The midweek market update is a recurring series that keeps shippers and carriers informed with market trends, data, analyses, and insights.

Transfix Take Podcast | A Weathered Road into Q2

Jenni: Hello and welcome to an all new episode of the Transfix Take podcast, where we are performance driven. It’s the week of April 6th, and we are bringing you news, insights, and trends for shippers and carriers from our market expert, Justin Maze. Maze, it’s Q2. What say you?

Maze: Hey, Jenni, great to be with you as well as we cross the line into Q2 of 2023.

Jenni: Admittedly, I cannot believe we’re already in April, and I’m actually really glad that April Fools was on a Saturday.

Maze: That’s right, Jenni. There were no April Fools jokes, and the freight market really just continued to be depressed for the carriers.

Jenni: I know things do not seem to be letting up for our carrier friends, but I’d love to hear your perspective on where we landed in the month of April.

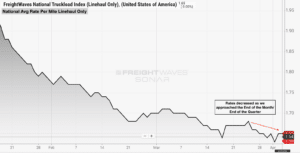

Maze: Well, the end of month and quarter showed no flex in the pressure of demand. Rates continued to lower through the last week of Q1.

Source: FreightWaves

Jenni: What do you think were some of the more surprising elements there?

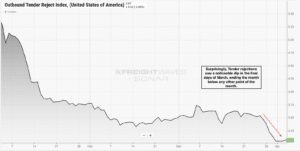

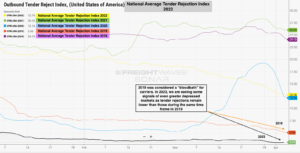

Maze: One of the most surprising things is that we started the month of March with 3.5% tender rejections. After a sharp dip the last week of the month, we are now seeing tender rejections almost break in that 3% line as they ended last week at 3.07%. This is not a good sign for carriers. We are starting to see signals that are pointing to a worse and more depressed freight market than we saw in parts of 2019.

Source: FreightWaves

Source: FreightWaves

Jenni: That must mean on the opposite side, shippers are faring out really well.

Maze: That’s right, Jenni. No pressure on the demand side at the end of the month led to lower rates last week. We saw rates decline through most of the week and we are starting April off almost ten cents per mile lower than we started the month of March.

Jenni: Why don’t we take a drive around the country? You know what it’s time for – the regional breakdown. Let’s do a zero-in into each region to see where we land and where we are going to land right now. Where are we going to start off, Maze?

Maze: We’re going to kick it off with the Northeast, Jenni. We continue to see loosening in capacity. We saw a little over a one percent drop in the average rate outbound in the Northeast this past week. This coming week we’ll see a similar trend. Most noticeably, the highest volume freight markets, Elizabeth, New Jersey and Harrisburg, Pennsylvania continue to move in favor of shippers. Carriers out there, there are very limited areas that you are going to continue to see increases, but most likely it’s going to be in a more remote, less volume market such as Maine or upstate New York, where we saw some pressure last week. But I do not anticipate this to continue this week. I do believe this week we’re going to see every market in the Northeast see declines through the week.

Jenni: All right, well, let’s jump on over to the Midwest.

Maze: I really do think I start spoiling the weather every time I say we’re looking in the clear for weather, as this week the Midwest continued to battle some severe thunderstorms and even potential record-breaking snow in the Plains states. But aside from the weather, we are seeing decreases, generally speaking, outbound from the Midwest. Now there are some pockets of tightness around parts of Michigan and Indiana, but overall we are seeing a little over a percentage decrease from last Monday to this Monday.

Jenni: We’ve got to stop jinxing that midwest weather. But let’s move on to the Coastal region, Maze.

Maze: This region actually experienced the biggest decline in average spot rates leaving, just under 2% decrease week over week. Every single market out of the Coastal region, Jenni, saw a decrease in average rates. When you dig a little bit deeper, you do see that city, local and short hauls saw a slight increase. Freight staying within the Coastal region is not seeing a decrease such as the freight leaving the Coastal region. The longer the haul it seems, the lower the rate went over the past week.

Jenni: It’ll be interesting to see over the next couple of weeks if longer line hauls coming out of the Coastal region will fare out better in terms of rates. But let’s get into the Southeast region.

Maze: If you remember, Jenni, last week we were talking about Florida changing direction and seeing capacity loosen throughout the state. It’s almost like a rollercoaster ride because this past week we saw rates throughout Florida increase week over week. The farther south you are in Florida, the higher the increase we saw. Just like the Coastal region, city and local runs are seeing the largest increase.

Jenni: Which could have an impact on whether or not produce season is going to have a heavier uptick, maybe mid Q2. Why don’t we head over to the gold coast or the West Coast?

