The midweek market update is a recurring series that keeps shippers and carriers informed with market trends, data, analyses, and insights.

Transfix Take Podcast | Ep. 70 – Week of October 5

Ian’s Impact

In mid-September, a sigh of relief was heard across the supply chain when railway unions reached a tentative agreement, and now– even as the industry has been coping with a major hurricane– we still have not seen much change in truckload markets. As we turn into the final stretch of 2022, this absence of disruption to trucking capacity can, nevertheless, shed some light on anticipated conditions. At this point, our “crystal ball” for the coming months is showing a loose trucking market.

Thoughts and prayers for everyone who experienced and is affected by Hurricane Ian. Ian– a “once in a lifetime” storm, according to some– made landfall twice on the US mainland last week. The first hit was Wednesday around Fort Myers (on the west coast of Florida) at Category Four strength. While the impact of this massive storm stretched across Florida, the most devastation was seen in the southwestern part of the state. Ian then returned to sea, regaining strength before making landfall again in South Carolina.

Major weather events like hurricanes tend to disrupt supply chains, but the industry has some familiarity with navigating these events. For example, many major retail chains have plans in place to bring in additional supplies like bottled water and canned foods ahead of surging demand. Organizations will also sometimes close up operations early in anticipation of necessary shut-downs. We have seen (and will continue to see) unscheduled disruptions such as port, airport, and major highway closures due to wind damage, widespread power outages, and flooding.

Current Capacity & Other Factors

As for trucking capacity, impacts seemed to have been much smaller than most anticipated; we did not witness capacity issues on a scale that would have been expected for a natural disaster of this magnitude. Despite the fact that the storm took place during the end of a month and the end of a quarter (when shippers are pushing more loads to hit goals and capacity subsequently tightens), capacity has– surprisingly– been able to navigate shifts in demand thus far.

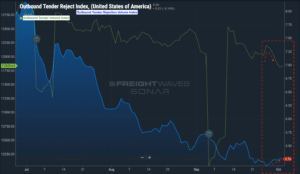

Nationwide, this could be a telling sign of how loose capacity is, in general, as we drive toward peak retail season in Q4. Ahead of the storm, we saw a climb in outbound tender volume that quickly dropped off. This was most likely due to shippers pushing freight forward, moving it ahead of schedule in an attempt to beat the storm. Carriers generally continued to accept their contracted freight and most likely worked with shippers to navigate around closures and adjust pickup dates. Efforts like these likely prevented rejections from spiking, and nationally, we only saw a slight uptick in tender rejections.

Source: FreightWaves, SONAR

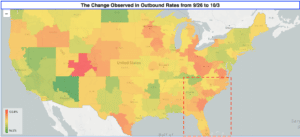

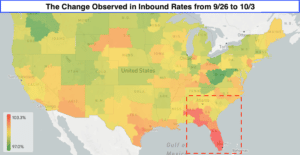

Rates also saw slight pressure (which pushed them up nationally by a modest amount), but this was primarily due to a rise in rates for freight destined for the Southeast. This week, it’s likely we’ll see rates remain slightly higher on freight that is originating in or destined for markets in Florida and other parts of the Southeast. This is because freight on these lanes may see higher volumes, given that some shippers were unable or unwilling to ship last week.

Source: Transfix

Source: Transfix

Regional Report

As we kick off October and weather starts to chill, truckload markets may continue to see some areas of distress in the Southeast. Apart from that, they should essentially continue along the same stagnant path we experienced through most of September. The Pacific Northwest will be in the spotlight as capacity predictably tightens to service the produce markets. The Pacific Northwest is the largest producer of Christmas trees in the US, so that seasonal product will also contribute to an expected tightening of capacity.

Freight markets may have navigated (or even escaped) some recent challenges in the form of potential union strikes and natural disaster. However, hurricane season doesn’t end for about two months . . . and we will also need to keep an eye on winter weather throughout the Midwest and Northeast.

Imports and More

Most years, imports drive volume for that big peak retail season we ride through every fourth quarter. In 2022, it seems as if peak season will not see much of a “peak” when it comes to volume or tender rejections.

After seeing some weakening in import volumes in the last few months, last week saw an uptick ahead of Golden Week, an extended national holiday in China that impacts national (and international) commerce. For the remainder of Q4, we are likely to face lower import volumes as compared to the previous two years and go back to the levels considered “normal” prior to explosive pandemic-era growth.

Disclaimer:

All views and opinions expressed in this blogpost are those of the author and do not necessarily reflect the views or positions of Transfix, Inc. or any parent companies or affiliates or the companies with which the participants are affiliated, and may have been previously disseminated by them. The views and opinions expressed in this blogpost are based upon information considered reliable, but neither Transfix, Inc. nor its affiliates, nor the companies with which such participants are affiliated, warrant its completeness or accuracy, and it should not be relied upon as such. In addition, the blogpost may contain forward-looking statements that are not statements of historical fact. All such statements are based on current expectations, as well as estimates and assumptions, that although believed to be reasonable, are inherently uncertain, and actual results may differ from those expressed or implied. All views, opinions, and statements are subject to change, but there is no obligation to update or revise these statements whether as a result of new information, future events, or otherwise.