Temperatures Start to Rise Along with Tender Rejections & Rates

Welcome to the week of January 24th edition of the Transfix Take! Gear up for the latest updates and trends in the trucking industry. In this issue, we're revving up with industry news, sprinting through regional breakdown highlights, and putting the spotlight on what's on the horizon for truckers.

Industry Insights: Unpacking the Road Ahead

In this week's edition of Transfix Take, we bring you the latest updates and insights from the world of freight. Co-hosts Justin Maze and Jenni Ruiz share the following highlights and updates:

Winter Weather Finally Chills Out: Impacts were widespread, with the Midwest, Northeast, and Pacific Northwest facing significant challenges. The storm led to disruptions in trucking operations, causing delays and tightening capacity.

Potential Port Problems: Issues in the Red Sea and Suez Canal are escalating, impacting global supply chains.

Maritime shipping costs are rising, particularly in routes avoiding the Red Sea, which can increase transit time by up to 20%.

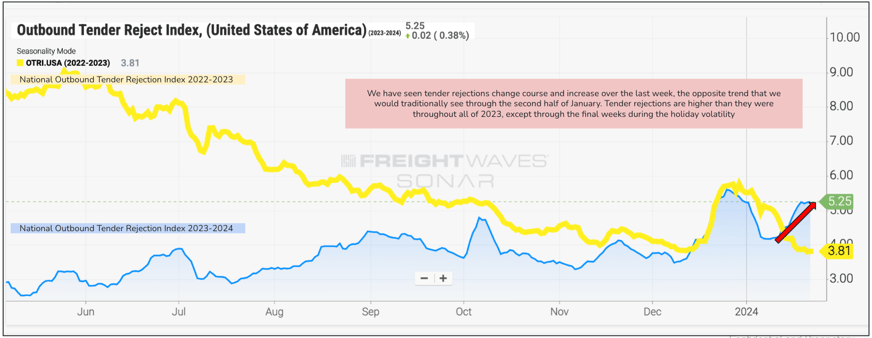

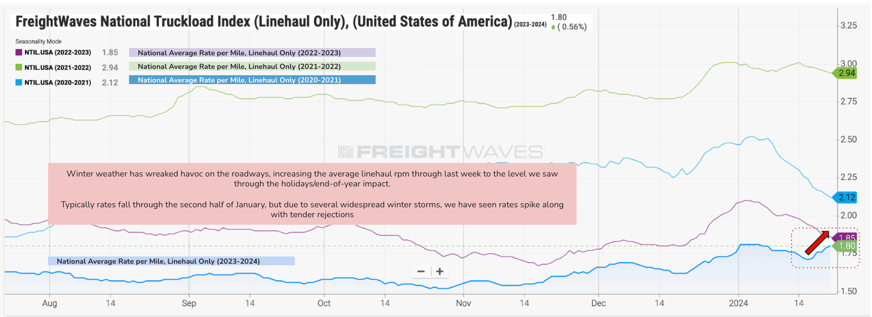

National Average Rate Per Mile and Tender Rejections On the Rise: Tender rejections are at over 5%, with reefer rejections exceeding 10% in Midwest markets like Chicago. The national average rate per mile is $1.88, marking a 15% increase since early November.

Source: Freightwaves

Source: Freightwaves

Regional Roadmap: Where the Rubber Meets the Road

Below is a regional breakdown of the freight industry, uncovering nuances and trends in various regions across the nation.

