Transfix Take Podcast | Ep. 65 – Week of August 31

As Summer Ends, Speculation About Q4 Intensifies

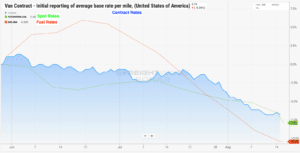

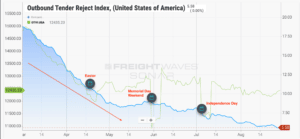

For most, Labor Day Weekend symbolizes the unofficial ending of summer. For those in the transportation industry, it represents not just a change of seasons, but a potentially volatile spot market, as well. In 2022, Labor Day Weekend could provide a glimpse into Q4 truckload market conditions. In the final two weeks of August, we have seen the decline in line haul spot rates accelerate– and fuel is starting to level off after several weeks of decline, as well. The decline in spot rates comes as tender rejections remain below 6%, even as overall volume holds consistent.

Source: FreightWaves, SONAR

Holidays, especially those landing on or around the end of a month, traditionally represent a fork in the road. One outcome would lead to volatility and a bumpy ride in truckload markets, while the other would make for a nice, calm drive. As we mark the end of summer, I firmly believe this Labor Day Weekend will be smooth driving for shippers as market trends continue to move in a direction that favors them. Truckload rates will likely decline as tender acceptance rises, which is the best outcome a shipper can ask for. Holidays usually allow carriers to pull back a little, in terms of pricing power…but I don’t think they will have much ability to pull that pricing power in their favor this year, apart from some remote markets.

Still, by and large, carriers won’t find much change from the current trend. This stasis could also be a more vital indicator for Q4 as a whole. Without a doubt, there will be some volatility and shifts in the truckload markets around the major holidays, but it will likely not be anywhere near the degree we have seen over the past two years.

Source: FreightWaves, SONAR

Mostly Smooth Sailing

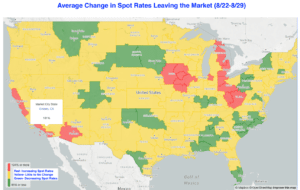

Jumping a little deeper into the markets themselves, we continue to find that most markets witnessed little to no change in the past seven days. Higher volume markets in the South and Southeast still bear witness to declining spot rates. Throughout the country, only a few markets saw rates incline. Among the inclining markets, the most notable were in Southern California and parts of the Midwest.

Last week, we called out the changing conditions in Southern California– and we’ll continue to flag them, as this represents one of the largest outbound freight hubs and tends to be a starting point for increasing spot rates in Q4. The 1% increase over the past week is nothing to worry about at present, but we will continue to monitor closely.

Source: Transfix

“Bear” in Mind: Q4 2022

The closer it gets, the more I continue my lean towards the “bearish” side of the Q4 trucking market. However, I’ll state that this stance might change at any moment if certain dominos fall and start their chain reactions…but I’ll stay optimistic for now. Why? Because carriers are presently accepting their freight at such high levels, it would take a domino effect of certain combined factors to cause a quick change in that carrier behavior.

Supply and demand are, of course, major determinants in the volatility of the truckload market, and we continue to look broadly at factors that might give us a crystal ball view of Q4. Last week, for instance, we did a quick overview of what’s happening with large retailers’ purchase orders. These retailers have been making headlines with the actions they’re taking, such as canceling orders or discounting inventory.

Impacts From Outside of Trucking?

Some of those “other factors” live outside the truckload transportation sector. We frequently check the pulse at the ports and on the rails to get a different view of what’s making the supply chain tick, as both impact truckload markets. Union negotiations are still top of mind for both the ports and rail lines, but there’s not much news to report here. As we enter the industry’s traditional peak season, I don’t anticipate that other modes will have a major impact on the truckload markets, and I’ll keep an ear out for more news in the near term.

Inventory is another congestion point for many shippers. Finding warehousing space continues to be tough and is, for some, translating into bottlenecks. Last year, retailers struggled to maintain inventory levels due to supply chain chaos. This year, many retailers find themselves with too much inventory on hand. Some are now facing inventory issues with higher inventory sales ratios than before the pandemic. Data from the US census bureau shows that retail “inventory to sales ratio” issues are at a high level. This has a major impact on the trucking industry as retailers drive demand in the dry van sector, and is one of many reasons why trucking demand has not been as chaotic. The problems shippers experience when they collectively need additional freight moved with urgency are not pressing at this time.

Source: U.S. Census Bureau

The Road Ahead

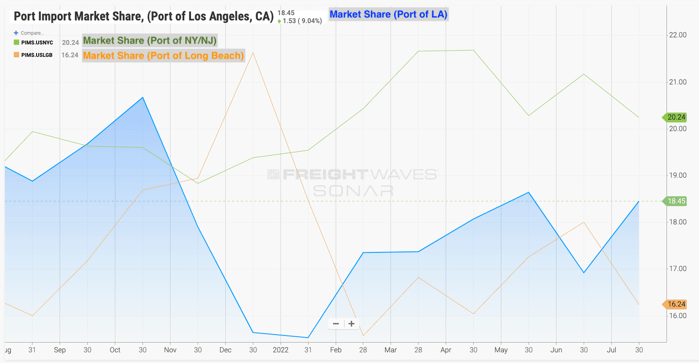

Next week, we’ll take the analysis a step further. Join us as we dive into the “pre-peak season” congestion and trends at ports as well as the warehousing pain points shippers are dealing with. Below is a sneak peek of what we’re seeing as the port of NY/NJ continues to experience strong demand.

Source: FreightWaves, SONAR

The movement of freight is changing in every mode, as shippers do their best to keep up with record demand while fighting congestion at multiple points throughout the supply chain. Shippers who think forward, use data and think outside the proverbial box on solutions, while partnering with companies such as Transfix, will come out of this ongoing freight rally in a better position and well ahead of competitors. The one huge win through this pandemic has been speeding up the digital transformation of the transportation industry.

With the uncertainty and volatility surrounding the U.S. economic recovery, shippers need a partner that can help them adapt and excel — no matter the circumstance. Shippers turn to Transfix for our leading technology and reliable carrier network. As volumes drive higher, we are here to help: Learn more about our Core Carrier program and Dynamic Lane Rates. As part of our ongoing market coverage, we’ll continue to provide breaking news, resources and insight into emerging trends and the pandemic’s impact on the transportation industry.

Disclaimer: All views and opinions expressed in this blogpost are those of the author and do not necessarily reflect the views or positions of Transfix, Inc. or any parent companies or affiliates or the companies with which the participants are affiliated, and may have been previously disseminated by them. The views and opinions expressed in this blogpost are based upon information considered reliable, but neither Transfix, Inc. nor its affiliates, nor the companies with which such participants are affiliated, warrant its completeness or accuracy, and it should not be relied upon as such. In addition, the blogpost may contain forward-looking statements that are not statements of historical fact. All such statements are based on current expectations, as well as estimates and assumptions, that although believed to be reasonable, are inherently uncertain, and actual results may differ from those expressed or implied. All views, opinions, and statements are subject to change, but there is no obligation to update or revise these statements whether as a result of new information, future events, or otherwise.