Executing a once-a-year request for proposal (RFP) or request for quote (RFQ) is a common shipper practice in the freight industry. However, the advances in bidding technologies and the unforeseeable freight boom in connection with the COVID-19 pandemic highlighted the need for more than just annual bidding and contracting. A need for more flexible pricing has become ever more apparent.

Shippers and carriers can spend months bidding on and negotiating rates and analyzing carrier performance, only to change course over the year due to market shifts and more favorable freight rates, be it spot market or contract freight.

However time-consuming or out of sync with the market annual RFPs can be, the industry cannot seem to be able to move away from them. Instead, bids covering shorter time periods are an additional arrow in a shipper’s quiver, so rates can more accurately reflect market pricing and perhaps reduce tender rejections.

“Shippers need to know whether seasonality or overall market capacity is driving prices for their commodities,” said Paul Poziumschi, Senior Director of Freight Market Intelligence at Transfix. “During COVID-19, capacity shortages were driving market prices irrespective of lane seasonality. Equally, post-pandemic, excess capacity ironed out seasonality in some lanes and for some commodities, where there were many trucks available even at the peak of seasonal trends.”

When determining the appropriate frequency of RFPs, shippers should consider, among other things, their product mix, distribution network needs, and the related cycles they have previously experienced, while also thinking about additional strategies like cost-plus pricing or the use of dedicated carriage.

Building Strategy for Carrier Acquisition for Shippers with Predictable Seasonality

Perhaps your shipment volumes are relatively predictable, so predictable in fact that you roughly know your future shipment volume across your network. Take a look at the generally accepted historical patterns of the following three verticals:

- Building Materials: Volumes ramp up in late winter and remain steady until fall

- Food Manufacturing / Grocers: Volumes ramp up predictably before all major holidays

- Beverage Distributors: Volumes peak in summer, with upticks before Cinco de Mayo, Memorial Day, and Fourth of July

If your commodity has a predictable demand, a longer-term RFP timeframe scheduling may be the right choice. However, you should also have short-term capabilities to manage unexpected spikes or declines in volume, such as those caused by COVID-19.

Data-driven transportation service providers can assist by participating in a pre-RFP network analysis, where shippers can view market capacity trends and historical seasonality at the lane and network levels.

Case Study: A beer distributor’s sales and volumes spike during the summer, and contracts with carriers can handle this volume based on forecasts. However, if there are more orders than forecasted, it might be hard to move the additional surge. In a softer market, the extra volume can more likely be covered, and likely at lower rates. The surge can be handled by the spot market, or the distributor can make use of dynamic pricing (like our Transfix TrueRate+ solution) which can find capacity and ensure a fair market rate.

RFPs for Unpredictable Carrier Demand

Shippers whose carrier demand is less predictable not only face the risk associated with shipment execution; those shippers must also reckon with the risk of product demand. For big box retailers and other shippers of consumer goods, whose success is more contingent on fickle consumption patterns, predicting demand is not so straightforward.

“If you are a general merchandise retailer, things are more complicated, because you are depending on a number of choices that customers make, whether between competitor stores or shopping online vs. in-store,” said Poziumschi. “For these companies, we can still offer competitive contract rates, but we advise shorter-term contracts (1 to 3 months), dynamic pricing solutions, or dedicated partnerships with carriers.”

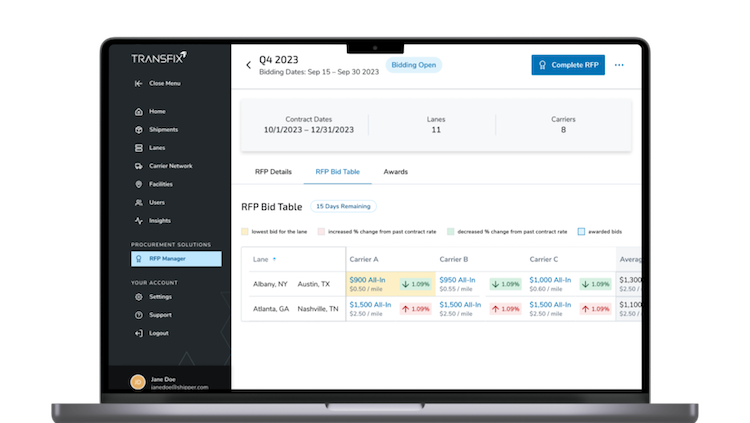

- Embracing Agile Pricing: Instituting quarterly and monthly bid cycles allows the shipper to respond more effectively to market shifts, ensuring rates reflect current realities rather than potentially out-dated projections.

- Fostering Dedicated Relationships: Developing enduring business relationships with carriers based on volume-based pricing creates a win-win scenario, where reliable service is rewarded with consistent business and carrier portfolio optimization driven by technology.

The Importance of Data Partnerships in Carrier Procurement

As you move deeper into RFP season and think more strategically about your distribution networks and seasonality, reach out to us. As a tech-powered freight broker, we have the data sets and the transportation expertise to provide 6-month market outlooks and apply our insights to your specific needs.

Our customers have indicated that access to our information on macroeconomic factors impacting the trucking industry, like inflation and consumer demand, as well as industry-specific factors like fuel prices, carrier consolidation, and rate volatility, has been useful to their decision-making.

Click here to learn more.

![[Webinar Recap] Diesel Download: A 2024 Outlook to Prepare for a Volatile Year Ahead](https://transfix.io/hubfs/iStock-1392574169.jpg)