Transfix Take Podcast | Ep. 48 – Week of April 26

Carriers Seek Far and Wide for Pricing Power

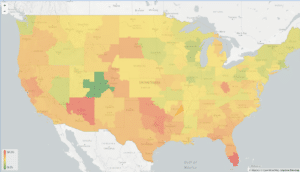

Today, the market continues to bend heavily in shippers’ favor as tender rejections near single digits and spot rates continue to drop. While the overall pace of the market is loosening and rates are starting to level off week-over-week in several regions, carriers still have a few markets left in their pocket where they can continue to drive pricing in their favor. These markets are mainly in the South and Southeast as produce season – combined with record imports – are tightening capacity. Miami is one of the only major markets in the U.S. to see an increase in rates week-over-week last week.

Out West, capacity remains loose, but rates have continued to stay flat. Carriers looking to move freight into the Northeast or Midwest, make sure you secure a higher rate heading to your destination to cover your costs when you leave these regions, because shippers are pushing down on spot rates. For shippers, freight running into the tighter markets influenced by imports and produce will be easy to move, because rates leaving these markets are attracting carriers.

Change in truckload rates over a 7-day period (April 17-24th)

Pulling Back the Curtains: Why is the Market Favoring Shippers Now?

For close to 18 months, due to various pandemic-related factors, carriers experienced a bull market. Rates embarked on record-breaking climbs, while shippers battled multiple supply chain disruptions and bottlenecks. Consumer demand for goods, as opposed to services, was at an all-time high, and truckload capacity struggled to keep up with shippers’ needs, as freight needed to move yesterday.

Since March, shippers have been able to flip the script, but multiple factors led to this change, some of which were in shippers’ control and some of which were not. Let’s start with the latter.

Shippers Accept What They Can’t Control

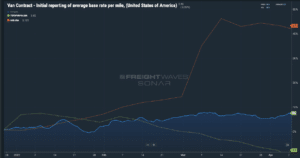

Contract rates have become more favorable as shippers experienced an 8% increase in contractual rates year to date, and this is after the incline we saw through Q4 of 2021.

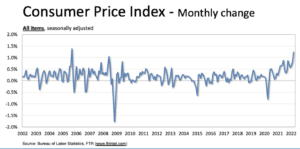

What’s driving this decrease in volumes and spot market activity? For one, consumers have eased the pace at which they’re purchasing durable goods and instead, are spending more on services. Retailers report higher inventory levels. This release of pent-up demand for services over goods is likely spurred by the easing of mask mandates and COVID-19 cases. But we can’t ignore the effects of inflation and higher fuel prices on Americans’ budgets.

With inflation continuing to rise, consumers spend more on everything. The Bureau of Labor Statistics Consumer Price Index below shows the impact consumers are experiencing. In addition, last week, mortgage rates reached over 5% for the first time since 2011. If consumer behavior shifts toward services and the cost of goods continue to increase, then freight volumes could continue to decline or stay flat as less freight is being moved around the country.

All of these factors can drive down demand. Regardless of volume levels, the fact shippers are not rushing to move freight allows them to release pressure on the rail and better plan how they release freight to their partners.

For 18 months, one in four contracted loads was rejected by carriers, which drove up spot rates month after month. As contract rates have garnered favor, and risen, in response to shifting demand, carriers are now experiencing the other side of the power struggle.

Shippers can push for better routing guide compliance with higher rates, pushing carriers to accept and eliminate volume overflow into the spot market. This move has ultimately changed the market’s momentum with the drop in demand and urgency. Currently, contract rates are much higher than spot rates, encouraging carriers to take all of their committed volumes, preventing them from hitting the spot market.

Advice For Shippers: How to Maintain This Market

A couple of factors could prevent shippers from enjoying the current market conditions for an extended period of time.

For one, shippers always have the power to optimize routing guide performance. Shippers already react quickly and attempt to push down rates on brand new contracts; if they bite too much, it could spur an adverse reaction. When some shippers see spot rates drop well below contract rates in different regions, they have a knee-jerk reaction to go back and force carriers to lower their rates.

However, this could do potential harm. Market conditions change, and we are in a traditional time of lower truckload volumes. The last thing shippers need is to push freight back into the spot market by forcing their partners to lower prices. Carrier operations could struggle to stay afloat if rates on the spot side and contract side decrease. A carrier’s operating cost has significantly increased, and rising diesel costs are not helping them. Lowering rates could drive new and old capacity out of the market, only creating trouble for shippers when volumes increase again.

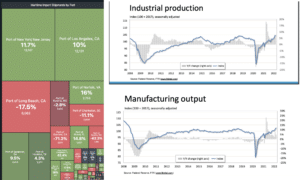

Second, demand can change. We continue to see imports strengthen, especially in the Southeastern ports. Below, you will see the month-over-month changes in import volumes, and this is all while China’s largest port continues to have significant issues. We must remember that imports are not the only freight volumes increasing. Over the past few weeks, we have continued to see an increase in manufacturing output as well as industrial production. If this continues, we will see capacity tighten, just moving different types of freight in place of all those retail goods that carriers were regularly hauling. These are just two of many factors that could help push the pendulum the other way.

With the uncertainty and volatility surrounding the U.S. economic recovery, shippers need a partner that can help them adapt and excel — no matter the circumstance. Shippers turn to Transfix for our leading technology and reliable carrier network. As volumes drive higher, we are here to help: Learn more about our Core Carrier program and Dynamic Lane Rates. As part of our ongoing market coverage, we’ll continue to provide breaking news, resources and insight into emerging trends and the pandemic’s impact on the transportation industry.

Disclaimer: All views and opinions expressed in this blogpost are those of the author and do not necessarily reflect the views or positions of Transfix, Inc. or any parent companies or affiliates or the companies with which the participants are affiliated, and may have been previously disseminated by them. The views and opinions expressed in this blogpost are based upon information considered reliable, but neither Transfix, Inc. nor its affiliates, nor the companies with which such participants are affiliated, warrant its completeness or accuracy, and it should not be relied upon as such. In addition, the blogpost may contain forward-looking statements that are not statements of historical fact. All such statements are based on current expectations, as well as estimates and assumptions, that although believed to be reasonable, are inherently uncertain, and actual results may differ from those expressed or implied. All views, opinions, and statements are subject to change, but there is no obligation to update or revise these statements whether as a result of new information, future events, or otherwise.