Driving out of Thanksgiving

The Thanksgiving and end-of-November market drove along the trend we predicted last week. Rates continued to rise along with tender volumes, as more spot freight was available. After experiencing a few weeks of easing in much of the country and lower load-to-truck ratios (LTRs), last week brought a rise in LTRs to more than five loads per truck.

During the past few weeks, we’ve been calling out the Pacific Northwest; this week is no exception. This market is only tightening week over week, making it shippers’ top pain point even as they navigate a tough carrier market throughout the rest of the West.

While imports are still at highs, future maritime bookings are starting to trend lower, which could eventually bring some relief in early 2022 — but don’t be surprised if this slowdown doesn’t stick.

This week likely will continue to see tight markets. Freight volumes should remain high, as many shippers were closed for part of last week, and we saw a traditional end-of-month push. We expect tight capacity coming off the end of the month. Additionally, whenever we miss a day or two from a normal workweek, as we did last week, it can bring more stress to supply-chain bottlenecks. Shoppers have begun to discover how much impact bottlenecks have for them, whether their expected gifts are out of stock, or they are shocked by price tags.

Driving Through December and Onward

If nothing changes, we expect the first half of 2022 to bring more truckload and supply-chain normalcy and easing of bottlenecks. However, there are still factors on the demand side that could prevent this. Thanksgiving brought news of a new COVID variant that could be meaningful.

We’re already starting to see changes worldwide. China, the largest manufacturer of U.S. goods, “recently imposed as much as a seven-week mandatory quarantine for returning Chinese seafarers. Even vessels that have refreshed their crew elsewhere have to wait two weeks before they’re allowed to port in China,” Bloomberg reports. “To comply, shipowners and managers have had to reroute ships, delaying shipments and crew changes, adding to the supply-chain crisis.

“‘China’s restrictions cause knock-on effects,’ said Guy Platten, the secretary general of the International Chamber of Shipping, which represents shipowners and operators. ‘Any restrictions to ship operations have an accumulative impact on the supply chain and cause real disruptions.’”

In addition to this, multiple countries, including China, are experiencing an energy crisis that could worsen into the colder months.

There is good news, though. We are happy to see supply hitting the market! Notably, this is more pronounced with smaller fleets. This could lessen the effect on the overall pricing benefit shippers traditionally see, as supply starts to grow faster than demand.

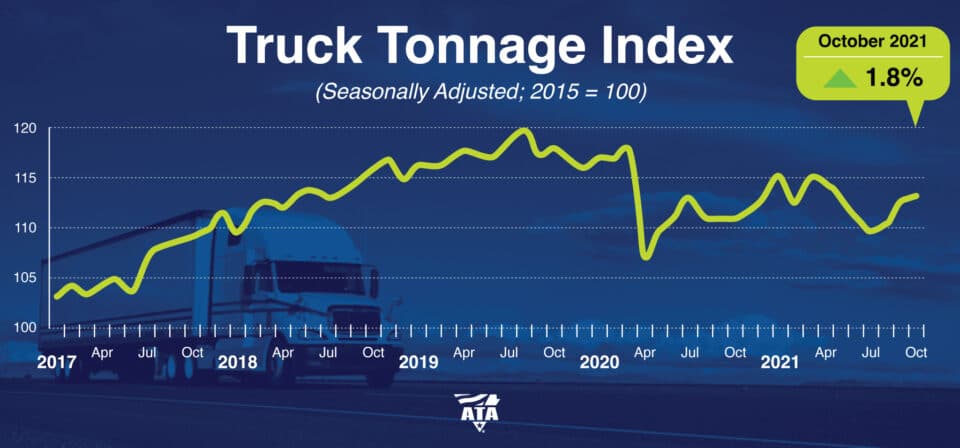

ATA October Freight Tonnage Index Up 1.8% YoY

The American Trucking Association’s (ATA) advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index increased .4% in October to 113 (2015=100).

Compared with October 2020, the index rose 1.8%, which was the largest year-over-year gain since May. In September, the index was up 1.4% from a year earlier. Year-to-date, compared with the same 10 months in 2020, tonnage is up 0.1%.

“The combination of solid retail sales, inventory rebuilding, and generally higher factory output offset some areas of softer freight growth, like home construction, in October,” ATA Chief Economist Bob Costello said.

The movement of freight is changing in every mode, as shippers do their best to keep up with record demand while fighting congestion at multiple points throughout the supply chain. Shippers who think forward, use data and think outside the proverbial box on solutions, while partnering with companies such as Transfix, will come out of this ongoing freight rally in a better position and well ahead of competitors. The one huge win through this pandemic has been speeding up the digital transformation of the transportation industry.

With the uncertainty and volatility surrounding the U.S. economic recovery, shippers need a partner that can help them adapt and excel — no matter the circumstance. Shippers turn to Transfix for our leading technology and reliable carrier network. As volumes drive higher, we are here to help: Learn more about our Core Carrier program and Dynamic Lane Rates. As part of our ongoing market coverage, we’ll continue to provide breaking news, resources and insight into emerging trends and the pandemic’s impact on the transportation industry.

This communication may contain certain forward-looking statements that are not statements of historical facts. All such statements are based on current expectations as well as estimates and assumptions that, although believed to be reasonable, are inherently uncertain. These statements involve numerous risks and uncertainties, and actual results may differ materially from those expressed in any forward-looking statements. We undertake no obligation to update or revise any of the forward-looking statements contained herein, whether as a result of new information, future events, or otherwise.