Rate Dips and a Potential End to the UAW Strike

Welcome to the week of November 1st edition of the Transfix Take! Gear up for the latest updates and trends in the trucking industry. In this issue, we're revving up with industry news, sprinting through regional breakdown highlights, and putting the spotlight on what's on the horizon for truckers.

Industry Insights: Unpacking the Road Ahead

In this week's edition of Transfix Take, we bring you the latest updates and insights from the world of freight. Our market expert, Justin Maze, shares the following highlights and updates:

National Average Rate per Mile: The national average rate per mile currently stands at $1.53. While we've seen an uncharacteristic decline in rates over the last week, in light of the time of year. There's a cautious optimism that rates may see some pressure in the back half of November ahead of the Thanksgiving and Chanukah holidays, though it might be short-lived.

Source: Freightwaves

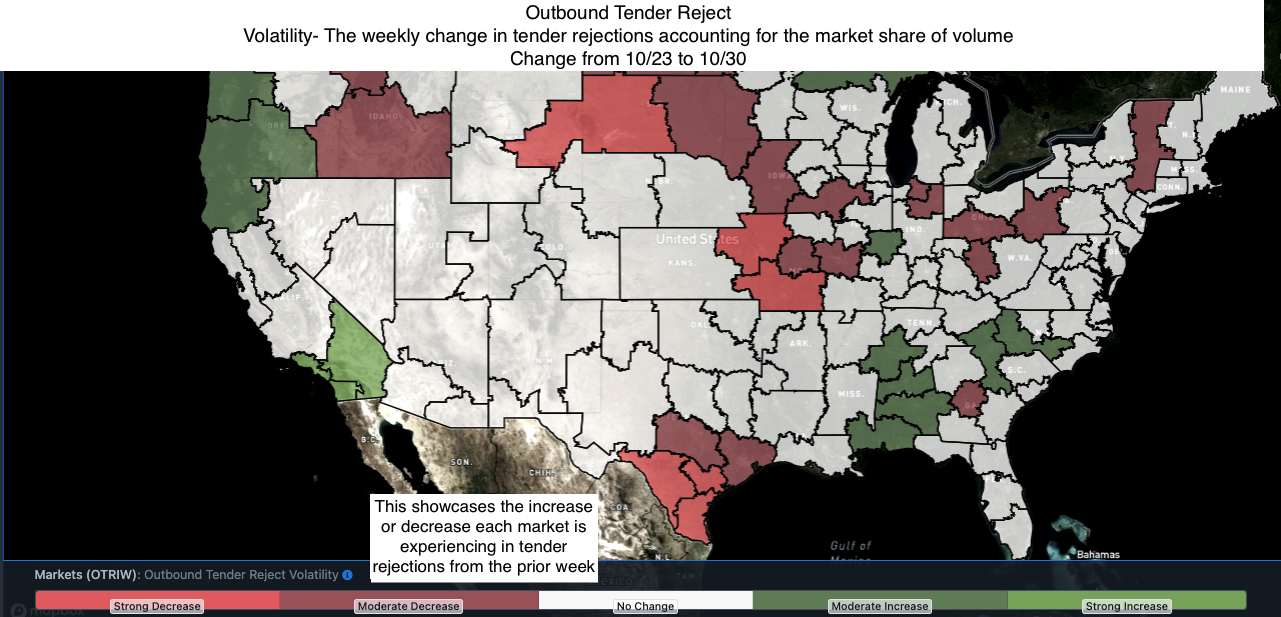

Tender Rejections Update: Tender rejections have fallen slightly to approximately 3.5%. This trend indicates that most carriers and brokers are accepting the contract loads that come their way, contributing to the ongoing decrease in the spot market rates.

Source: Freightwaves

Regional Roadmap: Where the Rubber Meets the Road

Below is a regional breakdown of the freight industry, uncovering nuances and trends in various regions across the nation.

