Transfix Take Podcast | Ep. 51 – Week of May 18

Where are the Fruits of Produce Season?

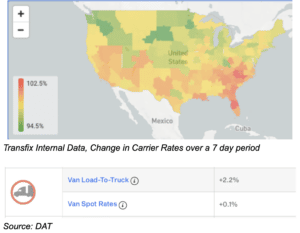

Last week, the influx of produce volumes in the Southeast coastal region led to the tightening of capacity and rise of spot rates. Produce volumes today are strong in Georgia and the Carolinas, which has contributed to this boost in rates for carriers. However, while national spot rates saw a slight increase overall, drivers were not able to significantly combat the rise in fuel cost.

Produce volumes are building more slowly than usual, and one cause is the underperformance of the orange and corn harvest in Florida. The 2022 produce season will likely have a smaller impact on volumes and rates than years past.

Two Timely Threats on Capacity

May 10th marked the beginning of the labor union contract negotiations across 29 West Coast ports, which affects the employment of over 22,000 people. If a labor dispute ensues from the negotiations among 70 shipping and warehouse companies, we could certainly expect supply-chain-damaging disruptions. Jim McKenna, Pacific Maritime Association President, said talks could extend into July.

International Road Check Week (May 17-19) is a 72-hour inspection blitz of commercial vehicles. During this period, capacity traditionally tightens as some drivers decide to park their truck for the week to avoid the possibility of fines. Therefore, the spot market will likely pick up steam with more available freight and higher rates.

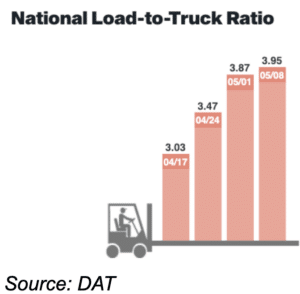

Over the past four weeks, the load-to-truck ratio has increased in the spot market. With rates on the rise in the South, West, and Southeast, this pattern will only continue. Shippers are likely to struggle with capacity throughout the country, especially during these 72 hours, while carriers have an opportunity to carry this pricing-power through Memorial Day weekend.

Fuel Surges Mask True Impact of Loosening Spot Capacity

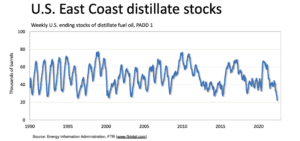

Rising fuel costs have been a mainstay concern in the headlines for weeks – a pain felt in the pockets of all consumers. With spot rates declining and fuel prices surging, the impact of fuel costs alone could drive capacity out of the market or shift drivers back to larger fleets. As FreightWaves’ Rachel Premack points out, the East Coast is currently witnessing the lowest diesel inventory on record. The Department of Energy shows the average price for a gallon of diesel on the East Coast at $5.90, up 63% from the beginning of the year. If inflation did not impact consumer spending already, the continued rise in diesel cost could worsen inflation. Diesel powers industries from agriculture to manufacturing. A potential diesel shortage could bring on an entirely new supply chain crisis we have not recently experienced.

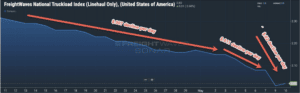

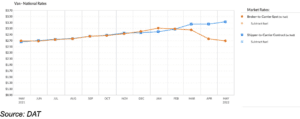

Even as the spot market heats up in the short term, spot capacity overall continues to loosen. The average linehaul rate for spot freight has been on a steep decline, and the surge in the price of fuel is masking the true impact this is having on carriers, especially smaller carriers.

However, because spot rates are well under most contract rates, shippers are pushing more freight into the spot market.The gap between spot and contract rates is only widening.

Shippers have been quick to take two actions:

- Move more contract freight to the spot market, skipping contracted carriers

- Bring their network to the table to negotiate contractual rates

The Crystal Ball Is Cloudy

What are the impacts of shippers pushing contractual freight into the spot market – the opposite action they were pursuing in the last two years – or even pulling back contract commitments for repricing? Could this cause a volatile market later in the year?

China’s reopening could come with a possible tidal wave of imports and multiple other potential bottlenecks. This could not only cause more volatile markets later in the year, but also speed up the traditional pricing power exchange between carriers and shippers. This cycle is one of the most persistent hurdles the industry faces and must overcome with a global solution that works and improves efficiency.

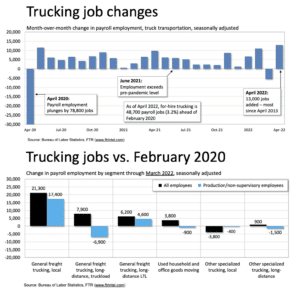

Even as truckload markets loosen, capacity continues to grow. According to the Bureau of Labor Statistics, April alone saw the largest increase in truck transportation jobs since 2013 (9 years). We currently have a larger pool of truck drivers than we did before the pandemic started. So, even though I think the market could heat back up with potential bottlenecks later in the year, we as an industry are certainly more prepared for it with the capacity we continue to add, but we need to make sure a down spot market does not drive out capacity.

Freight Recession: Too Soon To Call It?

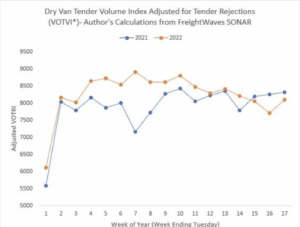

I believe it’s too soon to call a recession . A knee-jerk reaction is never good. We are seeing improved contract compliance through routing guides and shipper network efficiency improvement with the reduction of bottlenecks and the need for expedited freight. Looking at SONAR’s Dry Van Tender Volume Index (Adjusted for Rejections), volume in the market is down, but not by much. At Transfix, we see a significant volume taken through contract agreements that allow carriers and shippers to operate more efficiently. Lengths of haul continue to drop as shippers can navigate supply chains smarter with fewer bottlenecks and less urgency.

The movement of freight is changing in every mode. Shippers who think ahead, use data and think outside the proverbial box on solutions, while partnering with companies such as Transfix, will be well-positioned to withstand market volatility and end up ahead of competitors. The one huge win through this pandemic has been speeding up the digital transformation of the transportation industry.

With the uncertainty and volatility surrounding the U.S. economic recovery, shippers need a partner that can help them adapt and excel — no matter the circumstance. Shippers turn to Transfix for our leading technology and reliable carrier network. As volumes fluctuate, we are here to help: Learn more about our Core Carrier program and Dynamic Lane Rates. As part of our ongoing market coverage, we’ll continue to provide breaking news, resources and insight into emerging trends on the transportation industry.

Disclaimer: All views and opinions expressed in this blogpost are those of the author and do not necessarily reflect the views or positions of Transfix, Inc. or any parent companies or affiliates or the companies with which the participants are affiliated, and may have been previously disseminated by them. The views and opinions expressed in this blogpost are based upon information considered reliable, but neither Transfix, Inc. nor its affiliates, nor the companies with which such participants are affiliated, warrant its completeness or accuracy, and it should not be relied upon as such. In addition, the blogpost may contain forward-looking statements that are not statements of historical fact. All such statements are based on current expectations, as well as estimates and assumptions, that although believed to be reasonable, are inherently uncertain, and actual results may differ from those expressed or implied. All views, opinions, and statements are subject to change, but there is no obligation to update or revise these statements whether as a result of new information, future events, or otherwise.