Winter Weather Doesn’t Let Up in the West

Welcome to the week of February 7th edition of the Transfix Take! Gear up for the latest updates and trends in the trucking industry. In this issue, we're revving up with industry news, sprinting through regional breakdown highlights, and putting the spotlight on what's on the logistics horizon.

Industry Insights: Unpacking the Road Ahead

In this week's edition of Transfix Take, we bring you the latest updates and insights from the world of freight. Co-hosts Justin Maze and Jenni Ruiz share the following highlights and updates:

West Coast Weather Alert: Earlier this week, a state of emergency was declared due to severe rainstorms in California, specifically in Los Angeles and San Francisco. More inland markets like Nevada, Colorado, and Utah will have to deal with the impact of snowfall throughout the week, as well. While we anticipate these weather conditions may impact freight movement in the coming days, current data shows no significant impact yet.

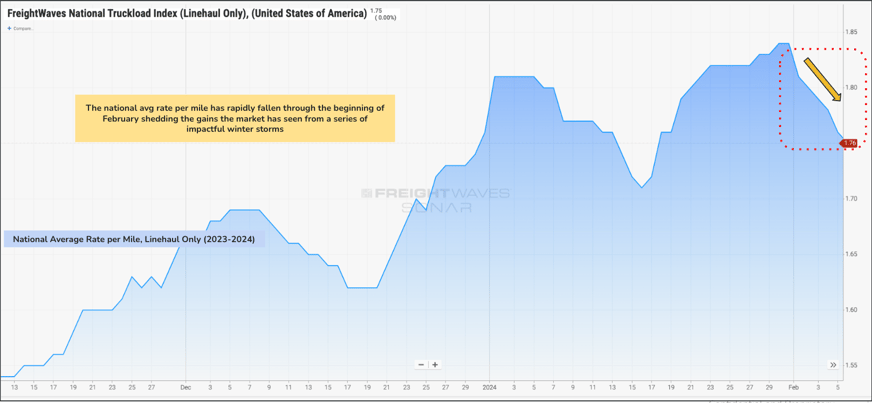

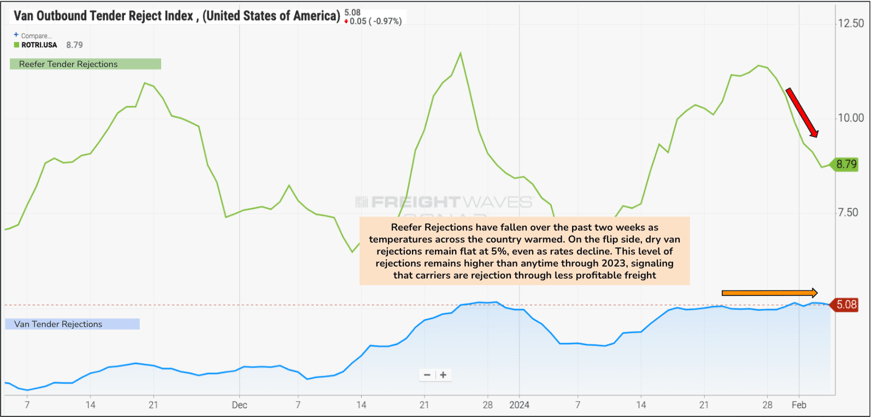

A U-Turn in Rate Nationwide Rate Gains: The national average rate per mile has declined from $1.84 to $1.76 over the past week. Notably, tender rejections remain at around 5%, higher than at any time in 2023, potentially due to carriers selectively rejecting unfavorable freight amidst ongoing negotiations and new RFPs.

Source: Freightwaves

Source: Freightwaves

Regional Roadmap: Where the Rubber Meets the Road

Below is a regional breakdown of the freight industry, uncovering nuances and trends in various regions across the nation.

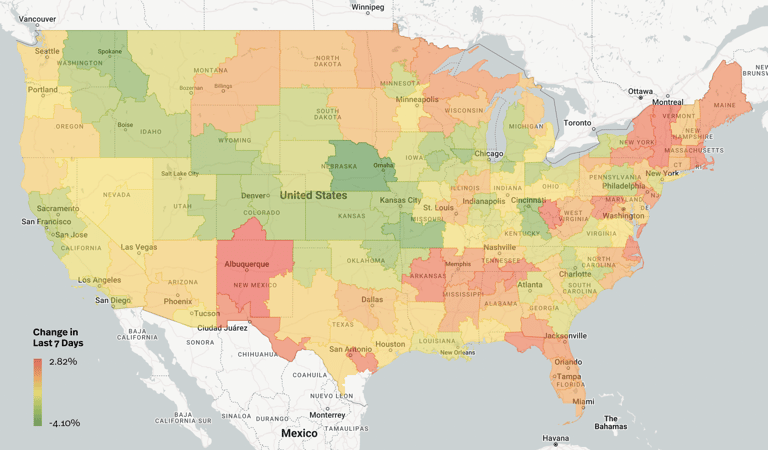

Source: Transfix Internal Data

Source: Transfix Internal Data

West Coast: Despite potential weather disruptions, freight movement remains relatively unaffected. However, rates are low, especially leaving the West Coast, with potential capacity issues. The Pacific Northwest, particularly Washington and Oregon, may see declining gains in the coming weeks.

Midwest: Significant rate declines are observed, making it a desirable destination for carriers in the short term. Over the last 7 days, the entire region took a near 2% dip, with long-hauls at a 2.52% loss. Rates are expected to continue trending downwards in both inbound and outbound lanes.

Northeast: While the New England market experiences snow showers and high winds, others see slight rate declines. Oversupply of capacity in major markets like New Jersey and Pennsylvania may lead to further rate decreases, through the week.

South: A nationwide strike in Mexico affects cross-border trucking, potentially causing delays in imports. Capacity issues persist in border markets, influencing rate movements but markets like El Paso and San Antonio, Texas and Little Rock, Arkansas hold on to their gains.

Southeast: Increased flower imports drive up costs, particularly in Miami, while other markets like Atlanta experience rate declines with continued loosening. These trends are expected to continue post-Valentine's Day.

Coastal Region: Rates decline, especially in markets in the Carolinas, as oversupply of capacity persists. This region continues to mirror that of the Northeast as continued decreases are anticipated throughout February. Although, some of the hotter markets include Norfolk and Winchester, Virginia.

The Crystal Ball Forecast for February

Looking ahead to February, national rates are predicted to decline by approximately 4%, with tender rejections gradually decreasing towards the 4% mark by month-end. Reefer rejections are expected to level out and decline, particularly in the Midwest and Southwest regions, as warmer temperatures reduce the need for reefers to protect against freezing. As the Q1 RFP season unfolds, the spread between spot and contract rates will be closely monitored, potentially impacting rate trends.

Join us next week for an all-new episode where we hope the rain dries out on the West Coast. Until then, drive safely.

To make sure you never miss an episode of the Transfix Take podcast, subscribe on Spotify or Apple Music.

DISCLAIMER: All views and opinions expressed in this podcast are those of the speakers and do not necessarily reflect the views or positions of Transfix, Inc., or any parent companies or affiliates or the companies with which the participants are affiliated and may have been previously disseminated by them. The views and opinions expressed in this podcast are based upon information considered reliable but neither Transfix Inc. nor its affiliates nor the companies with which the participants are affiliated warrant its completeness or accuracy, and it should not be relied upon. As such, all views and opinions are subject to change.