out of this ongoing freight rally in a better position and well ahead of competitors. The one huge win through this pandemic has been speeding up the digital transformation of the transportation industry.

With the uncertainty and volatility surrounding the U.S. economic recovery, shippers need a partner that can help them adapt and excel — no matter the circumstance. Shippers turn to Transfix for our leading technology and reliable carrier network. As volumes drive higher, we are here to help: Learn more about our Core Carrier program and Dynamic Lane Rates. As part of our ongoing market coverage, we’ll continue to provide breaking news, resources and insight into emerging trends and the pandemic’s impact on the transportation industry.

Disclaimer: All views and opinions expressed in this blogpost are those of the author and do not necessarily reflect the views or positions of Transfix, Inc. or any parent companies or affiliates or the companies with which the participants are affiliated, and may have been previously disseminated by them. The views and opinions expressed in this blogpost are based upon information considered reliable, but neither Transfix, Inc. nor its affiliates, nor the companies with which such participants are affiliated, warrant its completeness or accuracy, and it should not be relied upon as such. In addition, the blogpost may contain forward-looking statements that are not statements of historical fact. All such statements are based on current expectations, as well as estimates and assumptions, that although believed to be reasonable, are inherently uncertain, and actual results may differ from those expressed or implied. All views, opinions, and statements are subject to change, but there is no obligation to update or revise these statements whether as a result of new information, future events, or otherwise.