Transfix Take Podcast | Ep. 60 – Week of July 20

Drivers Protest AB5: Why Everyone Should Be Paying Attention

We still don’t have a firm grasp on how this new law will impact the freight market, but drivers have started to make a statement. At the busiest U.S. ports in Southern California, hundreds of drivers gathered for peaceful protests. According to the Los Angeles Port Director, protests resulted in no disruption of port throughput. However, drivers are frustrated. After being praised as heroes during the pandemic for keeping goods on the shelves, many now feel like their voices and concerns are irrelevant. In response to the industry’s intensifying pushback, last week the California governor’s office said it would look into the concerns.

Even if you’re not doing business in California, keeping an eye on what happens here is important. The supply of drivers could change, or the disruption from long-term protests could cause more significant bottlenecks at the ports.

Will Rail Chaos Resolve Before Peak Season?

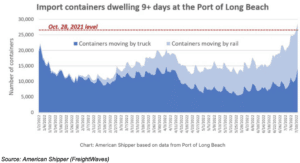

Ports in Southern California are suffering from container congestion, and it’s only getting worse. Vessels waiting at berth are no longer the bottleneck. This congestion is caused by the increasing dwell time for rail-bound containers. The pileup of import containers is quickly reaching levels similar to those at the height of pandemic congestion as a result of a lack of available rail cars.

Alongside this container jam, railroad workers who are dissatisfied with current working conditions are threatening to strike, which motivated intervention from the White House. An emergency board will begin weighing in on a series of disputes over wages and health care that began in January 2020.

As rail issues persist on the West Coast, the East Coast continues to take advantage.

July Truckload Market Looks Like a Peaceful Back-Country Highway

How did we arrive at this current soft and shipper-favored freight market? Back in March, truckload demand fell down a steep slope, making capacity easily accessible to shippers. Creating the supply and demand curves that carriers enjoyed through the pandemic might require the force of a freight train. Will “rail congestion and AB5” be the freight train carriers are looking for? Likely not, but it could help steer markets a little more in their favor. For small and mid-size carriers, steering the market in their favor could just mean helping them stay profitable.

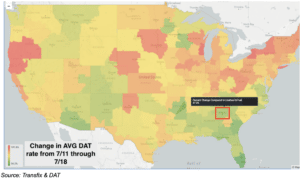

Atlanta, GA – One of the Tightest Markets – Finally Softens

The most significant shift this past week was the Atlanta, GA market. For weeks, this market has been one of the tightest, but that trend reversed last week. Tender volumes, rejections, and spot rates all declined by varying degrees. Atlanta’s rates fell just under 3%, while rejections dropped by 2% (maintaining a level above the national average of 6.9%).

This wasn’t the only market to see uncharacteristic softening. Markets throughout the Southeast– especially Florida– saw declines, which are expected to continue in the coming week. Border markets in Mexico and Texas show signs of softening, but not as rapidly as the border between Mexico and Arizona.

Around the rest of the country over the past two weeks, markets have been flat, with pockets of tightening in the Midwest and Northeast. However, most of these tightening markets have low outbound volumes. Picture a peaceful drive across a back-country highway with miles and miles of calm, unchanging conditions. Well, that’s what the remainder of July is expected to be like for the truckload markets. That is, of course, unless there are major disruptions in Southern California due to the potential impacts of current congestion and labor unrest.

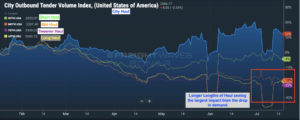

Shorter and Local Hauls See Volume Spikes

It’s been a little over a month since I called out the clear separation in volume trends by the length of haul. As overall volumes continue to stagnate or even decline, shorter and local hauls continue to see substantial volumes – volumes even stronger than during most of the pandemic. Longer haul freight, however, is experiencing lower volumes, which makes sense. Currently, most shippers are not moving with urgency, and this allows them to move more intelligently and efficiently. With a higher level of inventory, freight is likely to move to nearby warehousing markets instead of being rushed across a larger geographic area. Rail congestion in Southern California could potentially change this, also factoring in rail container backup and softening truckload spot rates.

The movement of freight is changing in every mode, as shippers do their best to keep up with record demand while fighting congestion at multiple points throughout the supply chain. Shippers who think forward, use data and think outside the proverbial box on solutions, while partnering with companies such as Transfix, will come out of this ongoing freight rally in a better position and well ahead of competitors. The one huge win through this pandemic has been speeding up the digital transformation of the transportation industry.

With the uncertainty and volatility surrounding the U.S. economic recovery, shippers need a partner that can help them adapt and excel — no matter the circumstance. Shippers turn to Transfix for our leading technology and reliable carrier network. As volumes drive higher, we are here to help: Learn more about our Core Carrier program and Dynamic Lane Rates. As part of our ongoing market coverage, we’ll continue to provide breaking news, resources and insight into emerging trends and the pandemic’s impact on the transportation industry.

Disclaimer: All views and opinions expressed in this blogpost are those of the author and do not necessarily reflect the views or positions of Transfix, Inc. or any parent companies or affiliates or the companies with which the participants are affiliated, and may have been previously disseminated by them. The views and opinions expressed in this blogpost are based upon information considered reliable, but neither Transfix, Inc. nor its affiliates, nor the companies with which such participants are affiliated, warrant its completeness or accuracy, and it should not be relied upon as such. In addition, the blogpost may contain forward-looking statements that are not statements of historical fact. All such statements are based on current expectations, as well as estimates and assumptions, that although believed to be reasonable, are inherently uncertain, and actual results may differ from those expressed or implied. All views, opinions, and statements are subject to change, but there is no obligation to update or revise these statements whether as a result of new information, future events, or otherwise.