UAW Strikes Could Mean A Softer-Than-Predicted Market

Welcome to the week of September 27th edition of the Transfix Take! Gear up for the latest updates and trends in the trucking industry. In this issue, we're revving up with industry news, sprinting through regional breakdown highlights, and putting the spotlight on what's on the horizon for truckers.

Industry Insights: Unpacking the Road Ahead

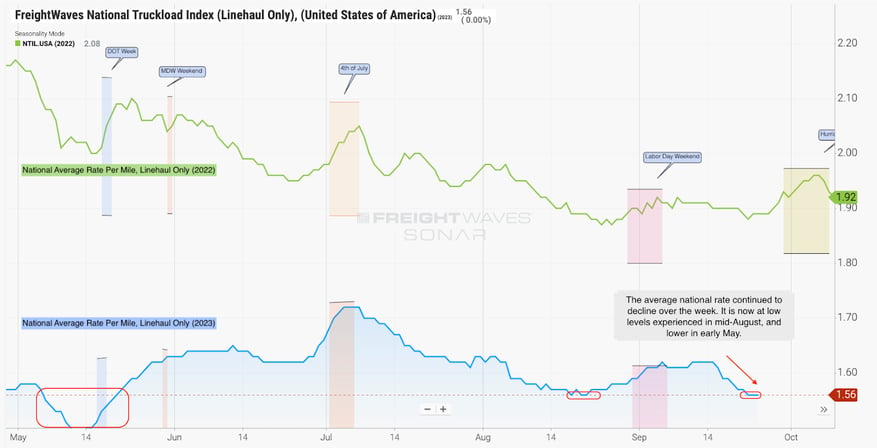

Average National Rate Per Mile Update

Last week, we monitored the average national rate per mile, and here's what we found: the rate saw a slight drop from $1.59 to $1.56. While this may not seem like a significant decline, it shows the market continues to soften. We anticipate continued loosening in the weeks ahead, but keep an eye on the second half of October, which may bring some volatility caused by labor strikes mentioned below, potentially driving up spot rates.

Source: Freightwaves

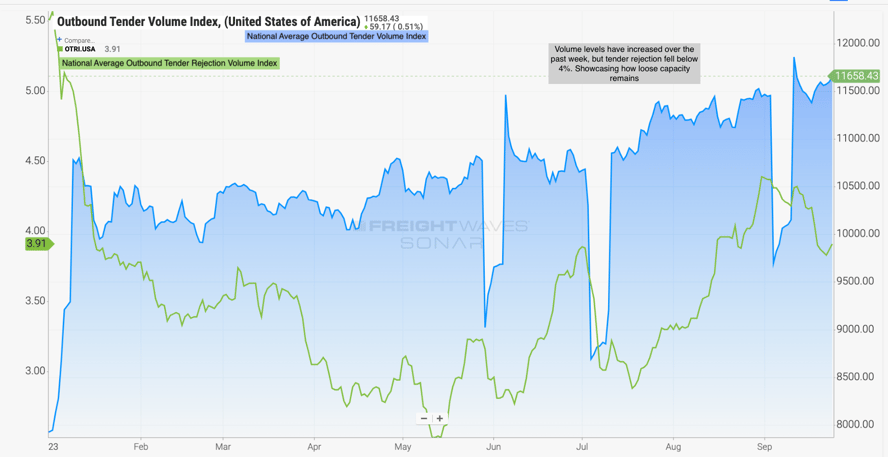

Tender Rejections

Tender rejections are another crucial indicator to watch. Currently, the average national tender rejection rate hovers around 3.91%. This level is lower than expected as we enter the peak season of Q4, traditionally characterized by tightening capacity. However, tender volumes remain robust, showcasing the persistent loose capacity that has defined 2023.

Source: Freightwaves

Regional Roadmap: Where the Rubber Meets the Road

Let's take a closer look at how different regions across the United States are faring in terms of freight and capacity..png?width=769&height=429&name=Map%20chart%20-weekly%20market%20update-0913%20(2).png)

Source: Transfix Internal Data

West Coast: The West Coast is experiencing some tightening, especially in major markets like Ontario, California. However, the most significant tightening is observed in the Pacific Northwest. However, the most significant tightening is observed in the Pacific Northwest, where we anticipate further tightening driven by the annual Christmas tree season as we drive into October.

The South: In the southern region, the situation is mixed. Larger volume markets, such as Dallas, Fort Worth, and Houston, are experiencing loosening rates. On the other hand, markets along the border are slightly tighter, although this trend may dissipate soon. Keep an eye on cross-border freight as the UAW strike, discussed below, could impact car and car parts manufacturing supply chains.

The Southeast: This region is generally favoring shippers, with most markets seeing loosening. However, there are some pockets of tightening in Northern Alabama and the southwest part of Tennessee. The UAW strike may also influence cross-border movements here.

The Coastal Region: With the exception of the Raleigh and Wilmington, North Carolina markets, every market in the Coastal region is experiencing declining rates. These declines are expected to continue, with capacity gradually opening up.

The Northeast: While this region experienced continued tightening over the past weeks, it's now showing some signs of softening. Larger markets, including Allentown, Pennsylvania, Elizabeth, New Jersey, and Harrisburg, Pennsylvania, are seeing slight rate decreases. While some pockets of tightening remain in New England, in lower volume markets, the overall trend is toward softening.

The Midwest: We have this region on close watch as we’ve witnessed loosening across its markets–a departure from the typical Q4 tightening. Notably, rural markets in North Dakota and Montana are showing some tightening while larger volume markets like Chicago, St. Louis, and Indianapolis are seeing slight declines in average rates. Carriers operating in the Midwest may face challenges when heading to less desirable markets.

On the Horizon: What Lies Ahead in the Trucking Terrain

The United Auto Workers (UAW) strike has been ongoing for twelve days, with no immediate end in sight. The strike initially began with Ford but has since expanded to include General Motors (GM) and Stellantis. While concentrated in the Midwest, the strike has repercussions across the country. It could disrupt supply chains and impact full truckload markets, as Chris Spear, the president of the American Trucking Association, points out, trucks move more than $950,000,000,000 worth of cars, trucks, and parts and that is a significant contributor to overall volume for truckload.

Surprisingly, the strike is causing downward pressure on the trucking market, contrary to the usual upward pressure seen during such events. This shift is due to potential impacts on non-union jobs and suppliers of the big three car companies. If the strike persists, it may lead to capacity being pushed into the spot market for other types of freight, resulting in lower-than-anticipated rates, which could pose challenges for carriers, especially smaller ones, during Q4.

While we continue to monitor this strike, it's essential for industry stakeholders to keep a close eye on developments and be prepared for potential shifts in the trucking terrain.

That's the wrap for this edition of the Transfix Take Newsletter. We'll continue to keep you in the driver's seat with the latest news, trends, and insights in the supply chain. Until the next pit stop, drive safe and stay ahead of the curve!

Drive safely!

Disclaimer:

The views and opinions expressed in this newsletter are based upon information considered reliable, but Transfix, Inc. does not warrant its completeness or accuracy, and it should not be relied upon. All views and opinions are subject to change and should not be interpreted as specific advice of any nature. Any reproduction or distribution of the content of this newsletter is prohibited without the explicit written consent of Transfix, Inc.