The midweek market update is a recurring series that keeps shippers and carriers informed with market trends, data, analyses, and insights.

Transfix Take Podcast | One Year Since the Market Shifted in Shippers’ Favor

Jenni: Hello, and welcome to an all new episode of the Transfix Take podcast where we are performance driven. It’s the week of April 12 and we are bringing you news, insights and trends from our market expert, Justin Maze. Maze, it is always great to be with you. How’s it going?

Maze: Hey Jenni, great to be back with you this week as we drove past the Easter holiday weekend and navigate the second week of April.

Jenni: That’s right. I know that we are coming up or approaching quite a milestone for carriers, not necessarily the best of news, but certainly one we have kept in mind.

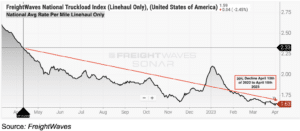

Maze: That’s right, Jenni. This past weekend also marks a year since the so-called “freight recession” has been in place for carriers. From April 10 of last year to April 10 of this year, rates dropped just about 30%.

Jenni: That creates a really big impact specifically for small to mid-sized carriers.

Maze: Last year at this time, carriers were getting about $2.33 line haul rate per mile and this year the national average is sitting at $1.63 per mile. Now that is a pretty significant drop that we saw take place over the last twelve months. Jenni, we’re going to get into it, but nothing is looking on the upside for carriers, even as we continue to navigate the beginning of produce season this year.

Jenni: What we’ve been exploring over the last week or so is determining where and when the cycle will change. We’re just coming off of a two year cycle of a carrier favored market, but is that going to change anytime soon?

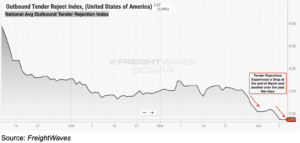

Maze: This past week also set a new record low in tender rejections. That’s right, Jenni, I did not think this was going to happen; I said this a couple of episodes ago. But tender rejections are now below 3%. Tender rejections, which started really dropping towards the end of March, have continued to fall through the first week of April. Rates have fallen as well but not as significantly as tender rejections as rates closed out last week, April 7, at $1.63 per mile on the line haul side. A lot of people anticipate fuel prices to start increasing, but since last week we really haven’t yet seen much of an impact in fuel prices. So we’re going to keep a pulse there.

Jenni: That’s right. Part of being a consumer in the supply chain is also looking for these on-the-ground indicators and quite frankly when I went to go fill up my car the other day, I didn’t really see much of a change specifically for diesel. We’ll keep an eye on that. You know what, it’s time for – the regional breakdown. Where are we starting, Maze?

Maze: I’m going to start in the home region of Transfix: the Northeast.

Jenni: All right, Maze, let’s get into it. We are well into spring at this point.

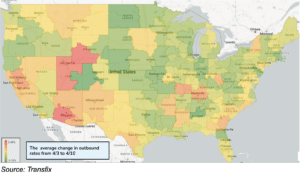

Maze: Now we continue to see softening happening in the Northeast. This is especially for freight heading down south into the Southeast. That has not changed since the last time we spoke. More notably, we are seeing the larger freight markets experience larger decreases week over week. Now, I do not see any change coming as we continue to drive through spring, the Midwest and Northeast will continue their downward fall.

Jenni: It’s that bottom that you keep mentioning. But while we’re on the subject, why don’t we move over to the Midwest?

Maze: Very similar to the Northeast, we continue to see softening markets. This week, I do believe we’re going to see the largest decrease week over a week come from the Midwest. The Bowling Green market, though just north of the Nashville market, is one area that remains to be stubborn and really, it’s that domino effect coming out of the Nashville market. But we will likely see this softening continue this week. It’s important to call out rates going back to the West Coast out of the Midwest, which have been difficult lanes recently are starting to ease, and we’re going to get into why when we touch upon the West Coast.

Jenni: Okay, but before we do that, why don’t we jump over to the Coastal region?

Maze: We continue to see different messages from the Coastal region, mainly within the short hauls and city local runs. The shorter the haul, the more the rates are starting to increase, especially in South Carolina. Overall, the Coastal region is seeing the rate decline week over week, but keep an eye on shorter and local runs, especially again in the South Carolina markets and even over along the North Carolina coastline.

