Will Peak Holiday Season Peak or Peter?

Welcome to the week of October 11th edition of the Transfix Take! Gear up for the latest updates and trends in the trucking industry. In this issue, we're revving up with industry news, sprinting through regional breakdown highlights, and putting the spotlight on what's on the horizon for truckers.

Industry Insights: Unpacking the Road Ahead

A Freight Rate Update: The national average rate per mile line haul remains steady at $1.58. However, it's essential to note that rates vary significantly by location, driven by seasonality and market-specific factors.

Source: Freightwaves

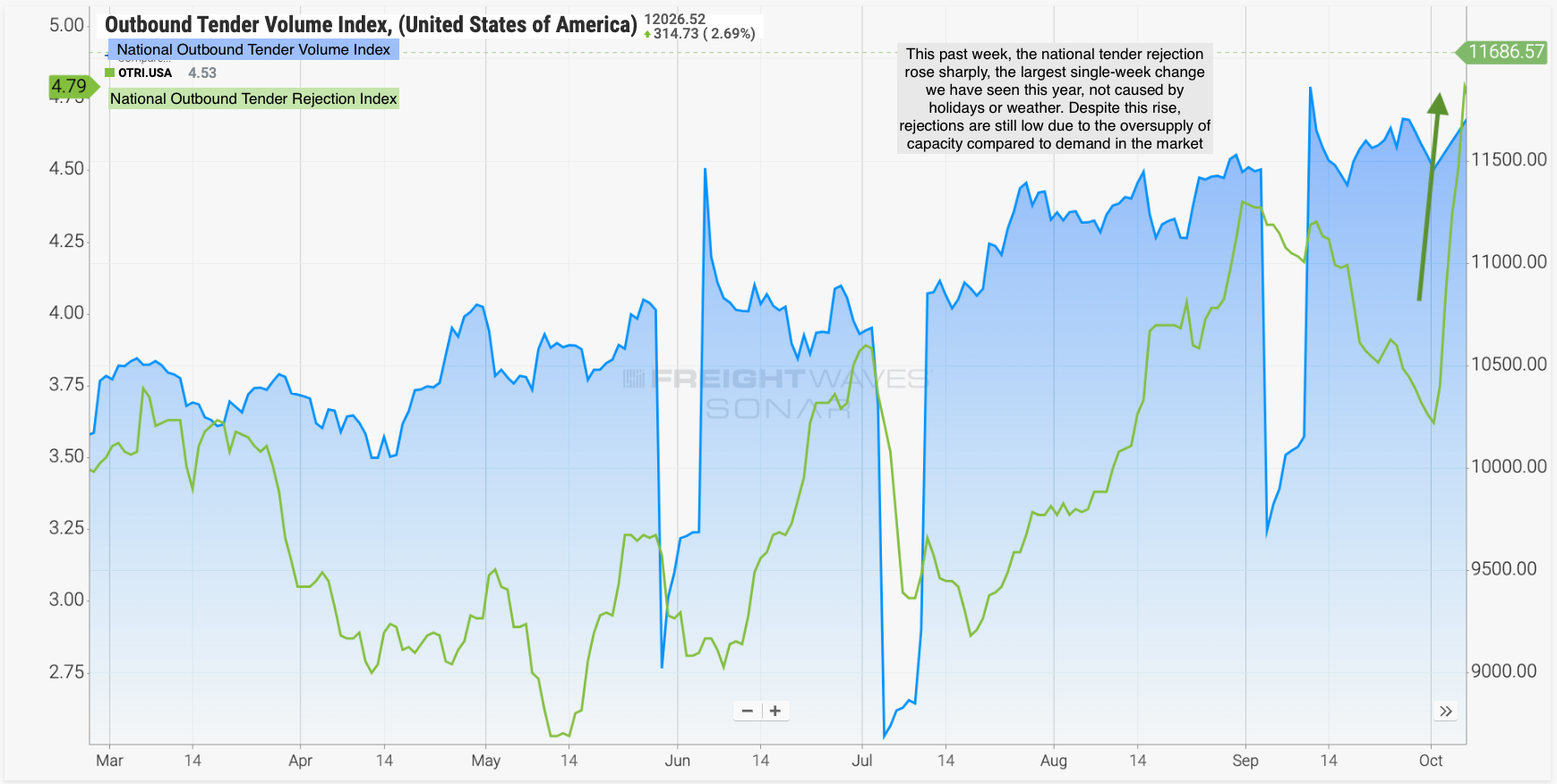

Some Tender Turbulence: Tender rejections took a notable jump last week, although they still remain relatively low for this time of year. This anomaly, typically associated with Q4's anticipated volatility, has not materialized yet, primarily due to factors beyond seasonal demand. Simply put, there is still too much available capacity on the road to justify movement towards what a ‘normal’ holiday season would look like. We are, however, anticipating a jump in demand the week before Thanksgiving.

