Carrier Capacity Continues to Outweigh Demand

Welcome to the week of October 25th edition of the Transfix Take! Gear up for the latest updates and trends in the trucking industry. In this issue, we're revving up with industry news, sprinting through regional breakdown highlights, and putting the spotlight on what's on the horizon for truckers.

Industry Insights: Unpacking the Road Ahead

In this week's edition of Transfix Take, we delve into the latest developments in the freight industry, analyzing key indicators that affect shippers and carriers across the nation.

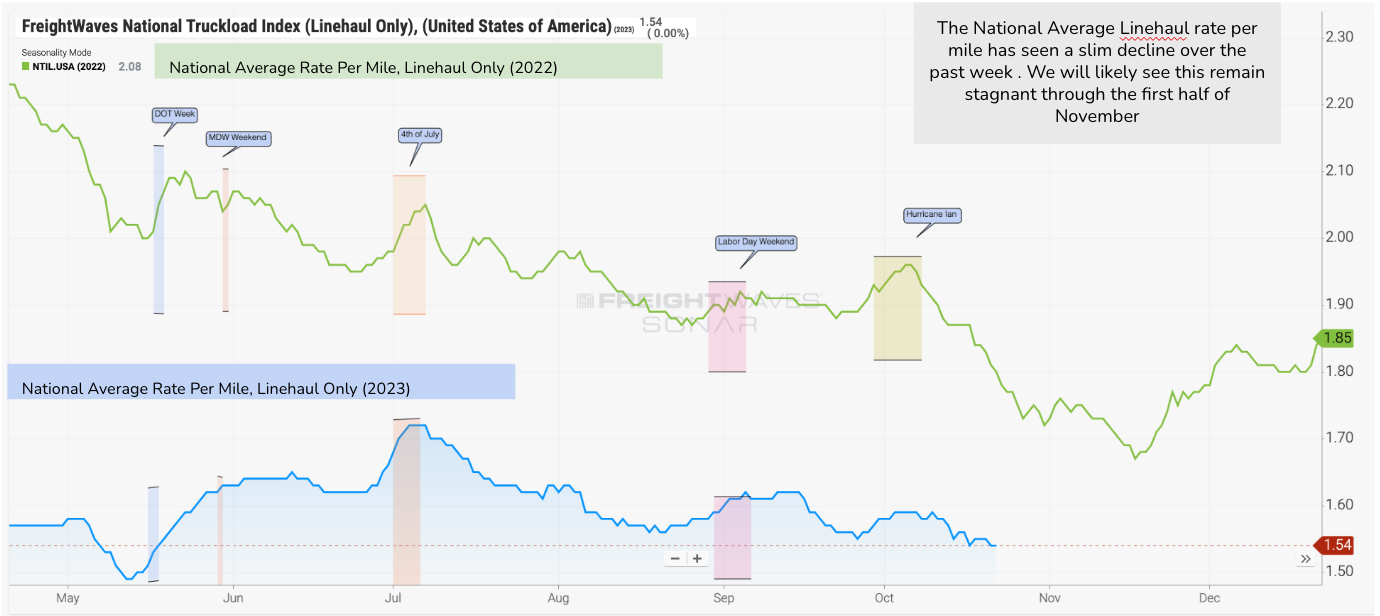

Source: Freightwaves

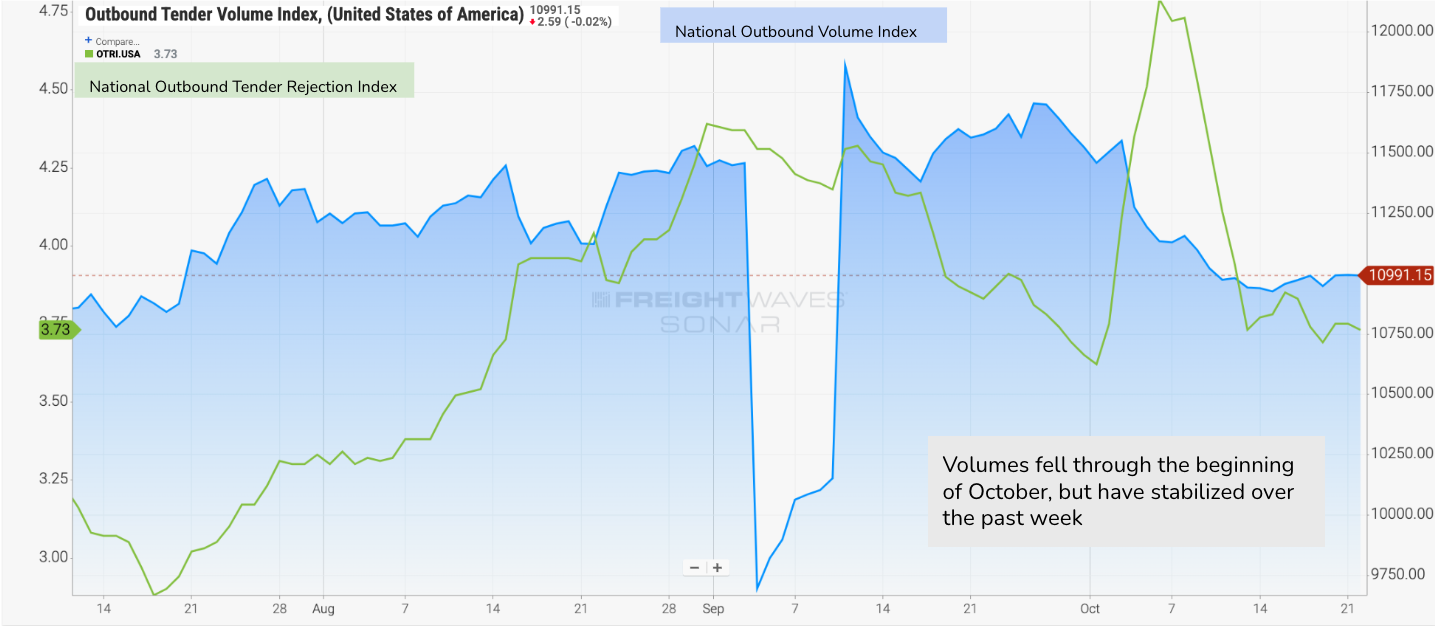

A Freight Market Update: The freight market continues to show signs of a steady decline despite volatility in headlines. Volumes have plateaued, and tender rejections are below 4%. Rates have started declining again, with fuel price increases masking line haul declines and the national average sitting at $1.54.

Source: Freightwaves

Volatility in the Freight Industry: Seattle-based trucking startup Convoy has closed its doors after an unsuccessful four-month search for an acquirer. Additionally, two major carriers, Meadow Lark Transport and Certified Freight Logistics, also ceased operations. These developments have sparked further discussions about the state of the industry and the overall balance between supply and demand, and raise questions about their impact on rates and capacity.

Regional Roadmap: Where the Rubber Meets the Road

Below is a regional breakdown of the freight industry, uncovering nuances and trends in various regions across the nation.