Jenni: Why don’t we jump over to the Southeast area where you’re located with a lot of our Transfixers in the Atlanta office.

Maze: Now, the Southeast has been sending mixed messages lately, that’s for sure. One week we feel like we’re hearing some produce season pressure coming out of the Southeast, especially in Florida. Then the next week we start feeling softness. Well, that’s happened again. This week, we are continuing to see some easing, especially in Northern Florida. The main area of concern throughout the Southeast is what I was talking about in the Midwest: the Nashville market. This market continued to tighten over the last two weeks, though I do believe that some of this was due to the recent storms. This week we will actually start seeing that loosening happen. That’s why, again, in the Midwest, I believe Bowling Green, Kentucky’s market will also see declining rates.

Jenni: I know we’re specifically going to keep an eye on the Florida markets as well, because obviously that is a big indicator of the produce season market.

Maze: Now Jenni, let’s head over to the West Coast. This is where we have experienced the most changes over the last week. Since the last time we talked, parts of California, especially Northern California have seen some tightening with rate increases in markets such as San Francisco and Sacramento. Now in Southern California and the Pacific Northwest we continue to see that easing. But most notably, let’s jump over to Arizona and New Mexico, both of these states border the Mexico-US border and we are seeing tightening capacity especially in the Tucson and Phoenix markets. I want to say it’s because of produce but I think after what we’ve seen in Florida the past couple of weeks, let’s wait before we make any calls there. I do want to jump up to Colorado. Colorado has been a pain point for capacity in the last couple of weeks, most likely due to the weather that we continued to experience through the month of March. But in the last two weeks, especially this past week, we’ve continued to see loosening markets and this is somewhere that shippers can look to drive down rates. Now carriers, freight heading back to the West Coast is getting easier because you are starting to see some pressure in some West Coast markets.

Jenni: Let’s move on over to the South. I know we’ve called out some tightness in the specifically bordering region of the South. Have we seen any change over the last week or so?

Maze: It hasn’t changed so much in southern Texas and western Texas, those markets along the border like El Paso and Laredo, but it is notable to call out Dallas, Fort Worth, and Houston as these are the larger freight markets by volume where we are seeing loosening. This is a great sign for shippers. For carriers, it is difficult out there to find markets that are going to pay you a premium right now and every single week these markets are really shifting. There’s no continuous trend of markets tightening which makes it difficult for a carrier who is relying on the spot market to optimize their revenue by heading towards tighter markets. This week it’s Phoenix, Arizona and Salt Lake City, Utah and parts of Northern California but these are all new, which is why it’s so difficult for carriers relying on the spot market to optimize their revenue heading into these markets.

Jenni: We’re going to keep on giving the same advice to our carrier listeners here. This is the time to really lean into your shipper partners when it comes to that contracted freight, that’s going to keep your business afloat because honestly we don’t really have an idea of when rates are going to bottom out at this point. Right, Maze?

Maze: I continue to think we are very close to reaching the bottom, but to my surprise we continue to see rates decline and this is most likely as we stated many times before, due to larger assets and national fleets going as low as they need to just secure freight for backhauls. It doesn’t look like this is going to stop anytime soon, with tender rejections this past week falling below 3%, which we haven’t seen.

Jenni: Now, do you think we’re going to see more of that as we carry over into the next week through the month? What are you thinking about, Maze?

Maze: I would not be surprised if we are not hearing much different than we’ve heard this past week. Rates will continue to go down. Tender rejections will probably stay stagnant, and produce season does not look like it’s going to be putting much pressure on capacity this year.

Jenni: All right, these are all things that we will certainly report on next week in an all new episode of the Transfix Take Podcast.

Until then, drive safely.

DISCLAIMER: All views and opinions expressed in this podcast are those of the speakers and do not necessarily reflect the views or positions of Transfix, Inc. Or any parent companies or affiliates or the companies with which the participants are affiliated and may have been previously disseminated by them. The views and opinions expressed in this podcast are based upon information considered reliable, but neither Transfix, Inc. Nor its affiliates, nor the companies with which the participants are affiliated warrant its completeness or accuracy and it should not be relied upon as such. All views and opinions are subject to change.