The midweek market update is a recurring series that keeps shippers and carriers informed with market trends, data, analyses, and insights.

Transfix Take Podcast | The Yellow Bankruptcy Impact & Greener Roads Ahead for Carriers

Jenni: Well, hello and welcome to an all-new episode of the Transfix Take podcast, where we are performance-driven. It's the week of August 2, and we are bringing you news, insights, and trends for shippers and carriers from our market expert, Justin Maze. Now, Maze - it's August. Normally I'd ask you how you are, but there's just so much to get through.

Maze: Hey Jenni, great to be back with you as well, and you are 100% right. There was a lot of news that broke throughout last week after we recorded.

Jenni: I mean, where do we even begin, Maze?

Maze: Jenni, let's start with the good news. Shortly after we spoke, we found that UPS was able to avoid a strike as the Teamsters reached a new labor deal, avoiding a national strike that would have most likely impacted most consumers. But as we called out last week, we were anticipating a deal would be made.

Jenni: Which is great news for my shopping habits. But on the other hand, something happened on Monday that we were not anticipating.

Maze: Yellow was not able to keep their wheels turning. Yellow now has about a 100-year history, so this is the largest trucking company to ever go under. They've had years of difficult times, as we stated before, and I don't think this is necessarily a huge shock to anyone in the industry.

Jenni: Right, but to be clear, this does impact about 30,000 LTL drivers across the country. That said, I also heard that that freight had been absorbed last week in anticipation of a Yellow shutdown. Maze, that said, how would this impact the supply chain as a whole?

Maze: Well, Jenni, to be honest, I don't think it's going to have a large noticeable impact on the full truckload space. Now, the same can't be said for LTL, as Yellow was the third-largest provider in the LTL space. I'm sure their competitors are somewhat happy to see some volume coming their way, as LTL carriers have been struggling with declining volume for a couple of months. On the full truckload side, there may be some spillage coming from shippers not being able to redirect freight needs as quickly as possible. Now, Yellow does have a 3PL business unit which is in the full truckload business, but Jenni, they are still going through a process to sell off that arm of the company. But ultimately, I don't think we're going to see too much of a noticeable change when it comes to full truckload.

Jenni: Good to know. And now that we've gotten that out of the way, let's talk a little bit about what August is going to bring to the full truckload sector.

Maze: That's right, Jenni. We are turning into August, and rates nationally are holding pretty steadily. Now, we did experience a slight decline leaving last week, but this week we are seeing that decline eroded with a slight increase in rates due to the end of the month. Average national rates are basically sitting around $1.62 to $1.63 per mile line haul only. Now, this is a similar mark to where we sat at most of June until the end of the month.

Source: FreightWaves

Jenni: So, we've been holding pretty steady. But Maze, I know you've got your eye on something, so let's hear it.

