Port Cities Booming; Produce Season on Cusp of Heating Up Already-Hot Market

Both U.S. coasts are seeing explosive imports. Last month, the Los Angeles, N.Y./N.J., Charleston and Savannah ports all hit record import levels (see below). The freight from imports shows no signs of slowing, with some port cities, such as Harrisburg and Atlanta, hitting record-high spot rates on some major lanes.

“During the past several weeks, national average rates have stayed pretty flat, with small week-over-week increases — but this could come to an end soon,” says Justin Maze, Transfix’s senior manager of carrier account management. “While we continue to see record imports, which translate directly into over-the-road freight, we are also on the cusp of produce season, where markets that provide or transport large amounts of produce start to heat up and capacity flips, becoming extremely tight. We are already seeing impacts of produce season in some of the largest produce markets, such as southern Florida, Texas, Arizona and California.”

Both reefer and dry-van volumes and rejections continue to climb, with the load-to-truck ratio widening. If these two factors were not enough pressure on a fragile freight market, add the annual DOT road-check Blitz Week, May 4–6, which cripples capacity throughout the country, as small and mid-size carriers take their trucks off the road for a few days.

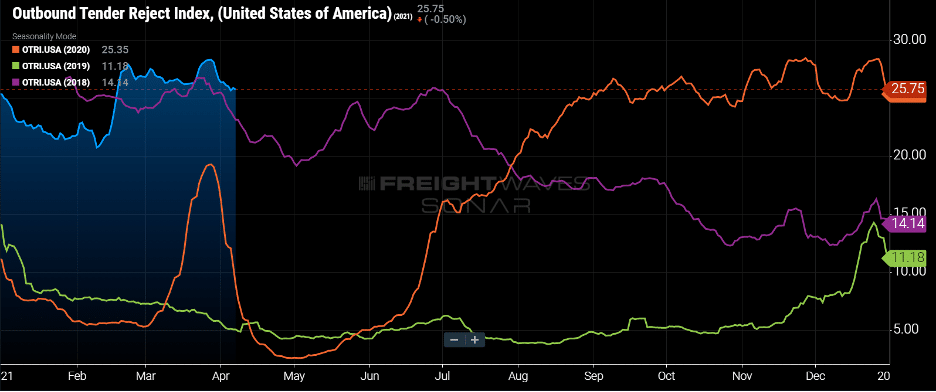

The Outbound Tender Reject Index (OTRI) has hovered around 25% since the February storms disrupted freight networks nationwide. (In the chart below, blue is 2021, purple is 2020, green is 2019, orange is 2018.) “Geographically, there was some volatility on the market level,” Andrew Cox writes for FreightWaves. “Every market west of Colorado saw rejection rates rise this week, while carriers in most Midwestern and Rust Belt regions rejected less freight this week than last.”

“In the coming weeks, rates will continue to rise in the Southeast, South and West, while the Midwest sees rates and tender rejections continuing on their downward trend,” Maze says. “We could be in for an extremely tight May. All these things happening could create a domino effect across all markets, as capacity consistently gets displaced. Many carriers are still rejecting 1 in 4 shipments to take advantage of the spot market or because they just don’t have capacity.”

“Contract rates are quickly ticking up toward spot rates,” Cox adds. “Spot rates will stay elevated if the current environment of high demand and relatively scarce capacity remains. Catalysts, including new truck orders and the ending of social distancing measures, will add capacity, but the questions linger: When and how much? For now, carrier networks remain strained with this level of demand, and I anticipate demand will increase from here when the produce season begins in earnest and more regional economies reopen.”

Transfix advises shippers to continue working with partners who can provide dynamic solutions on their spot needs and ensure they have the right carrier — and rates — for their contract needs.

“March Madness”: California Ports Shattering Records

The ports of Los Angeles and Long Beach smashed more records in March. Port of L.A. Executive Director Gene Seroka called his port’s latest volume figures “March Madness,” as March 2021 traffic marked the busiest March in the port’s 114-year history, its third busiest month on record and its largest monthly increase (113%).

“March also capped an exceptional first calendar quarter of 2021, with overall cargo volumes during the first three months of the year increasing 44% compared to the same period in 2020,” Donna Littlejohn wrote for DailyBreeze.com. “The numbers are all the more remarkable, since March is typically a slow month in shipping, port officials said, paling in comparison to the industry’s peak season in late summer through the end of the year.”

The Port of L.A. is on track to end its fiscal year (June 30) exceeding 10 million TEUs, Seroka said. That would mark the best fiscal year in history for any port in the Western Hemisphere.

Seroka expects it will take about six weeks to clear the backlog of ships waiting at anchor. That number stood at 21 on April 14.

With the uncertainty and volatility surrounding the U.S. economic recovery, shippers need a partner that can help them adapt and excel — no matter the circumstance. Shippers turn to Transfix for our leading technology and reliable carrier network. As volumes drive higher, we are here to help: Learn more about our Core Carrier program and Dynamic Lane Rates. As part of our ongoing market coverage, we’ll continue to provide breaking news, resources and insight into emerging trends and the pandemic’s impact on the transportation industry.