The midweek market update is a recurring series that keeps shippers and carriers informed with market trends, data, analyses, and insights.

Transfix Take Podcast | A Sneak Peek at 2023

Carriers May Not See Real Rate Increases Until Q2

Driving further into Q4, and only days away from Black Friday, carriers continue to experience a bumpy road with a disappointing truckload market. Usually, around this time, carriers are experiencing a more robust spot market as retailers move freight into place. Instead, with Thanksgiving a little over a week away, it is clear that unless we see significant disruption caused by a rail strike, the demand in the truckload market will remain low through the end of 2022, with loose capacity and freight rates for all transportation methods heavily favoring shippers. Carriers may not see capacity or rate trends turn in their direction until the produce season in the South and Southeastern regions during Q2, or even further into 2023.

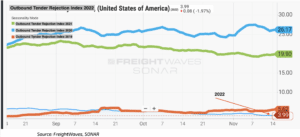

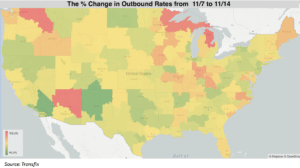

This year, instead of discussing the peak season that Q4 traditionally brings heading into the holidays, we are trying to predict just how loose markets can get. On November 14th, we saw tender rejections dip below 4%. This is a dramatic difference from the past two years when shippers experienced 20%+ of contract freight being rejected, leading to a volatile spot market. But as for the end of 2022, carriers are accepting nearly all of their contractual tenders, the spot market is depressed, and spot rates continue their downward trend. In nearly all markets, rates declined over the past week, with the exception of rural markets.

Shown below are rural markets in the Midwest and the Pacific Northwest (Michigan, Arizona, Idaho, and Washington) where rates increased slightly last week. The Northeast markets have been easing, but winter weather events could change market dynamics. Overall, if a carrier is operating off of the spot market, it will be challenging to determine the best load to take. It’s becoming more critical to plan ahead, dive into industry insights, and ensure you are making the best decisions on the miles you run.

Rail Disruptions: Monkey Wrench or Saving Grace?

Rail disruptions can throw a wrench in the supply chain and be a saving grace for many carriers. As of Nov 14th, three unions have rejected the tentative agreements. A potential strike could take place as early as December 9th. Any disruption to rail freight caused by a strike will notably impact supply chains. While a strike is looking more likely than it has in the past, keep in mind that congress can step in and extend the cooling-off period once again. Don’t sleep on Q4 just yet, as 2022 may have one last surprise for the freight industry.

Crystal Ball: The Fallout of Declining Contract Rates

Looking past 2022, truckload markets will likely remain soft, with capacity and rates remaining in favor of shippers. At least for the first half of 2023, carriers will be faced with low truckload rates, not only on spot freight but contract as well. Contract rates have continued to decline and are anticipated to decline faster as new contracts start in Q1. The question will be how long the industry can sustain such low rates as operational costs remain high. The tug-of-war pricing game between carriers and shippers has only seemed to intensify in the past few cycles. The industry needs to address this problem with creative solutions.

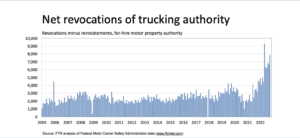

Since the beginning of the decline in spot rates that started in March, the number of carrier revocations of authority have increased and remain at relatively high numbers. As spot demand has decreased and rates have fallen significantly, we may be seeing a shift from drivers running under their own authority to moving their employment to larger carriers. As spot volume and rates continue to fall and operating costs for smaller carriers increase putting pressure on profitability, we may see more drivers move from operating under their own authority to becoming employees of larger carriers. Yet another area for creative solutions.

Disclaimer:

All views and opinions expressed in this blogpost are those of the author and do not necessarily reflect the views or positions of Transfix, Inc. or any parent companies or affiliates or the companies with which the participants are affiliated, and may have been previously disseminated by them. The views and opinions expressed in this blogpost are based upon information considered reliable, but neither Transfix, Inc. nor its affiliates, nor the companies with which such participants are affiliated, warrant its completeness or accuracy, and it should not be relied upon as such. In addition, the blogpost may contain forward-looking statements that are not statements of historical fact. All such statements are based on current expectations, as well as estimates and assumptions, that although believed to be reasonable, are inherently uncertain, and actual results may differ from those expressed or implied. All views, opinions, and statements are subject to change, but there is no obligation to update or revise these statements whether as a result of new information, future events, or otherwise.