The midweek market update is a recurring series that keeps shippers and carriers informed with market trends, data, analyses, and insights.

Transfix Take Podcast | Celebrating 100 Episodes with a Crystal Ball Outlook

Jenni: Well, hello and welcome to the Transfix Take podcast where we are performance-driven. It's the week of May 31, and we are bringing you news, insights, and trends for shippers and carriers from our market expert, Justin Maze. Maze, it is our 100th episode. We are finally here. How does it feel?

Maze: Honestly, Jenni, it feels like we just started yesterday, but I am happy that our hundredth episode is on a shortened holiday week.

Jenni: And you know what, it's only been a couple of years, but so much has happened. And for those of you who might be tuning in for the first time today, we started this podcast back in 2020 as a way to get shippers and carriers up to date on what was going on in the markets because of the pandemic. And since then, so much has happened. Port closures and backlogs, inventory gluts, trucker protests, all of those things that we've helped keep you abreast of each week.

Maze: It certainly feels great to be hitting that 100th milestone, and I look forward to continuing and growing this with you over the years to come.

Jenni: Well, my friend, I could not agree with you more. That said, I know we're celebrating, but there's a lot to get into. So what have we got first?

Maze: Well, Jenni, not only are you and I celebrating, but I think carriers out there are somewhat celebrating over some of the pressure that they were able to apply over the last couple of weeks. As we anticipated, pressure brought on by the DOT Road Check Blitz week and the holiday weekend drove up truckload costs. Carriers, like I mentioned, were able to push rates in their favor in just about all regions. But as we take a turn into June, we are likely to see this turn back downward.

Jenni: And you know what, Maze? That tracks. We had two big events happen in the industry last week or the week before that, Blitz Road Check week, but then also Memorial Day weekend, which typically causes our favorite word, volatility.

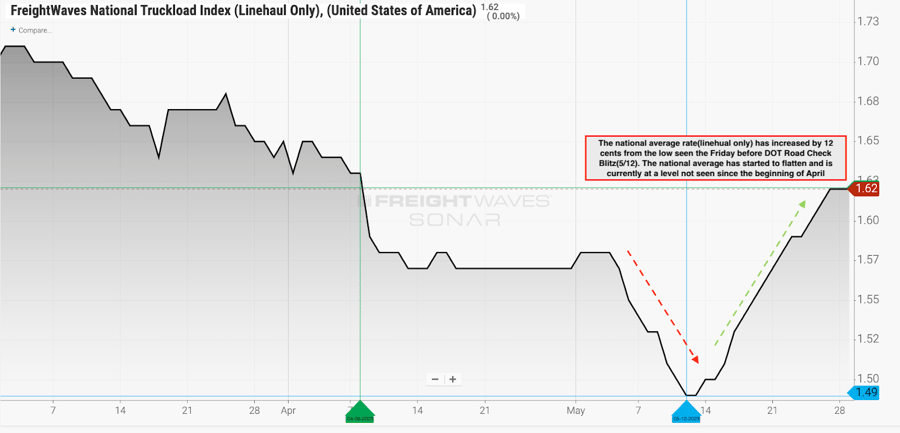

Maze: That's right, Jenni. What's a 100th episode without a little bit of volatility in the market? Rates and rejections increased for just about two straight weeks. Walking into this week, the national average line haul rate was at $1.62 per mile. This is up $0.12 from the bottoming of rates we saw back on May 12, the Friday before we drove into the volatility over the past two weeks. This is the highest that we've seen the national average since the first week of April, Jenni.

Source: FreightWaves

Jenni: And you know, ever since then we've been hearing a lot about the fact that rates have stayed stagnant. Now, what I'm curious to know a bit about is what do tender rejections look like.