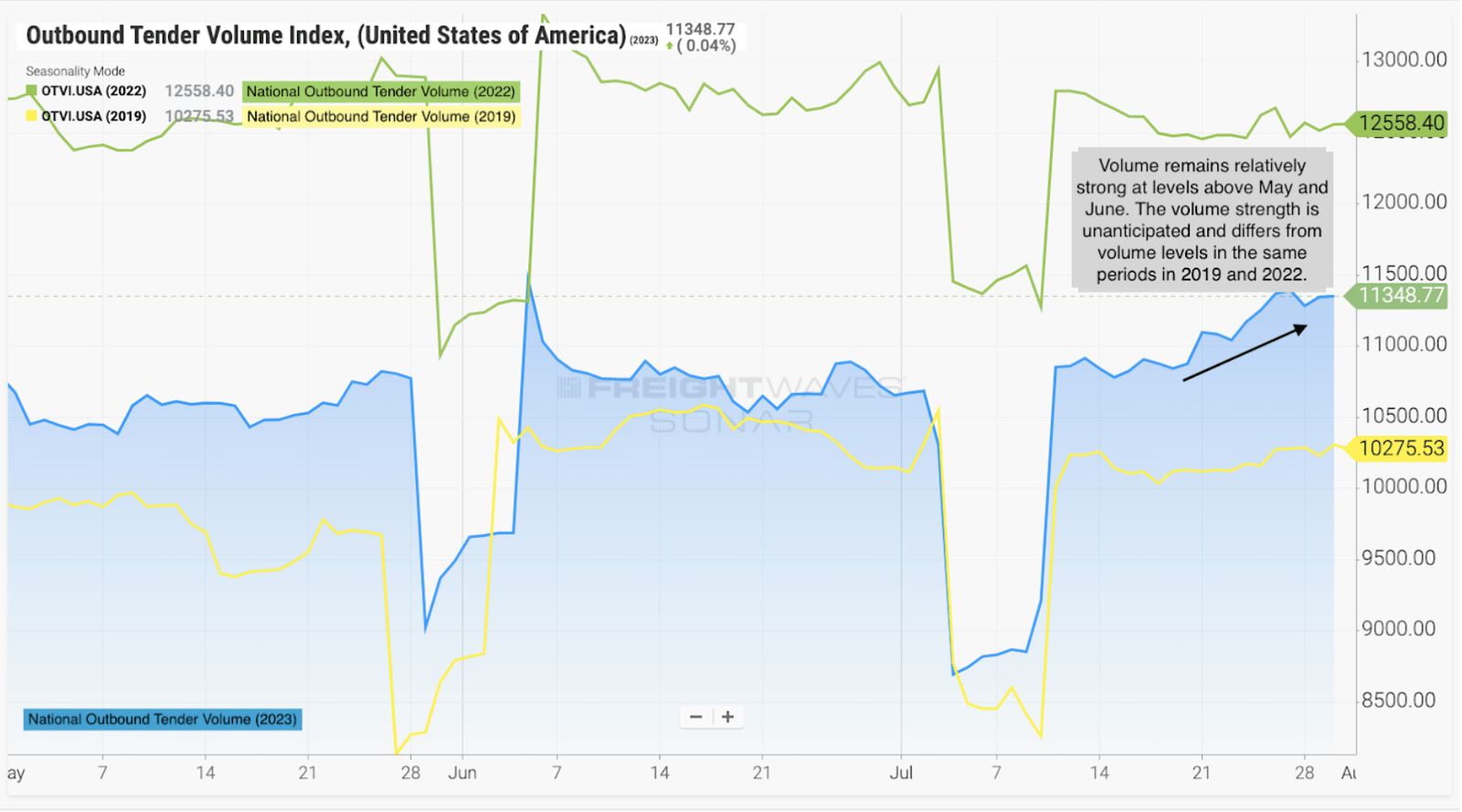

Maze: Well, Jenni, what keeps drawing my eye is volume. As volume remains relatively strong, above levels any time in May, June, or the first half of July. This is a little unseasonal. When you look a little farther into the data, you see that longer hauls are actually contributing to the volume increase. Usually, we don't start seeing long hauls pick up until the end of August or early September, but this could potentially keep rates from falling through August like we anticipated. But again, we still have a ton of capacity in the market. Over the next week, we will see if this continues or if it's just an end-of-month bump.

Source: FreightWaves

Jenni: I wonder if this is shippers preparing much earlier than normal for the peak holiday season, given the state of the market and how there is a potential carrier purge that we've been anticipating and projecting for the second half of the year.

Maze: If these long hauls continue to be in high gear, we could potentially see some pressure on rates nationally in all different lanes of haul.

Source: FreightWaves

Jenni: And that's interesting because what's going to end up happening here is the typical capacity that shippers would normally have access to has now shifted. So that could potentially cause more volatility. But that said, Maze, you know what it's time for, of course, the regional breakdown. Where do you want to get started this week?

Maze: Jenni, this week we're going to start in some regions where it's a little more shipper-favored, just because we know our shippers out there may be a little stressed out with their current environment if they've partnered with Yellow in the past. So that's going to take us down to the South. The South continues to loosen up, like I stated before. As a matter of fact, if you look at every single market leaving the South region, they all saw rate decreases week over week, even as we approach the end of the month, except for one market, and that's Texarkana. Now, I will say it's a little interesting when we look at city and local runs because they are experiencing a slim increase, but the largest markets by volume, like Dallas and Houston, are seeing pretty significant decreases week over week, over 2%.

Source: Transfix

Jenni: Now, let's stay in the same region and head on over to the Southeast. What's going on there, Maze?

Maze: Every single market saw a decline week over week. Yes, Jenni, that's right, every single market. Now, last week we called out that we were not seeing any easing on city and local runs. Well, that's really changed this past week, where city and local runs have seen the largest decrease week over week. The largest markets by volume, such as Miami, Jacksonville, and Atlanta, are all seeing comfortable decreases for shippers.

Jenni: Interesting developments there. Now, why don't we take a drive on up to the Coastal region?

