Transfix Take Podcast | Ep. 50 – Week of May 11

Fuel Costs Have Doubled Year Over Year: How Shippers & Carriers Are Faring

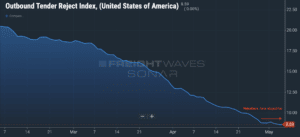

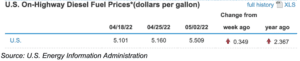

During the week leading up to Mothers’ Day weekend, we saw a static truckload market as volume and tender rejections stayed relatively flat. Fortunately for carriers, that means more markets with rising spot rates. However, as freight kept rolling at similar levels to the prior week, carriers faced a surge in fuel costs. Diesel fuel jumped 35 cents per gallon on May 2nd from the week prior.

It’s not surprising that rising fuel costs put more pressure on smaller carriers having to manage rising operating costs and decreasing operating revenue due to declining rates. To paint a picture, fuel cost has almost doubled from this period last year as carriers and shippers incur an increase of $2.37 per gallon.

Why Are Spot Rates Heating Up?

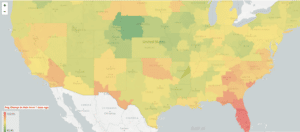

Last week, shippers faced more markets with tight capacity and increased spot rates. The South, Southeast, Coastal, and California markets saw spot rates slightly incline. What’s the cause? Produce season or the increase in imports. In just a 7-day period ending May 6th, Miami saw close to a 5% increase, followed by Charleston and Atlanta at 4%. Markets along the border, including California, experienced spot rate increases of 2-3%.

We shouldn’t expect anything different as rates are likely to see slight increases before heading into International Road Check Week, which could temporarily pull pricing power toward the carrier side as we approach the Memorial Day weekend. The spot market could pick up steam heading into the summer.

A Mad Rush to Lower Contract Rates Is Counterproductive

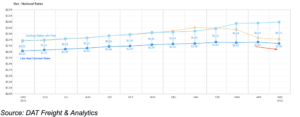

Shippers continue to face a favorable scenario they haven’t witnessed in nearly two years. Tender acceptance remains high, and rates are moving in shippers’ favor. The decline of spot volume is naturally pulling down spot rates and pushing carriers into the contract market. Still, with fewer than two months into a softer market, shippers are reacting quickly and pushing to pull down contract rates as they witness lower spot rates. Unfortunately, it can prove to be counterproductive.

Some shippers are opting to move freight onto the spot market instead of honoring new contract rates, but if they push enough into the spot market, it could push pricing power back to the carrier side. Other shippers are flipping the script on repricing and forcing carriers to pull contract rates down.

While shippers could look to lower some contract rates, they should not do so on their entire network, or we could see markets become volatile. This period of the year is generally softer, so repricing contract freight may backfire if markets pick up steam in the coming months resulting in carriers rejecting contract loads to take on spot freight instead.

Potential Headwinds Ahead for Carriers

After a strong 2021 for carriers, countless factors and headwinds could turn market conditions in the coming months:

- Fuel

- Bottlenecks in China

- Bottlenecks at U.S. ports

- Hurricane Season

- Inflation

For the time being, shippers are certainly holding the upper hand as carriers navigate a difficult market, especially smaller carriers.

With the uncertainty and volatility surrounding the U.S. economic recovery, shippers need a partner that can help them adapt and excel — no matter the circumstance. Shippers turn to Transfix for our leading technology and reliable carrier network. As volumes drive higher, we are here to help: Learn more about our Core Carrier program and Dynamic Lane Rates. As part of our ongoing market coverage, we’ll continue to provide breaking news, resources and insight into emerging trends and the pandemic’s impact on the transportation industry.

Disclaimer: All views and opinions expressed in this blogpost are those of the author and do not necessarily reflect the views or positions of Transfix, Inc. or any parent companies or affiliates or the companies with which the participants are affiliated, and may have been previously disseminated by them. The views and opinions expressed in this blogpost are based upon information considered reliable, but neither Transfix, Inc. nor its affiliates, nor the companies with which such participants are affiliated, warrant its completeness or accuracy, and it should not be relied upon as such. In addition, the blogpost may contain forward-looking statements that are not statements of historical fact. All such statements are based on current expectations, as well as estimates and assumptions, that although believed to be reasonable, are inherently uncertain, and actual results may differ from those expressed or implied. All views, opinions, and statements are subject to change, but there is no obligation to update or revise these statements whether as a result of new information, future events, or otherwise.