Transfix Take Podcast | Ep. 61 – Week of July 28

Truckload Markets Remain Motionless

Truckload markets have been relatively quiet since Independence Day weekend, even as West Coast port protests continue. Last week, national tender rejection rates stalled out around 7%, continuing the trend we’ve been seeing over the past several weeks: capacity continues to ease, the spot market is shrinking, and rates are in steady decline.

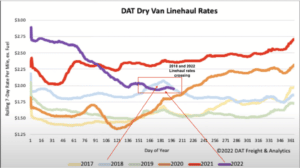

As of the end of last week, since the beginning of the year, spot line haul rates had decreased 26% while fuel prices increased 50%. As a result, total truckload volumes are starting to resemble volumes from 2018 – the industry’s last bull market. While some carriers struggle to survive on the spot market, others are basking in the contract rates that have remained flat throughout the first half of the year.

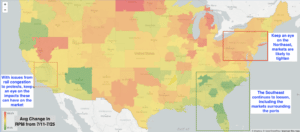

Keep Eyes on Northeast for Tighter Capacity

As produce season ends in the Southeast, freight rates leaving this region continue to decline, while freight rates heading to the Southeast have increased. Because it’s not as lucrative for carriers to leave the Southeast, shippers are having to pay higher rates to send drivers there. Meanwhile, shippers need to keep an eye on the Northeast, as port markets continue to witness record volumes and could cause capacity to tighten. In the coming week, these existing patterns in the Southeast and Northeast should continue. Also, keep your eyes peeled for updates on Southern California, especially in light of container congestion and AB5 port protests.

Source: Transfix & DAT

The Great Driver Migration: How the Shifting Market Influences Driver Behavior

Along with the spike in freight demand and record rates at the peak of the pandemic came a migration of drivers. Drivers left larger fleets to run solo or with smaller fleets and new drivers entered the industry to take advantage of the carrier-favoring market.

More recently, as the freight market has been shifting into reverse, so has this driver migration. Net revocations are setting records, so more drivers are handing in their authority to drive for larger fleets. Why? With the spot market drying up and fuel prices at all-time highs, it’s simply difficult to operate as a smaller carrier. In a tight market, driving with a smaller carrier can be more lucrative, but in a soft market, many drivers will gravitate towards larger companies for job security.

It’s not all bad news for carriers. Over the past week, some of the largest truckload carriers have released earnings and continue to do well. J.B. Hunt even reported that since June 30, 2021, its independent contractor portion of its truckload tractor count increased by 86%. Many of these trucks are likely leased on owner ops, who may be returning to larger carriers in the soft market to avoid having to navigate the surging fuel and declining spot rates on their own. Marten also announced record Q2 earnings.

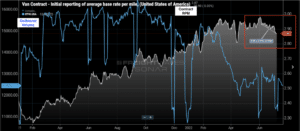

Across the truckload market, contractual rates soared in the past 12 months, and contract tender acceptance remains high – a core reason behind the drought in spot rates. Large carriers like Marten and J.B. Hunt, who stayed ahead of the moving market, were able to capitalize. This doesn’t only apply to large carriers, but also brokers, who help the majority of carriers in the industry to get freight and access to larger shippers.

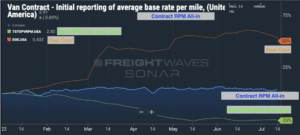

Maze’s Crystal Ball: Driver Satisfaction Isn’t All About Rates

How long will contract rates remain strong? As volumes have continued to decline over the past month, we are seeing subtle signs that contract rates are deteriorating. So far in July, contract rates have declined by 2%, causing shippers to reprice contract freight. The market is also seeing spot freight slightly increase, likely due to shippers moving high-priced contract loads into the spot market to take advantage of low rates. However, 2% is a drop in the bucket from the climb we have seen in the past year.

Too often the focus is on driver pay, which is relative to market rates. However, pay is only one factor that should be considered when joining or continuing a career as a driver. Drivers were hailed as heroes throughout the pandemic as they kept our supply chains running. Drivers are the backbone of the economy – one of the essential jobs that are overlooked too often.

The lifestyle of a driver is different from that of other professions, especially if they are driving over the road. Parking has been a persistent issue for decades. Drivers often spend the night on the road in preparation for their next delivery or pickup. This means they are sleeping in their truck and are struggling to find a safe, reliable, and legal place to shut down for a good night’s sleep. If you ask any driver, they will tell you this is one of the most challenging parts of the job.

Good news hit the industry last week. The Committee on Transportation and Infrastructure in the US House of Representatives approved legislation (HR 2187) which, if passed through Congress, would dedicate funding of $755 million for safer, more abundant parking.

Next week we’ll dive back into AB5 and the issues persisting on the rails.

The movement of freight is changing in every mode, as shippers do their best to keep up with record demand while fighting congestion at multiple points throughout the supply chain. Shippers who think forward, use data and think outside the proverbial box on solutions, while partnering with companies such as Transfix, will come out of this ongoing freight rally in a better position and well ahead of competitors. The one huge win through this pandemic has been speeding up the digital transformation of the transportation industry.

With the uncertainty and volatility surrounding the U.S. economic recovery, shippers need a partner that can help them adapt and excel — no matter the circumstance. Shippers turn to Transfix for our leading technology and reliable carrier network. As volumes drive higher, we are here to help: Learn more about our Core Carrier program and Dynamic Lane Rates. As part of our ongoing market coverage, we’ll continue to provide breaking news, resources and insight into emerging trends and the pandemic’s impact on the transportation industry.

Disclaimer: All views and opinions expressed in this blogpost are those of the author and do not necessarily reflect the views or positions of Transfix, Inc. or any parent companies or affiliates or the companies with which the participants are affiliated, and may have been previously disseminated by them. The views and opinions expressed in this blogpost are based upon information considered reliable, but neither Transfix, Inc. nor its affiliates, nor the companies with which such participants are affiliated, warrant its completeness or accuracy, and it should not be relied upon as such. In addition, the blogpost may contain forward-looking statements that are not statements of historical fact. All such statements are based on current expectations, as well as estimates and assumptions, that although believed to be reasonable, are inherently uncertain, and actual results may differ from those expressed or implied. All views, opinions, and statements are subject to change, but there is no obligation to update or revise these statements whether as a result of new information, future events, or otherwise.