The midweek market update is a recurring series that keeps shippers and carriers informed with market trends, data, analyses, and insights.

Transfix Take Podcast | Mixed Messages from the South

Jenni: Hello, and welcome to another episode of the Transfix Take podcast where we are performance driven. It’s the week of April 19, and we are bringing you news, insights and trends for shippers and carriers from our market expert Justin Maze. Maze, after a great weekend, it’s always good to be with you. How’s it going?

Maze: Hey, Jenni, great to be back with you again this week to talk more freight after this beautiful weekend we witnessed in both Atlanta and New York City.

Jenni: After hearing the Transfix Take On the State of Freight with Paul Poziumschi, I’m curious to know, are we in a bullish or bearish market for carriers, Maze?

Maze: The bear market continues for carriers, and to be quite honest, Jenni, there’s no clear signs of this stopping anytime soon, especially when you click into volumes and find that we were right around the 2019 levels but with a lot more capacity in the market.

Jenni: Now that is fair. Of course, we are waiting for those volumes to ramp up any moment now, but what did we see last week as some notables, Maze?

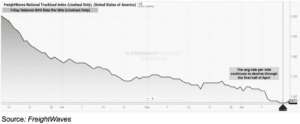

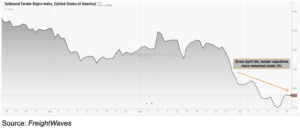

Maze: This past week we saw the average rate per mile linehaul drop farther, and ended on Friday at $1.58 per mile. That’s as tender rejections continue to show resilience through shipper routing guides.Tender rejections continued to be under 3% for dry van and even under 3.5% on the reefer freight.

Jenni: Well, something to consider as well is that spring weather can be rather unpredictable. I mean, take it from me, this past weekend felt like it was summer, right, Maze?

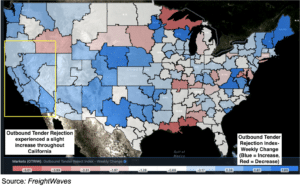

Maze: Exactly, Jenni. This past weekend most of the country was enjoying summer temperatures, but it is now quickly becoming a potential threat to capacity in limited markets throughout Wisconsin and Michigan. However, I do not believe this is going to bring a noticeable change in capacity in these markets, as the Midwest continues to loosen as a whole.

Jenni: If I’m reading between the lines here, Maze, what I’m hearing is there aren’t going to be many changes to the market anytime soon. Is that right?

Maze: That’s right, Jenni. I don’t think there’s going to be any change in overall capacity and market conditions anytime soon. But as contract rates continue to decline, we will see the spread between contract and spot close in, which in return will bring the spot rates to a bottoming where they stay stagnant. You’ll see those seasonality trends lane by lane with some increasing and some declining, but I do believe we are getting closer to the bottoming. It’s not like there’s a great upside coming for carriers necessarily. We’re mainly going to remain stagnant through the rest of this year unless something significant happens with imports or inventory levels or even wide scale weather events. But at the end of the day, Jenni, for the remainder of this year we are probably going to be facing pretty loose capacity throughout the country.

Jenni: Oh, but hold on, Maze, what about produce season? Where are we with that? I mean, we’re still at the beginning.

Maze: That’s right, Jenni. Produce season was one opportunity that carriers were looking forward to bringing some volatility into the spot market. But to be quite honest, as we continue to speak on this topic week after week, we see pockets of tightness through the Mexico and U.S. border and parts of southern Florida, but nothing that clearly shouts out that we’re going to have a strong produce season to bring volatility. In fact, this week we were getting more mixed messages in both the South and Southeast, which we’ll jump into in the regional breakdown.

Jenni: Well, now that you mentioned it, let’s get right into the regional breakdown, Maze. Where are we starting this week?

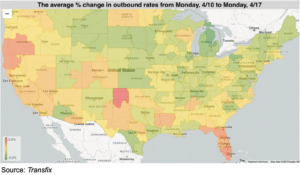

Maze: Jenni, we’re going to start up in the Northeast. I know you guys enjoyed beautiful weather this weekend. For the freight markets, we’ve continued to see spot rates decline over the past week. Now, there is not one single market in the Northeast that saw rates remain flat or rise throughout the entire region. This is as the Northeast continues to loosen going into the warmer months. Now, jumping over to the Midwest, it’s a similar story. Warmer weather usually brings looser capacity in the beginning of spring. Most notably, longer hauls and cross country hauls are seeing larger declines heading back to the West Coast. Now, this has been a lane we continue to be cautious of as rates were going up, and it was difficult to find capacity heading back to the West Coast. When we jump to the West Coast, we’ll dive a little bit into why we’re seeing this happen. As I said earlier, the Midwest may experience pockets of tightening due to weather, but nothing too alarming for anyone to worry about.