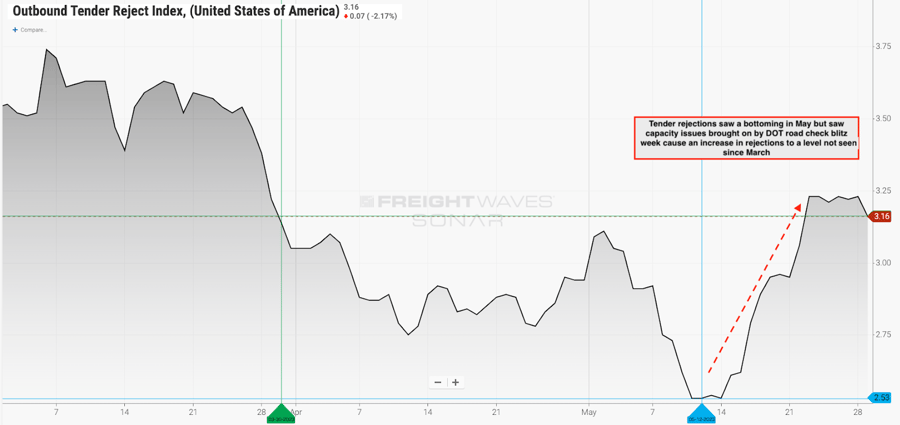

Maze: Well, Jenni, when we look over at tender rejections, it shows a very similar story. Though keep in mind, rejection rates remain at very low levels, even as we saw some volatility. Tender rejections were all the way down to 2.53% when they bottomed out on the same day, May 12. And as we drove into that volatility, we have since seen them go back above 3% to levels not seen since late March. Again, this is less than a complete 1% increase overall, which shows carriers and brokers, regardless, were accepting as much freight as they could. Now again, we are nowhere near the levels of concern that we've seen before, but it's still something to take note of. We went from the potential bottoming in the freight market to flipping into a volatile market due to outside forces such as the Road Check Safety Week and the holiday weekend, which happens every single year, Jenni, so it's not like it's a big surprise, as we called for this to happen for weeks now. But still, volatility happens, and that's why it's ever so important to continue to be on top of the market.

Source: FreightWaves

Jenni: And speaking of staying on top of the market, what do you think this outlook is going to provide for carriers in the next month or so? Do you think it's going to stay, do you think it's going to go?

Maze: Well, unfortunately for carriers, this will be short-lived. I see rates coming back down over the next few weeks, but potentially not going back to the lows witnessed in May. We're going to continue to see signs of seasonality driving capacity trends in different regional lanes, as we stated several times now.

Jenni: Which is a signal for, you know, what time it is, the regional breakdown, Maze. Why don't you give us an overarching view of where we landed and where we will head in this short week ahead?

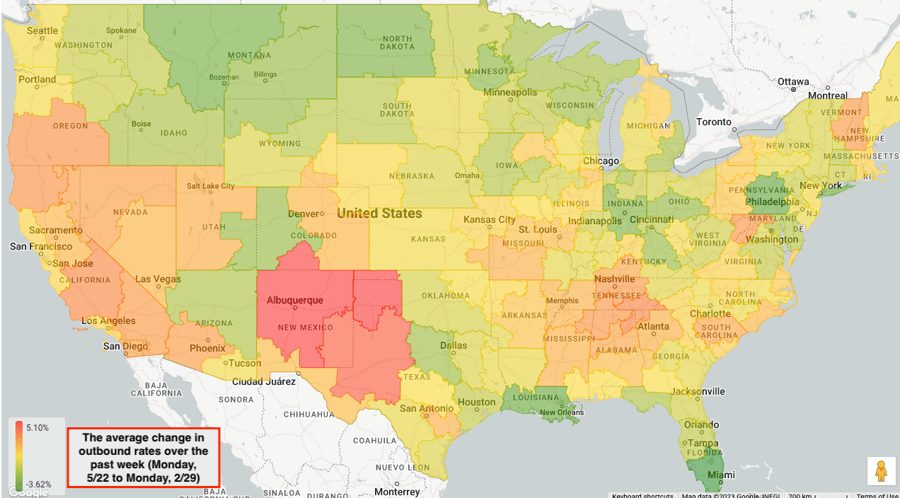

Source: Transfix

Maze: Now, again, nationally, we did see pressure continue through the last week, but this week we're already starting to see some declines, even though it's one day past Memorial Day weekend. For the Northeast, we saw very slim rate increases in aggregate on freight leaving, but most notably out of eastern Pennsylvania, such as the Pittsburgh market. Now, overall, Jenni, I do think that we're going to continue to see loosening in the Northeast as capacity comes back online from the Memorial Day weekend.

Jenni: All right, and what about the Midwest, Maze? What do we see there?

Maze: We saw very slim increases through last week brought on by the pressure of Memorial Day weekend. But overall, we're going to see that slip back downward with rates decreasing as capacity starts becoming looser.

