The midweek market update is a recurring series that keeps shippers and carriers informed with market trends, data, analyses, and insights.

Transfix Take Podcast | Capacity Loosens in Unexpected Markets

Jenni: Hello, and welcome to an all new episode of the Transfix Take podcast where we are performance driven. It’s the week of March 8th, and we are bringing news, insights, and trends for shippers and carriers from our market expert, none other than Justin Maze. Maze, welcome to spring!

Maze: Hey, Jenni, glad to be back with you this week as we start to shift gears into springtime. Now, I can’t speak for everyone, because I know those out West and in the Midwest are still experiencing some winter weather. But down here in Atlanta, it is gorgeous out.

I hope that you’re having some good weather up in New York City as well.

Jenni: Maze, it is always hit or miss here in New York City. Today is very cold, yesterday was spring-like, and tomorrow is probably going to be summer. But that said, why don’t you give us a bit of a recap from last week?

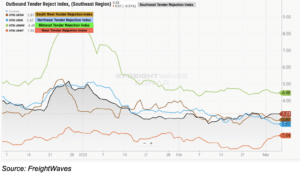

Maze: Last week, we saw rates remain relatively flat with a slim increase, but this is still higher than the lows we saw throughout the month of February. Rejections, in fact, are still seeing slight gains week over week, mainly caused by rejections jumping out on the West Coast due to the weather from the last two weeks.

Jenni: That’s right. Some of that weather even moved up to the Southeast.

Maze: The Southeast is also a little bit higher than we saw most of February. The Midwest is experiencing the flip side, with a slow decrease in tender rejections. Overall, the national tender rejection rate is just over 3.5%, a very slim climb from last week.

Jenni: OK, and where did we land in terms of rates, Maze?

Maze: We are almost identical to where we were last week, with $1.70 a mile for line haul.

Jenni: Okay, not much of a jump. It looks like we’re remaining the same across the board. Is that the same for fuel?

Maze: As you’re seeing that at the pumps, fuel continues to decline. We actually started the month at a national average of $4.54 per gallon and we have come down to $4.27 as of today.

Jenni: That’s really great news for carriers, and I’m actually expecting fuel rates to go down a bit more, especially as we head into the warmer months. The same is happening in Europe. But you know what time it is? It is time for our regional breakdown, Maze.

Maze: Let’s do it, Jenni. Let’s jump right into the regional breakdown. This week we’re going to start with the Northeast. The Northeast continues to see slight softness week over week as we projected, especially as we move farther into the springtime. Now, the markets shippers should watch out for are Syracuse and Buffalo, as these markets are loosening faster than the larger markets in the Northeast, such as Harrisburg, Pennsylvania and Elizabeth, New Jersey. Now, there are no signs that capacity is going to get tighter in the Northeast, especially with imports still lagging where we anticipated them being, which we’ll touch on later. For the foreseeable future, we’ll likely see the same trend we saw over the past week. Rates are going to continue to slide their way down as the weather becomes more favorable.

Jenni: That’s right, Maze. I think what we’re starting to see now is not necessarily a normalization, but what we talk about often, both in Transfix and with our cohorts across the industry, is that these cycles that used to come so frequently in 2020, 2021, and even 2022 are now starting to level out and take longer, which, frankly, depending on which side of the shift you’re on, could be a bit of relief, comparatively speaking.

Maze: Freight going into the Southeast, Coastal region and South are going to become the most favorable to carriers, while the Midwest becomes a little less so. Let’s call out the West Coast again, where carriers are just staying away since rates continue to be extremely low for leaving.

Jenni: Let’s jump on over to the Midwest.

Maze: We anticipated a larger drop through the last week, but winter weather continues to make the Midwest a more stubborn region. As long as the weather continues to move in a favorable direction, then we are going to start seeing tender rejections and rates decrease. The Midwest will likely see the largest declines through the month of March as it comes out of its seasonal strong suit. Freight going to the Southeast and South will become the most favorable freight just like the Northeast. The West Coast is going to be an area where carriers try their best to avoid until volume picks back up.

Jenni: Let’s head on over to the East Coast then, Maze.

