Transfix Take Podcast | Ep. 56 – Week of June 22

Shippers Tighten Grip on Truckload Markets

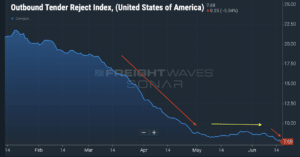

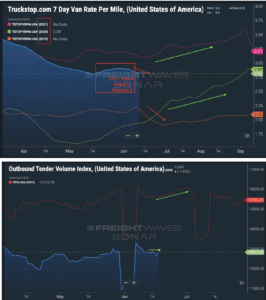

Markets this week continue to sit in the shipper’s favor, as they are picking up even more momentum as we drive through June. Tender rejections – the rate at which carriers forgo contract freight for the higher-paying spot market – were holding steady at 8% after collapsing through April. However, last week, rejections fell to 7% for the first time since the beginning of the topsy-turvy freight market caused by the pandemic.

It’s Mid-June: How Conditions Fare in the Truckload Market

Similar story, different month. So far, June has shown a similar trajectory as May, but there’s one major difference: the absence of DOT week. Therefore, the second half of June could take on a different shape.

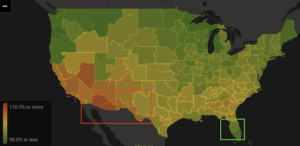

Some of the most noticeable shifts can be seen in the produce market. Thirty days ago, produce season was well underway in Southern Florida – a market that had seen the largest downward shift in rates in favor of shippers. The same pattern, however, wasn’t seen in produce markets along the US/Mexico border. Texas, New Mexico, and Arizona markets saw the largest increases in rate over the same 30-day period. For the most part, truckload markets throughout the U.S. stayed flat with a slight increase through DOT week and Memorial Day weekend, sliding back down through the beginning of June.

Carriers Gain Pricing Power on the West Coast

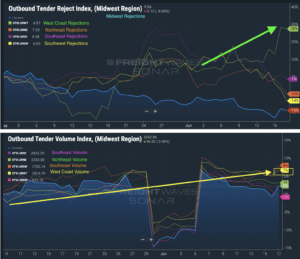

Shippers need to keep a close eye on West Coast markets as they continue to see demand strengthen and rates increase. Tender rejections jumped 28% from May 1st to June 17th, and volume increased 7% in the same period. What’s the culprit? Rail Congestion is a bottleneck that hasn’t eased as quickly as the truckload market. In some cases, it has been worse than what we experienced during the pandemic. Shippers are starting to push some rail volume to over-the-road trucking to take advantage of softening truckload rates. However, due to the volume build-up from the China lockdowns, some shippers still anticipate a surge, which could be problematic if we continue to see issues on the rails or with chassis availability. Keep an eye on West Coast truckload markets as we drive through summer, since many factors could unfold in the coming months, including the labor union negotiations.

What’s Inside the Crystal Ball?

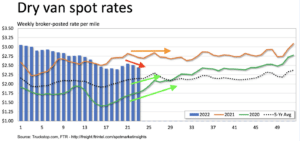

First, let’s reflect on historical trends. Traditionally, June brings tighter capacity, putting pressure on rates up until Independence Day weekend. After the holiday, markets cool before gearing for the retail season in the back half of Q3.

In 2022, however, it seems like we have changed course and are navigating a different route. We are currently witnessing capacity loosen and rates drop during a summer where carriers won’t experience the hot markets they controlled through 2020 and 2021.

Comparing current data with historical data helps us see beyond the present moment. The crystal ball seems to be showing a shipper-favored environment for the next few months at the very least. Carriers continue to battle a downward-shifting market, while fuel and other costs shift upward. As a result, pricing power is no longer a battle in most markets, and carriers will need to carefully navigate the next few months and look towards cost-saving measures to create efficiencies wherever possible.

Next week we’ll dive into what the upcoming shipping regulations mean for the overall market, the retail space, and imports.

The movement of freight is changing in every mode, as shippers do their best to keep up with record demand while fighting congestion at multiple points throughout the supply chain. Shippers who think forward, use data and think outside the proverbial box on solutions, while partnering with companies such as Transfix, will come out of this ongoing freight rally in a better position and well ahead of competitors. The one huge win through this pandemic has been speeding up the digital transformation of the transportation industry.

With the uncertainty and volatility surrounding the U.S. economic recovery, shippers need a partner that can help them adapt and excel — no matter the circumstance. Shippers turn to Transfix for our leading technology and reliable carrier network. As volumes drive higher, we are here to help: Learn more about our Core Carrier program and Dynamic Lane Rates. As part of our ongoing market coverage, we’ll continue to provide breaking news, resources and insight into emerging trends and the pandemic’s impact on the transportation industry.

Disclaimer: All views and opinions expressed in this blogpost are those of the author and do not necessarily reflect the views or positions of Transfix, Inc. or any parent companies or affiliates or the companies with which the participants are affiliated, and may have been previously disseminated by them. The views and opinions expressed in this blogpost are based upon information considered reliable, but neither Transfix, Inc. nor its affiliates, nor the companies with which such participants are affiliated, warrant its completeness or accuracy, and it should not be relied upon as such. In addition, the blogpost may contain forward-looking statements that are not statements of historical fact. All such statements are based on current expectations, as well as estimates and assumptions, that although believed to be reasonable, are inherently uncertain, and actual results may differ from those expressed or implied. All views, opinions, and statements are subject to change, but there is no obligation to update or revise these statements whether as a result of new information, future events, or otherwise.