Further Tightening Heading Into End of Q1

Spot rates saw some relief last week, but they will most likely inch back upward as we come to the end of Q1. All our usual measurements are already up this week.

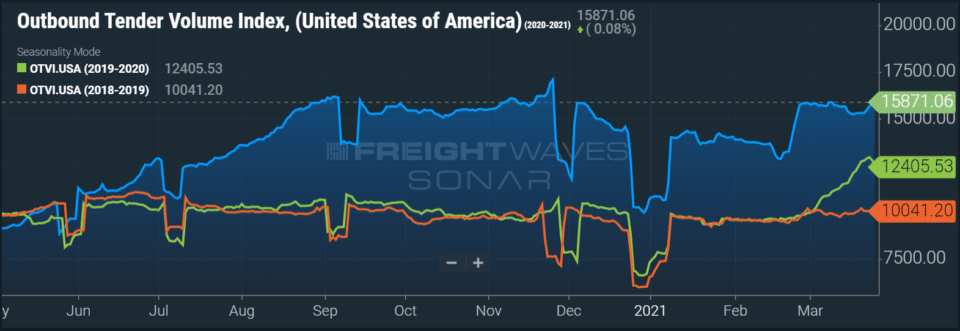

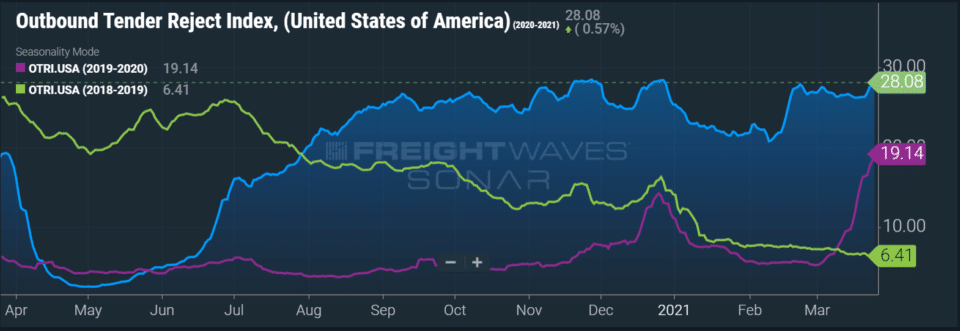

“Our carrier partners are signaling to us that their capacity is getting tied up further out than usual for the end-of-month pushes,” says Justin Maze, Transfix’s senior manager of carrier account management. “Volume remains extremely elevated, still holding 25% higher year over year. It was just a year ago that we saw supply chains flipped upside down, with panic buying leading to a huge spike in both volume and rejections, before both ultimately hit all-time lows.”

The Outbound Tender Volume Index (OTVI) marked its second-highest rate ever last week, reaching 15,871, which was a 4% jump over the previous week.

Even falling spot rates are holding higher than contract rates (according to DAT), which could signal trouble for shippers, as tender rejections continue at levels comparable to the weeks of Christmas and Thanksgiving. It’s been 8 months since tender rejections started sustaining above 20%, and this continues to be a significant driver in the rise of transportation costs. The Outbound Tender Reject Index (OTRI) sits at an incredibly high 28.08%.

“We have continually mentioned port congestion and higher consumer demand for goods as some of the leading factors driving the current market,” Maze says. “With a 95% YoY increase in imports for Q1, this will only continue. There looks to be no relief on the demand side of the industry any time soon, with new stimulus checks going out into the economy and many retailers struggling to replenish heavily depleted inventories. The industry is currently showing very low inventory-to-sales ratios.”

Next week’s Transfix Take will dive deeply into the challenges ahead for supply in Q2. Reefer capacity has been on a wild road, which could create some huge roadblocks as we enter produce season.

“Shippers need to act yesterday for their refrigerated needs,” Maze says.” And with rejections and rates at historic highs before we even start produce season, shippers need to hurry to secure capacity and renegotiate rates for routing guide compliance.”

What’s Behind the Driver Shortage?

As we noted last week, even the U.S. Congress is trying to address the industry driver shortage. The current driver shortage is different this time around, and it’s having a huge, sustained impact on the rising cost of transportation.

“The driver shortage, as a talking point, is not new to the industry, but we usually do not see the effects of a shortage for this long a period of time, with this big of an impact on the industry,” Maze says. “Usually, during periods of driver shortages, we see transportation costs go up, as carriers begin to increase driver pay and transfer that cost to the shipper. This helps recruit drivers back into the industry or attract new drivers.”

This time, in addition to those issues, there are several more piling on to compound the shortage:

- Driving schools remained closed for most of 2020, and those that could open were held to lower capacity.

- DMVs were also closed for much of 2020, which put a constraint on the process of new drivers getting their CDLs.

- Government stimulus checks and increased unemployment payments kept some of the workforce at home.

- Other industries that have remained strong, such as warehouse and construction, have attracted drivers with competitive pay and the promise of better “work–life balance.” According to a Centerline study quoted by Material Handling & Logistics, 76% of drivers prefer local or short-haul trucking, and 50% of commercial long-haul drivers do not feel safe on the roads; trucking was the sixth most dangerous occupation group in 2018, according to the Bureau of Labor Statistics.

What About That Ship in the Suez?

The Suez Canal sees $10 billion worth of goods — or roughly 10% of global trade — pass through its waters every day. Freed earlier today, the Ever Given container ship being stuck in the canal already has had a substantial effect on the European supply chain. Here in the U.S., we expect a less direct impact, because most of our trade from Asia comes via the Pacific Ocean.

“We expect much of the influence on U.S. supply chains will come primarily as a domino effect from European trade,” Maze says. “But with very volatile supply chains around the world due to the current pandemic, this could have an inflamed impact across supply chains regardless of where they sit in the world. Since the ship was dislodged more quickly than many experts expected, we are hopeful the effect on over-the-road transportation in the U.S. will be minimal. But we’ll be watching.”

With the uncertainty and volatility surrounding the U.S. economic recovery, shippers need a partner that can help them adapt and excel — no matter the circumstance. Shippers turn to Transfix for our leading technology and reliable carrier network. As volumes drive higher, we are here to help: Learn more about our Core Carrier program and Dynamic Lane Rates. As part of our ongoing market coverage, we’ll continue to provide breaking news, resources and insight into emerging trends and the pandemic’s impact on the transportation industry.