Jenni: And heading into one of our most-watched regions - what about the Coastal region, Maze?

Maze: The Coastal region has been stubborn going up and down, but this past week we saw South Carolina especially see some pressures. This is most likely from that domino effect of capacity moving to markets in Georgia and Tennessee that are experiencing higher rates. As capacity shifts to cover freight in those states, it only makes tighter capacity for South Carolina. The Columbia market stands out the most with almost a 2.5% rate increase week over week.

Jenni: Always interesting over there. Why don't we move on over to the Southeast region?

Maze: It's different than what we've been calling out, that's for sure. Southern Florida has shown signs of relief last week. Surprisingly, we actually saw rates decrease out of Southern Florida. But don't double down on this, Jenni. We're seeing this relief really on freight that's remaining in the Southeast. But contrary to the Southern Florida markets, every other market in the Southeast experienced tightening. This is especially for the largest market in the Southeast by volume, the Atlanta market, and surrounding markets in Tennessee, Alabama, and elsewhere in Georgia.

Jenni: And shall we take a drive over to the West Coast?

Maze: Rates continue to see increases. Now, Northern California has really tightened up in the past week along with New Mexico markets. This is most likely due to a similar trend we saw in the Southeast. Capacity is being absorbed by these other markets that we've continuously called out, seeing an upward trend and tightness and pressure in rates pulling that capacity down to the larger volume markets such as Southern California or even Phoenix, Arizona. In the coming weeks, I think that we're going to continue to see the West Coast play into the carrier's favor with tightening rates. But I want to keep an eye on one large lane, and that's Southern California up to the Pacific Northwest. This lane has continued to see a lot of upward pressure as there's plenty of freight going up to the Pacific Northwest, but not much heading back down, driving up costs for shippers.

Jenni: And this road trip ends exactly where we usually end - in the South.

Maze: The South is certainly sending us some mixed feelings lately, Jenni. We actually talked about this about a month ago. But similar to the West and the Southeast, we're continuing to see Arizona and New Mexico take capacity from Western Texas, which is forcing rates to increase. Now out of the larger markets by volume, like Dallas, Fort Worth, and Houston, we are still seeing relatively loosening capacity and this will most likely continue through this week.

Jenni: All right, Maze, well, when you were in New York this past week, I threw the crystal ball back in your hands, good friend. And I know that you took a long drive back to the Atlanta office from our New York office, so you've had a lot of time to think. And that leads me to my question, what is next up for us?

Maze: I really don't think there has been anything to shift my opinion or what the crystal ball is telling me about the market overall. I think we will see rates come off the inflation caused by the past two weeks, but not decline further than what we have seen in the last 45 days. Seasonality will continue to play a factor in what markets are favorable for carriers and for shippers. I know there has been some data around imports starting to pick up, especially on the West Coast, but I don't think there's enough to dictate a change in how the remainder of this year will play out. But obviously, the fourth quarter, or the holiday season in the truckload market, could shift the overall trucking market. But for now, my crystal ball is still shaking out and saying that we are going to remain relatively flat at a national view for the remainder of the year with little volatility outside of the usual volatility caused by things like the 4th of July weekend and Labor Day. Other than that, we don't see much of a big shift in volatility coming from outside factors. But again, as we've dug into multiple times in the last few years, anything can happen, from things like hurricanes to inventory shortages all of a sudden popping up out of nowhere.

Jenni: Well then I guess it's up to our audience to tune in each week and make sure that they're staying up to date on all things freight because as we know, anything can change at the drop of a dime.

Maze: Well, Jenni, this is the 100th time we are signing off and I look forward to 100 more with you.

Jenni: And you as well, Maze. We will see you next week with an all new episode of The Transfix Take Podcast. Until then, as always, drive safely.

DISCLAIMER: All views and opinions expressed in this podcast are those of the speakers and do not necessarily reflect the views or positions of Transfix, Inc. Or any parent companies or affiliates or the companies with which the participants are affiliated and may have been previously disseminated by them. The views and opinions expressed in this podcast are based upon information considered reliable, but neither Transfix, Inc. Nor its affiliates, nor the companies with which the participants are affiliated warrant its completeness or accuracy and it should not be relied upon as such. All views and opinions are subject to change.