Source: Freightwaves

The Strike Saga Continues: The UAW strike has expanded with 73% of Mack Trucks union workers rejecting proposed contracts, including, among other things, a 19% wage increase and $3,500 bonus for ratifying the contract agreement. It’s important to keep in mind that union workers are looking for a 40% increase in wages. The strike's ripple effect is beginning to impact freight markets, especially in the Midwest, where larger carriers may shift their equipment into the spot market.

Regional Roadmap: Where the Rubber Meets the Road

Below is an in-depth regional breakdown of the freight industry, uncovering nuances and trends in various regions across the nation.

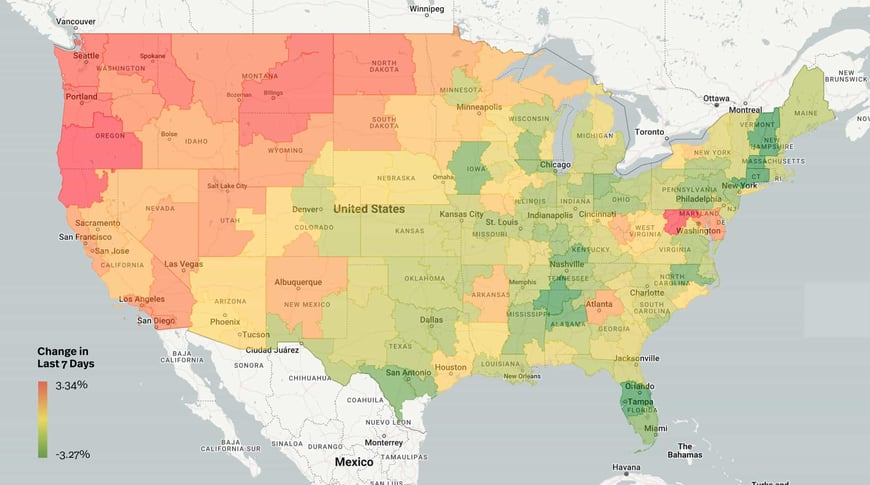

Source: Transfix Internal Data

West Coast: The West Coast is currently heating up, witnessing higher rates week over week. While this is a positive trend for carriers, although uncertain, it is likely that this market favorability will be short lived with rates in the Pacific Northwest expected to recede as November approaches.

The Midwest: Markets in the Midwest are experiencing a degree of rate easing, especially in higher-volume regions. However, the upper Midwest, with its plummeting temperatures, might see volatility in reefer market fluctuations. Keep an eye on shifting weather patterns.

The Northeast: The Northeast market is following a similar trend to the Midwest, with some decreases in outbound rates. The onset of winter weather may influence market dynamics, potentially leading to tightening conditions as we approach the Thanksgiving holiday.

Coastal Region: Rates in the Carolinas have been declining recently, while the DC-Baltimore metro area is showing some rate increases. Overall, the Coastal region is expected to remain relatively flat in the coming weeks.

Southeast & South: The Southeast and South are currently experiencing colder freight markets. Atlanta is the exception, with slight tightening. However, capacity continues to outweigh demand, resulting in generally loosening markets.

Border Markets: Markets along the border have seen some easing, offering a glimmer of hope for shippers in this region. Laredo, in particular, experienced a 2% rate decrease, signaling a potential shift in favor of shippers.

On the Horizon: What Lies Ahead in the Trucking Terrain

As we look ahead, a few key takeaways emerge from our crystal ball outlook for 2024 and the future of the freight market.

2024 Outlook:

- Our analysis suggests that the freight market may continue to pose challenges for carriers through the first half of 2024.

- While some expected a shift upward in the first half of the year, current market conditions, coupled with RFP season, indicate that supply remains abundant, and demand shows no significant changes.

- Carriers may need to adapt to a prolonged period of market stagnation and look to improve or strengthen their contractual relationships with shippers.

Staying informed about the evolving freight market landscape remains crucial. While the immediate future may not hold dramatic swings, vigilance is key to making informed decisions and optimizing your equipment for the best returns.

That's the wrap for this edition of the Transfix Take Newsletter. We'll continue to keep you in the driver's seat with the latest news, trends, and insights in the supply chain. Until the next pit stop, drive safe and stay ahead of the curve!

Drive safely!

DISCLAIMER: All views and opinions expressed in this podcast are those of the speakers and do not necessarily reflect the views or positions of Transfix, Inc., or any parent companies or affiliates or the companies with which the participants are affiliated and may have been previously disseminated by them. The views and opinions expressed in this podcast are based upon information considered reliable but neither Transfix Inc. nor its affiliates nor the companies with which the participants are affiliated warrant its completeness or accuracy, and it should not be relied upon. As such, all views and opinions are subject to change.