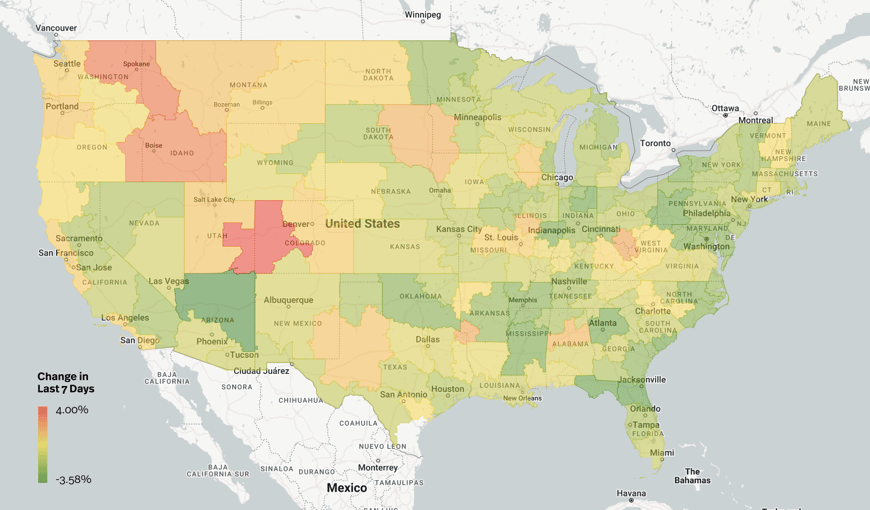

Source: Transfix Internal Data

The Midwest: The Midwest has seen a rate downturn in significant markets driving volume. While some rural areas have experienced slight rate increases, the region may see some volatility in the coming weeks, driven by the approaching winter weather. Reefer freight originating from the Midwest is something to watch closely, as it could influence dry van rates later in November.

West Coast: Markets in Arizona have experienced steep rate declines, contrasting with San Francisco, which remains one of the few higher-volume markets showing strength. The Pacific Northwest and rural markets have maintained some momentum, but higher volume markets on the West Coast continue to face oversupply, leading to declining rates.

The Northeast: Despite Bristol, New Hampshire showing a slim increase, the majority of markets in the Northeast have experienced outbound rate declines. Major markets, such as Harrisburg, Pennsylvania and Elizabeth, New Jersey, are showing strong rate decreases, and signs of tightening are not expected until the middle of November.

Coastal Region: Similar to the Northeast, the Coastal Region has seen decreases in rates in almost every market, with Charlotte, North Carolina showing only a slim increase, particularly in local runs. The Coastal market may not favor carriers in the near term.

The Southeast: The Southeast mirrors the Northeast and Coastal regions, with rate declines in almost every market. Atlanta, Georgia, Jacksonville, Florida, and Lakeland, Florida have experienced significant decreases. Carriers operating in this region may need to demand higher rates for freight destined here.

The South: There have been no significant changes in average rates for freight originating from the region since last week. While there is a noticeable rate decrease in city and local runs, the major volume markets such as Fort Worth, Houston, and Dallas in Texas have seen relatively slim declines. The border region, including Lubbock and Laredo, has shown some volatility.

On the Horizon: What Lies Ahead in the Trucking Terrain

The shutdown of Convoy and the closure of two major carriers have raised questions about the future of the industry. Here are some key factors to consider:

Impact of Convoy's Shutdown: While the closure of Convoy and other carriers may not have immediately caused significant volatility, it has introduced an element of uncertainty in the market. The freight industry has been grappling with the challenge of excess supply compared to demand. The ongoing decline in brokerages and carrier authorities is a symptom of this surplus. As the market continues to adjust, the impact of these closures may unfold in the coming months, and December and Q1 may be particularly interesting to watch.

Winter Weather and Hurricane Season: As we approach the winter months, particularly in the Upper Midwest states like Montana and Idaho, the potential for winter weather disruptions is on the horizon. However, keep a watch on the Atlantic Ocean and the possibility of storms during this hurricane season. We'll keep a close eye on these weather conditions and their potential impact on freight routes and delivery times.

UAW Strike Expands: In the last 24 hours, the United Auto Workers (UAW) strike has expanded. Approximately 40,000 UAW workers are on strike at Ford, General Motors, and Stellantis. A Ram truck plant has also been shut down. The full impact of this strike may not be evident for a few more months, particularly as we approach the holiday season when car purchases typically increase.

Staying informed about the evolving freight market landscape remains crucial. While the immediate future may not hold dramatic swings, vigilance is key to making informed decisions and optimizing your strategy and equipment for the best returns.

That's the wrap for this edition of the Transfix Take Newsletter. We'll continue to keep you in the driver's seat with the latest news, trends, and insights in the supply chain. Until the next pit stop, drive safe and stay ahead of the curve!

Drive safely!

DISCLAIMER: All views and opinions expressed in this podcast are those of the speakers and do not necessarily reflect the views or positions of Transfix, Inc., or any parent companies or affiliates or the companies with which the participants are affiliated and may have been previously disseminated by them. The views and opinions expressed in this podcast are based upon information considered reliable but neither Transfix Inc. nor its affiliates nor the companies with which the participants are affiliated warrant its completeness or accuracy, and it should not be relied upon. As such, all views and opinions are subject to change.