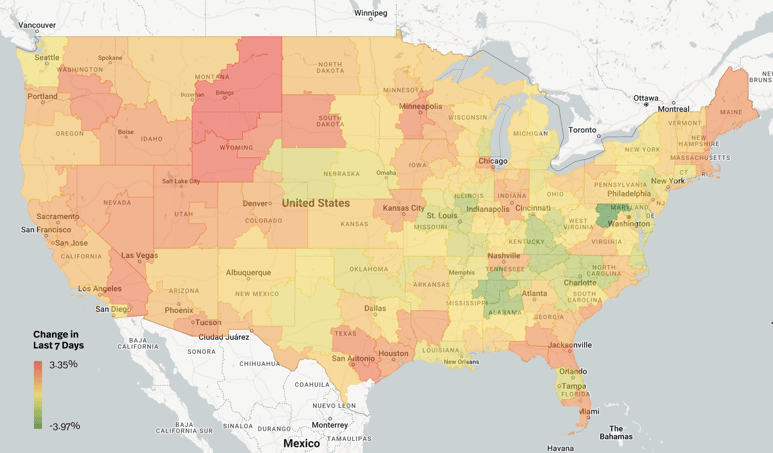

Source: Transfix Internal Data

The Midwest: While some rural markets in the Midwest, such as Bismarck, North Dakota, and Hutchinson, Kansas, have seen slight rate increases signaling potentially ideal opportunities for drivers, the region as a whole is experiencing a decline in rates.

The Northeast: The Northeast region, including markets like Elizabeth, New Jersey, Allentown, Pennsylvania, and Harrisburg, Pennsylvania, continues to face decreasing rates, particularly in higher-volume markets. We anticipate this will continue into next week.

Coastal Region: The Coastal Region is still favorable for shippers, with some pressure on local and city freight. Demand for freight picking up and staying in the Coastal Region remains higher, driving rates up in these areas.

The South: The South presents a mixed picture, with markets like Oklahoma City showing signs of softening. Markets in Texas, including San Antonio and Austin, are experiencing slight rate increases, while higher-volume markets are more favorable for shippers.

The Southeast: The Southeast is seeing a mixed trend, with some areas in Florida, such as Jacksonville and Miami, experiencing rate increases, while Georgia is loosening. However, overall, leaving the Southeast remains advantageous for shippers.

West Coast: Unlike the East Coast and South, the West Coast is showing tightening markets possibly due to an increase in imports. While most markets are experiencing slim rate gains, the Pacific Northwest is starting to soften as it shifts out of produce season.

On the Horizon: What Lies Ahead in the Trucking Terrain

As we approach the holiday season, the industry is grappling with unique challenges. Here's what's on the horizon:

Holiday Hurdles: Carriers may see some opportunities for rate increases around Thanksgiving, but these are not expected to last long. December is likely to see rates drop again, with traditional holiday volatility expected for Christmas and the new year. We anticipate the beginning of 2024 to be a challenging market.

UAW Strike May Be Over: The UAW auto workers have reached tentative agreements with all big three manufacturers to end the strike, potentially increasing volume in the truckload market, specifically in the Midwest region. While this development is promising, it may not have a significant impact overall as we await union workers to ratify the agreement.

Consumer Control: The holiday season and consumer behavior remain uncertain. While some signs indicate that consumers may be making purchases earlier to avoid any potential supply chain disruptions, the industry is still adapting to changing dynamics and an overall volatile economy.

As we continue to navigate these uncertain times, it's crucial for carriers and shippers to maintain strong partnerships and stay informed about market conditions. We'll be back next week with more insights and updates to keep you informed.

Drive safely!

DISCLAIMER: All views and opinions expressed in this podcast are those of the speakers and do not necessarily reflect the views or positions of Transfix, Inc., or any parent companies or affiliates or the companies with which the participants are affiliated and may have been previously disseminated by them. The views and opinions expressed in this podcast are based upon information considered reliable but neither Transfix Inc. nor its affiliates nor the companies with which the participants are affiliated warrant its completeness or accuracy, and it should not be relied upon. As such, all views and opinions are subject to change.