Jenni: All right, now, why don’t we head down to the Coastal region?

Maze: It’s another region that witnessed declines in every market last week.

Jenni: Not much to report there, but I know we want to get really into the Southeast region where there are apparently a lot of different variables to discuss.

Maze: This is where we start seeing those mixed messages about produce. Now, most of the markets here also saw decreases, especially along the Bible belt of Mississippi and Alabama and most of Georgia. Nashville luckily, saw pretty modest declines week over week after seeing rates jump up the week prior. But going down to Florida, we continue to see tightening capacity, actually pushing up rates outbound from Florida. More specifically, we are seeing the greatest tightening within Florida in the local lanes, so anything 100 miles or less is seeing the most pressure for rates right now.

Jenni: Certainly a market we’re going to keep a close eye on over the next week or so, but I know we want to broaden out into the full Southern region, obviously since that was one that you called out for produce season.

Maze: Now, Texas does make up most of the South, and the markets along the Mexico U.S. border are starting to see some pretty significant loosening. These markets are seeing rates decrease anywhere from 1.5% to almost 4% just over the last week. Even when we go to the larger markets by volume, like Dallas and Houston, we are still seeing loosening week over week. There are pockets of tightening like Amarillo, Texas and different areas in Oklahoma, but overall the South is seeing loosening capacity in favor of shippers.

Jenni: Why don’t we close out with the final region, the West Coast?

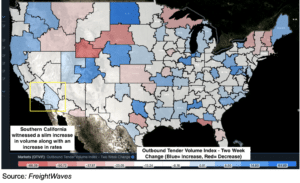

Maze: Save the West for last because we are seeing some patterns that do have cause and effect for other regions. The most noticeable one is that rates for freight heading back into the West Coast from the Midwest, the Northeast, the Coastal region and Southeast are declining. Now these are the regional lanes that I continue to call out because carriers are probably not going to be taking them due to the low outbound rates from the West Coast and shippers would have trouble covering them. Over the last seven to ten days we’ve seen this trend change. Rates going back to the West Coast from these regions, especially California, are starting to see decreases and an easing of capacity. Now there’s always that reason with supply and demand, and that’s because of outbound rates out of a lot of the West. When I say West, I do primarily mean California. We are seeing rates rise, leaving specifically Southern California, parts of the Denver- Colorado market and Northern California leaking over to Washington and Oregon. Now this is surprising because the West Coast has seen the most loosening over the past six months. Have we started to reach our bottoming of rate declines out of the West Coast?

Jenni: I’m really hoping so at this point. But what do you think, Maze?

Maze: I don’t think so just yet, but it is important to call out that volumes out of Southern California, which is known as the huge freight mecca, have been significantly declining year over year. But over the past seven days we’ve actually seen increased volume out of Southern California and tender rejections slightly tick upward. Now this is probably leading to those slightly higher rates. Nothing dramatic. I don’t want people to think that California is heating up and becoming the Gold Coast, again. It’s not significant. But it’s always important to keep an eye on what’s happening in Southern California as it does change the dynamics in other regions.

Jenni: One of the biggest factors that we have to note here is the fact that we’ve gotten a significant decrease in imports on the West Coast because of reshuffling over to the East Coast imports. I guess what that’s telling us is there really hasn’t been much that’s changed or will change.

Maze: That’s right Jenni. I don’t foresee much changing through the month of April. I don’t think that we’re going to see a strong produce season. We will still see the trends that we would normally see in outbound markets or freight going into those produce-stricken markets. But overall, April is going to continue to be a month sitting heavily in the shipper’s favor. Now it’ll be interesting to see what happens with the spot and contract rate spread going into May. As always we’re going to continue to keep an eye on imports on the West Coast and East Coast as those are drivers for over-the-road freight.

Jenni: All eyes are on imports. Of course we’ll get into that on a deeper level next week as well as what’s going on in the state of rail freight. Until then, we will see you next week with an all new episode of the Transfix Take podcast.

Drive safely.

DISCLAIMER: All views and opinions expressed in this podcast are those of the speakers and do not necessarily reflect the views or positions of Transfix, Inc. Or any parent companies or affiliates or the companies with which the participants are affiliated and may have been previously disseminated by them. The views and opinions expressed in this podcast are based upon information considered reliable, but neither Transfix, Inc. Nor its affiliates, nor the companies with which the participants are affiliated warrant its completeness or accuracy and it should not be relied upon as such. All views and opinions are subject to change.