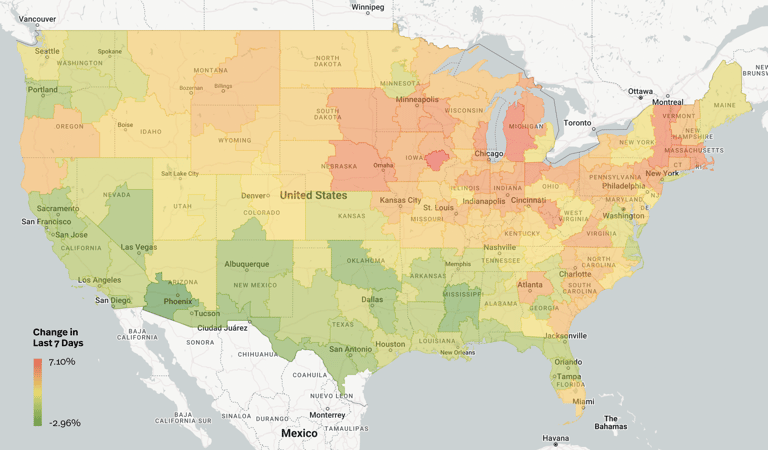

Source: Transfix Internal Data

Source: Transfix Internal Data

The Northeast: Post-winter storm, capacity is softening, especially in key markets like Harrisburg and Allentown. Lake effect snow in areas like New York and New England may still pose challenges but overall, the higher volume markets may see rates drop in Harrisburg and Allentown, Pennsylvania, and Elizabeth, New Jersey.

The Midwest: Winter weather backlog is causing continued tightness in the Midwest. Capacity is expected to open up slowly, but the backlog of freight may slow the decline so we should expect to see higher demands and higher rates for carriers through midweek but as we inch closer to the end of the week, the region is likely to decline..

Coastal Region: Anticipate larger decreases, notably in South Carolina and North Carolina. The region faced challenges from colder weather but is expected to recover with warmer temperatures this week making for more improved driving conditions than we saw last week.

West Coast: Severe floods impacted the West Coast, especially the Pacific Northwest, leading to difficult driving conditions and road and highway closures. Warmer temperatures are expected to alleviate challenges but watch for tightening in Southern California and parts of Arizona. We do anticipate rates to drop here, causing a potential dry-up of available capacity.

The Southeast: Short haul rates increased, particularly in Tennessee, which experienced snow and ice and continues to be difficult. Other areas dealing with snow included Memphis to Nashville to even Chattanooga. Over the last week, we've seen the largest market by volume, Atlanta, tighten up, which is going to drive tightening throughout most markets. Southern Florida may tighten closer to Valentine's Day due to flower imports. Reefer rates will also continue to increase as we get closer to the holiday.

The South: Dallas, Fort Worth, and Houston experienced capacity issues due to freezing temperatures. Expect a steady decline in major markets like Dallas and Houston where tender rejections increased last week. Border markets like Laredo and El Paso continue to loosen but we will see an uptick going into V-Day–just not nearly as much as Southern Florida. Some areas dealing with a backlog of freight included Oklahoma City and parts of Arkansas.

On the Horizon: What Lies Ahead in the Trucking Terrain

The Road Ahead May Not Be Paved with Flowers: Miami may experience tightening due to Valentine's Day flower imports coming from Columbia. Lunar New Year and Valentine's Day have the potential to set the mood for the rest of 2024 but it's all hinged on what Mother Nature has in store.

A Peak at the Next Few Weeks: Rain on the West Coast may positively impact the upcoming produce season. Keep an eye on produce season trends as weather conditions stabilize. Expect short-lived volatility during downtimes as the industry strives for normalcy. Uncertainty persists regarding rate movements, with rates higher than anticipated due to winter weather impacts. Rates are expected to continue falling, potentially leading to a decline in markets before the upcoming produce season. The next week will provide insights into weather conditions and potential rate fluctuations.

Join us next week for an all-new episode where we break down how regions have recovered over the last 7 days. Until then, drive safely.

To make sure you never miss an episode of the Transfix Take podcast, subscribe on Spotify or Apple Music.

DISCLAIMER: All views and opinions expressed in this podcast are those of the speakers and do not necessarily reflect the views or positions of Transfix, Inc., or any parent companies or affiliates or the companies with which the participants are affiliated and may have been previously disseminated by them. The views and opinions expressed in this podcast are based upon information considered reliable but neither Transfix Inc. nor its affiliates nor the companies with which the participants are affiliated warrant its completeness or accuracy, and it should not be relied upon. As such, all views and opinions are subject to change.