Maze: It's a mix of two different stories, and it really depends on where the market lies. Is it neighboring the Northeast, such as Baltimore and Alexandria? Because those markets that are neighboring the Northeast region are experiencing that domino effect to where they are actually seeing rates increase week over week, just like most of the Northeast as a whole. Now, if we reverse back down to the Carolinas, which are bordering the Southeast region, it's a different story where we are seeing rates continue to decline, especially out of Charleston, where rates declined over 4%.

Jenni: Okay. And it looks like our last stop here is going to be more of a carrier-favored region. Which one is that?

Maze: The Northeast is the complete opposite of the South. Every market saw increases week over week, except for one, and that was Pittsburgh, Pennsylvania. Now, it's important to note that the highest volume markets such as Harrisburg, Pennsylvania and Elizabeth, New Jersey, experienced increases in rates. I do not believe we're going to see much of a change on freight leaving the Northeast as we head into a more seasonal favored time for carriers up there. But one thing to call out is definitely what's happening with longer hauls and how it plays out for the Northeast, in particular, and freight leaving a market like Harrisburg, Pennsylvania. Are we going to see Harrisburg continue to increase and drag rates throughout the Northeast up, or are we going to start seeing Harrisburg decline or increase at a slower pace? It's definitely a market to keep an eye on as the Northeast starts to heat up. And that we will certainly do.

Jenni: Now, we're going to get a little bit more into the carrier-favored markets, especially over on the West Coast, but why don't we stop over to the Midwest?

Maze: The Midwest as a region for full truckload freight is not much different than the Northeast. There are a lot of markets that are teetering on declining or on increasing. It really depends on where the freight is destined. Now, the Midwest does seasonally get tighter going into the winter months, although we’re only in August, Jenni, and it's almost 100 degrees here in Atlanta. So I'm not trying to bring winter any earlier, but it's important to know that right now, the markets are really teetering on increases or decreases week over week, depending on where the freight's going. If it's staying within the Midwest, you're likely to see slim increases. If it's going to the South or Southeast, you're going to definitely see increases as they are less favorable markets to send the driver right now.

Jenni: Okay, and our last official stop of the regional breakdown is going to be the West Coast. And I hear that is something to look out for. What's going on?

Maze: That's right, Jenni. The West Coast is something to look at this week because the largest markets by volume are seeing rate decreases, such as Phoenix, Los Angeles, Ontario, California. This is a good sign for shippers after experiencing a few weeks of volatility as tender rejections climbed in most of those markets. Now, Phoenix is definitely flipped off of produce season, but Southern California is something to continue to watch, especially as we head toward September. But more notably, check out the Pacific Northwest. Now, yes, it is seasonal for the Pacific Northwest to pick up steam in August, but usually not until the end of August and really not til September when produce season really drives volume up. But already we're seeing markets throughout the Pacific Northwest gain some volatility, bringing higher rates in favor of carriers. Now, this is months after the Pacific Northwest was nothing but low rates with no freight leaving. Now it started to show signs of flipping. I'm not going to say this is going to continue at this speed, but we're likely going to continue to see slim increases week over week for the next two to three months as we kick into the Pacific Northwest produce season. Now, when we get into September and October and Christmas trees start coming out of the Pacific Northwest, that is definitely going to be when we should see the largest increases and it becomes the most favorable region for carriers.

Jenni: Okay, so despite the news, there's definitely some positive outlook somewhere in there. Now, Maze, considering all the developments that have happened, and I hope that nothing else happens by the time we drop this episode, what are you thinking the state of the market is looking like now?

Maze: It looks like we're starting to potentially see a shift in the broader outlook of the market. Now, I'm not trying to get carriers excited out there. There's still plenty of capacity for the demand we have within the market, but there are some signs that we are not going to go back and start declining at a national level to the rates we saw back in May. But how much further rates decline this month will be a big indicator of how Q4 performs, and that's also when a lot of RFPs start coming out to be priced for the year of 2024.

Jenni: You hear that, carriers? Just hang tight. We will get you there. That said, we will see you next week with an all-new episode of the Transfix Take podcast. Until then, drive safely.

DISCLAIMER: All views and opinions expressed in this podcast are those of the speakers and do not necessarily reflect the views or positions of Transfix, Inc., or any parent companies or affiliates or the companies with which the participants are affiliated and may have been previously disseminated by them. The views and opinions expressed in this podcast are based upon information considered reliable but neither Transfix Inc. nor its affiliates nor the companies with which the participants are affiliated warrant its completeness or accuracy, and it should not be relied upon. As such, all views and opinions are subject to change.