Have Rates, Rejections Bottomed Out?

During the past few weeks, the slow drop of tender rejections and volume started to level out and even increase as February began. The weather has played a key role all across the country, from the West Coast to the East Coast.

“Capacity started to tighten in the major West Coast markets, and capacity constraints rode the storm’s path across the country,” says Justin Maze, Transfix’s senior manager of carrier account management. “The largest East Coast markets (Allentown, Harrisburg, Elizabeth) remain tight days after the storm steered off the coast, and it looks as if the elevated tender rejections and rates will remain elevated for the time being, as new storms approach to keep carriers on their heels.

“The entire freight market is still idle, as we continue down the traditional trend lines that have been playing out so far this year. Repricing contract freight higher has led to less freight hitting the spot market. And as contract freight becomes the higher-paying tender, shippers’ routing guides are proving efficient once again.”

FreightWaves’ Seth Holm concurs: “Carriers are rejecting freight at historically very high levels, but the market seems to be getting accustomed to it. … The past few weeks have seen lower rejection rates and, in turn, lower rates because shippers have improved routing guides by agreeing to higher contract pricing. As the spot–contract spread declines, so does the benefit of opportunistically rejecting contracted freight in favor of testing spot markets.”

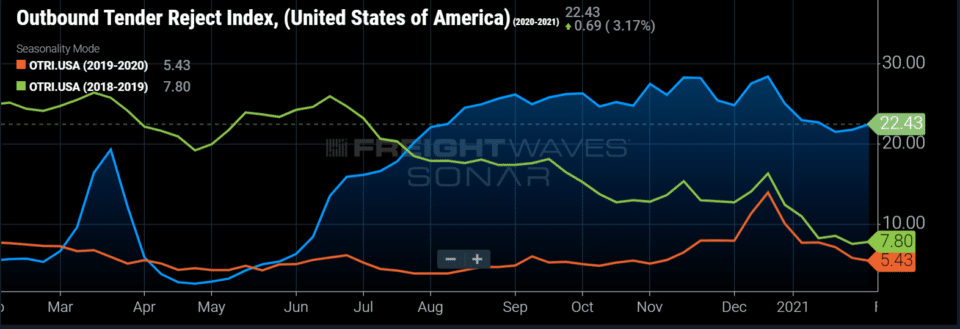

The Outbound Tender Reject Index (OTRI) sits at 22.43%, up for the first time since Christmas, though this was likely somewhat influenced by the snowstorm in the Northeast.

Major West Coast markets have seen slight rises in rates to move freight, and the amazing congestion at the ports of the West Coast has only gotten worse. More than 50 ships are anchored off the California coast waiting for a port spot to open. Cargo ship carriers have already started to cancel voyages to the U.S., not because there is a lack of imports to send, but because they do not want to send more ships just to wait at bay.

ISM: Manufacturing Growth Remained Strong in January

The manufacturing sector grew in January for an eighth consecutive month, according to the Manufacturing Institute for Supply Management (ISM) Report On Business. The report’s key metric, the PMI, read 58.7 (50 or higher indicates growth), which was 1.8% below December’s 60.5 and 5.6% above the 12-month average of 53.1.

New orders fell to 61.1, down 6.4% from December’s 67.9 reading, which was among the highest readings since 2004. Production and supplier deliveries also decreased compared with December 2020.

“Survey committee members reported that their companies and suppliers continue to operate in reconfigured factories, but absenteeism, short-term shutdowns to sanitize facilities, and difficulties in returning and hiring workers are continuing to cause strains that limit manufacturing growth potential,” said Timothy R. Fiore, chair of the ISM Manufacturing Business Survey Committee. “However, panel sentiment remains optimistic.”

Transfix Launches Fleet Planner 2.0

Transfix announced key enhancements to Fleet Planner, its free, online tool that grants small and mid-sized carriers access to a centralized platform for managing fleets, streamlining operations and, ultimately, scaling their businesses.

Most carriers in this segment still rely on manual load-booking processes and lack visibility into where their loads are in real time — not only increasing the risk of missing loads, but hindering their ability to book additional loads easily, grow and scale.

With Fleet Planner 2.0, carriers can seamlessly book loads directly in the platform, increasing carrier profitability and driver take-home pay. Carriers can also tap into new tools that automate communications. These features will be available in addition to the mobile-friendly fleet management capabilities already available in the tool.

“The second phase of Fleet Planner reflects our ongoing commitment to driving superior solutions for our partners across the supply chain. With this powerful update, small and mid-sized carriers can not only manage and centralize, but also grow their businesses,” says Lily Shen, CEO and president of Transfix. “Fleet Planner 2.0 represents the next build-out in our robust ecosystem of technology solutions for our partners, unlocking massive opportunity for efficiency and scale.”

For more information or to sign up for Fleet Planner 2.0 for free, visit https://transfix.io/fleetplanner/.

With the uncertainty and volatility surrounding the U.S. economic recovery, shippers need a partner that can help them adapt and excel — no matter the circumstance. Shippers turn to Transfix for our leading technology and reliable carrier network. As volumes drive higher, we are here to help: Learn more about our Core Carrier program and Dynamic Lane Rates. As part of our ongoing market coverage, we’ll continue to provide breaking news, resources and insight into emerging trends and the pandemic’s impact on the transportation industry.