Maze: Let’s talk about the Coastal region. The Charlotte, North Carolina market experienced a noticeable loosening over the past week. To be honest, Jenni, the entire Coastal region will continue to see that slim decrease, especially for freight going further down south into the Southeastern states like Florida and Georgia. Jumping down to the Southeast, we are seeing tightening continue. Severe weather has continued to plague states such as Tennessee within the Memphis market, as well as Mississippi and parts of Alabama. But down south in Florida’s Miami market, we are still seeing tightening week over week as we are heading into produce season. As for Southeast as a whole, we actually saw rates increase mildly over the last week. This is not for freight going back to the West Coast. The Southeast still isn’t hot enough to make freight heading to the West Coast favorable for carriers.

Jenni: Well, let’s talk about the other side, the West Coast.

Maze: We actually stopped seeing rates decline in the past week. Now, like I alluded to earlier, this is primarily due to the weather. Weather has plagued almost the entire West Coast from the Pacific Northwest down to Southern California, Colorado and Utah. Weather is actually continuing this week, but we should start seeing some relief in capacity. But I do not anticipate rates to decline much through the next week. But after this week, I do believe we’re going to start seeing rates decline back to where they were two weeks ago. But like I called out last week, we were approaching the bottom of the market out West.

Jenni: That’s right. I do often wonder when that’s going to happen on the East Coast. But why don’t we close this out with the South?

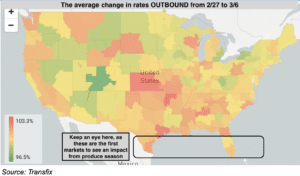

Maze: The South is also experiencing severe storms in that same Mississippi River valley, along with parts of Oklahoma. Similar to South Florida, South Texas is seeing some tightening week over week–signs of produce season starting up, which would make freight going out of the South very favorable for carriers. Shippers need to have a plan for produce season throughout the year.

Jenni: Produce season could last a lot longer this year than it has in the past. But it seems like shippers are really holding the lead in terms of market shifts. Is that right, Maze?

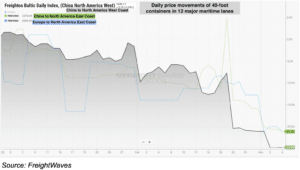

Maze: The market is still moving in favor of shippers, but it’s starting to show some signs of slowing down. Nonetheless, carriers will still be navigating rough waters in the months to come. One forward-looking indicator is certainly imports. And there’s been a lot of noise around imports. Just looking at the spot price to move containers from China to the West or East coast. Since the beginning of the year, we’ve seen these rates drop more than 20%, showing not only how soft not only the truckload market is, but also the maritime market. Now looking at imports by volume, we’re continuing to see very depressed volumes. Now, I don’t want to get anyone too excited, but looking at inbound ocean bookings, it looks like we’re going to start seeing a slight uptick in the amount of volume coming to the US. This won’t change the truckload market significantly. Instead, shippers and carriers really need to play on produce season in my opinion. Again, I don’t want to scare people into thinking that produce season is going to bring a ton of volatility, because it’s not. The market is just too soft to see a significant amount of volatility, but it will provide some pockets of relief for carriers if they stay up to date with what’s going on. At the same time, it’ll be the first time shippers may see pockets of difficulty in their network outside of the beginning of the year’s snowstorms.

Jenni: That’s right. We actually heard recently from one of our top shippers that they are starting to normalize, in terms of facing the same operational efficiencies that they had experienced prior to 2020’s pandemic. There’s a lot more to look out for in the coming weeks, Maze.

Maze: Well Jenni, as always it was great talking to you. I look forward to navigating through March and seeing what the markets have to bring to us.

Jenni: Same here as always, Maze. We’ll see you next week with an all new episode of the Transfix Take Podcast.

Until then, drive safely.

DISCLAIMER: All views and opinions expressed in this podcast are those of the speakers and do not necessarily reflect the views or positions of Transfix, Inc. Or any parent companies or affiliates or the companies with which the participants are affiliated and may have been previously disseminated by them. The views and opinions expressed in this podcast are based upon information considered reliable, but neither Transfix, Inc. Nor its affiliates, nor the companies with which the participants are affiliated warrant its completeness or accuracy and it should not be relied upon as such. All views and opinions are subject to change.