Transfix Take Podcast | Ep. 59 – Week of July 13

Just how loose is capacity in the current market?

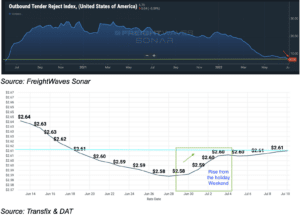

July’s freight market so far isn’t matching the historical status quo. The 4th of July holiday had little to no impact on the trucking industry, and this past week, markets continued to loosen, making it harder for carriers to find pricing power in any market. Meanwhile, shippers continue to marinate in favorable conditions.

Last week we saw dry van tender rejections drop below 7% – a level we have not seen since the week of June 6, 2020 – over two years ago! This level of tender rejections remains a deviation, as we normally see markets tighten after the holiday. Luckily for carriers, even as tender rejections declined to new lows, rates have stayed flat since the slight rise going into the Independence Day weekend. Rates are still lower than they were during the first half of June.

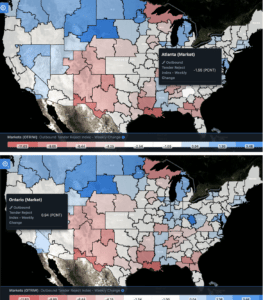

The markets with the highest volumes have been the tightest over the past few weeks. Both Atlanta and Ontario, CA have shown some loosening trends. From 7/5 through 7/11, rates in Atlanta have dropped just over 1%, while they’ve dropped 2% in Ontario. Ontario may have seen a more significant drop in rates, but tender rejections rose week over week. In Atlanta, tender rejections dropped.

Peeling Back the Band Aid Covering Rate Cuts

In the past 90 days, national average rates have dropped more than 10% on hauls greater than 300 miles. The decline was fast, and carriers have acutely felt the cut in rates. When you compare the drop in linehaul to all-in rates, the cut only gets deeper as fuel surged during the same period.

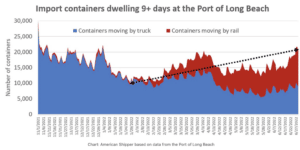

We’re expecting the coming weeks will be very similar to the past few. With tender rejections below 7%, rejections will likely remain flat along with spot rates. Markets neighboring major markets will continue to be a shipper’s pain point. This is especially the case for Southern California, as the rails continue to have issues, pushing volume to over-the-road trucking. For the East Coast, import volumes continue to be strong. Even with congestion on the rails and strong volumes at some East Coast ports, these factors are not enough to put pressure on trucking capacity or to make any significant change in the coming weeks. Especially as shippers don’t seem to have the stress or need to move freight as fast as possible – a complete 180 from this time last year.

What Looms Beneath the Soft Market?

Soft trucking markets may be hiding the congestion on the rails and other ongoing bottlenecks within the domestic supply chain. This year, it may not be front-page news, but don’t be fooled. These issues aren’t going anywhere. Rail congestion has only worsened with a lack of chassis and rail cars. Just as the backlog of vessels at Southern California ports moves in the right direction, this bottleneck could flip that around. In the West Coast ports, containers are starting to stack up. The number of containers dwelling for at least nine days has more than doubled since February. If this pattern persists, congestion issues we have only just started recovering from could reemerge. East Coast ports continue benefiting from these issues, having surpassed the West Coast on imports.

AB5: Gloom or Boon?

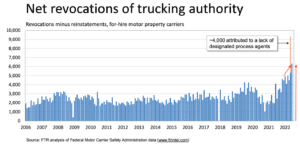

The industry is waiting to see the true impact of AB5. In the short term, small and mid-size carriers, along with some drivers, will feel additional pain on top of the major pain caused by the current market. Looking further into the future, however, AB5 could positively impact supply as a whole. Improving the quality of a driver’s life will make the driver profession look more appealing than it has in recent years.

As truckload demand cools, supply is feeling the squeeze. Net revocations of trucking authorities hit another high of over 6k. Shippers enjoy easing capacity and a more efficient supply with high contract tender acceptance. However, this dangerous reciprocal cycle of market power between the carrier and shipper must be top of mind. For shippers, this is an opportunity to think of long-term solutions as former partners go out of business.

The movement of freight is changing in every mode, as shippers do their best to keep up with record demand while fighting congestion at multiple points throughout the supply chain. Shippers who think forward, use data and think outside the proverbial box on solutions, while partnering with companies such as Transfix, will come out of this ongoing freight rally in a better position and well ahead of competitors. The one huge win through this pandemic has been speeding up the digital transformation of the transportation industry.

With the uncertainty and volatility surrounding the U.S. economic recovery, shippers need a partner that can help them adapt and excel — no matter the circumstance. Shippers turn to Transfix for our leading technology and reliable carrier network. As volumes drive higher, we are here to help: Learn more about our Core Carrier program and Dynamic Lane Rates. As part of our ongoing market coverage, we’ll continue to provide breaking news, resources and insight into emerging trends and the pandemic’s impact on the transportation industry.

Disclaimer: All views and opinions expressed in this blogpost are those of the author and do not necessarily reflect the views or positions of Transfix, Inc. or any parent companies or affiliates or the companies with which the participants are affiliated, and may have been previously disseminated by them. The views and opinions expressed in this blogpost are based upon information considered reliable, but neither Transfix, Inc. nor its affiliates, nor the companies with which such participants are affiliated, warrant its completeness or accuracy, and it should not be relied upon as such. In addition, the blogpost may contain forward-looking statements that are not statements of historical fact. All such statements are based on current expectations, as well as estimates and assumptions, that although believed to be reasonable, are inherently uncertain, and actual results may differ from those expressed or implied. All views, opinions, and statements are subject to change, but there is no obligation to update or revise these statements whether as a result of new information, future events, or otherwise.