Maze: We actually saw a surprising trend in the largest two outbound markets by volume out west – the Los Angeles and Ontario market – where we actually saw the average rate increase, similar to what we just said about the Coastal region. The shorter the haul, the larger the increase, as city, local and even mid-hauls saw an increase week over week. Now, long hauls and cross-country are continuing to see decreases in rates, but just how much farther can cross country freight from the West Coast go down? We are seeing very minimal decreases week over week of less than a quarter of a percentage point.

Jenni: There seems to be this growing trend now with longer line haul rates going down and decreasing in volume. But do you feel like that’s going to continue, especially on the West Coast?

Maze: Well, Jenni, I do not believe we’re going to continue to see this trend out West. I did mention that I do believe that the West Coast is starting to see a bottoming of rates, but I don’t think we’re there just yet. Throughout the month of April, due to lower volumes, I anticipate we will continue to see some rate decreases.

Jenni: That is quite a large bet there, Maze. We’ll keep an eye on that. Why don’t we close out with the South.

Maze: The South has been a region to keep an eye on as of late due to increased rates on a lot of lanes, especially out of Houston, Dallas and along the border of Mexico. Now, Dallas and Houston are definitely the largest markets by volume that are seeing pressure throughout the country. Unlike Atlanta, Harrisburg, Pennsylvania, and Chicago, we are seeing continuous pressure in these two markets, which will continue to spell rate increases in most of the freight leaving the state of Texas. Now Oklahoma and Arkansas continue to experience severe storms that have shifted capacity quite a bit.

Jenni: Speaking of big market shifts, we just got a big one in terms of fuel. Why don’t you elaborate on that, Maze?

Maze: This past weekend, OPEC announced that they were cutting oil production and after two months of consecutive decreases of the national average for diesel, we are likely going to start seeing an increase in the coming weeks. Now, this will potentially inflate all-in spot rates, but at the end of the day, Jenni, spot rates are going to continue to go down this month, unfortunately for carriers. Overall in spot and contract, we anticipate seeing drops throughout the month of April. As I mentioned many times, we are seeing a lot of RFPs go live. Every month in the beginning of the year, Q1 and in the beginning parts of Q2 especially, we see new RFPs go live. With each month, the shippers have most likely been pushing down the contract rates that they have been awarding as they monitor the spot market and see it continuing to decline.

Jenni: If there was any question on whether or not this year was a normal one, the resounding response is a no. Maze, usually we see a lot of volume coming in at the top of April, but it feels like that’s pretty much nonexistent.

Maze: Great point, Jenni. The month of April traditionally starts out with higher volumes than we drive out with, and that is worrisome for a lot of carriers out there.

Jenni: Why don’t we give them a heads-up in terms of what we can expect and what they should be looking for throughout the month of April into May?

Maze: Rates will decline through the month of April, and it’s purely due to the lack of volume that we are seeing. We are right around 2018, just off of 2019, tender volume levels. So national carriers will continue to drive down rates to fill backhaul capacity through the spot market. Like I mentioned, new contracts are going to continue to go in place with lower rates month over month as shippers continue to monitor the spot market. This is going to continue to put a lot of pressure on small, mid-sized carriers as we continue to point out week over week.

Jenni: We’ve said it before, we’ll say it again, and we’ll keep saying it right at this point: if you are exclusively a carrier looking to play in the spot market, now is not the time to do so. Now is really the time to start looking at your contract partnerships with your shippers and really build from there. I do want to get into produce season and see if there’s any changes that we should be on the eye out for, Maze.

Maze: I’m not completely sold on the fact that produce season is going to have much of an impact at all, although we have seen some tightening in the state of Texas and parts of southern Florida. It’s still relatively early as well, as you pointed out, but I just don’t believe we’re going to see much of an impact from produce solely due to the fact that overall volumes are continuing to decline. Traditionally in the month of April, we see it decline throughout the entire month. If carriers are lucky enough to see some pressure put on the spot market, I don’t think it’s going to make much of a difference overall, especially as these new contracts come in with lower rates.

Jenni: Which brings us right back to that original point: contract and strengthening partnerships with shippers is the way to go.

Maze: As always, Jenni, great talking to you this week and I look forward to our conversation next week.

Jenni: As do I. Until then, we will see you with an all new episode of the Transfix Take podcast next week.

Drive safely.

DISCLAIMER: All views and opinions expressed in this podcast are those of the speakers and do not necessarily reflect the views or positions of Transfix, Inc. Or any parent companies or affiliates or the companies with which the participants are affiliated and may have been previously disseminated by them. The views and opinions expressed in this podcast are based upon information considered reliable, but neither Transfix, Inc. Nor its affiliates, nor the companies with which the participants are affiliated warrant its completeness or accuracy and it should not be relied upon as such. All views and opinions are subject to change.