Transfix Take Podcast | Ep. 54 – Week of June 8

Hauling Through The Heat: A Summer Road Trip

As we turn the corner and drive further into summer, the truckload volumes will likely stay stagnant throughout June. Since the acceptance of contract freight remains consistently high, volume will likely stay flat and carriers whose livelihoods depend on the spot market may find that road challenging to navigate.

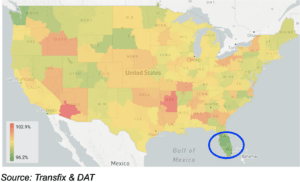

Southeast and Coastal

The Southeast and Coastal region continues to be a carrier favorite as shippers actively balance import volumes with produce season. East Coast ports continue to set import records as shippers increasingly utilize these ports to avoid West Coast bottlenecks and potential labor union strikes.

Produce season volumes are starting to decline in Southern Florida, as spot freight in markets like Miami, FL continue to see weekly decreases. Still, Georgia and the Carolina coastline continue to see capacity tighten and spot rates spike. The Memphis market proves to be a troublemaker for shippers as spot rates favor carriers. Florida experienced its first major storm last week, so in the coming week, we could see conditions that shift pricing power in favor of carriers. After all, in the week or two after major storms, there is less available capacity which in turn pushes rates higher.

Southwest

Markets along the Texas border have cooled over the past ten days. Arkansas and Arizona markets, however, are seeing strong demand leading to capacity tightness and pricing-power for carriers. This volume surge is motivated by a combination of produce and imports from the Gulf.

Northeast

Trucking markets throughout the Northeast remain stagnant with little change, even as New York and New Jersey ports see record volumes and intensifying congestion. Truckload demand won’t shift significantly in the coming weeks, providing a favorable market in the Northeast for shippers.

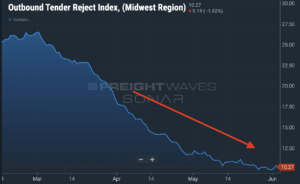

Midwest

Carriers looking for spot volumes are coming up short, as spot rates are dropping. For nearly two years, the midwest saw extremely tight markets, so this has been a big change for carriers, especially if they are newer entrants. In addition, the difficulty navigating out of the Midwest has driven up rates on freight destined to this region. Not much should change in the coming week, but we are starting to see certain pockets tighten.

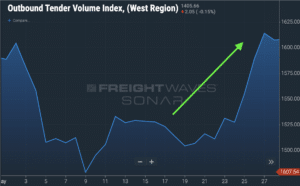

West

As we called out last week, the West Coast saw a jump in volume that was sustained until the end of May. As a result, spot rates slightly increased over the last few weeks, and in the coming weeks, we are likely to see this trend continue or for rates to stay flat.

Is It Time To Call A Recession? It Depends On Who You Ask

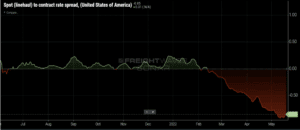

While the overall volume in the market remains strong, it’s the larger – not smaller – carriers that benefit. There is pervasive chatter on whether or not a freight recession is imminent. The data shows strong volumes and rates higher than they were pre-pandemic, but I believe the current conditions are impacting everyone differently, so it all depends on who you ask.

Larger carriers are better suited for the current market – which they’re thoroughly enjoying. With record high contract rates and the ability to run more efficient operations, established carriers can focus on moving more predictable freight instead of searching through the spot market.

For small carriers, who make up 86% of total carriers and 20% of the trucks on the road, the current market condition feels like a freight recession within the spot market. These carriers rely heavily on spot freight to operate, and spot linehaul rates have dropped significantly below that of contracted freight. This compromise in revenue sits on top of rising operating costs. We all know about the increased fuel costs, but over the past two years, carriers have faced other cost increases in equipment, driver pay, and insurance.

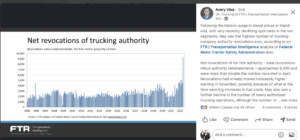

Even with spot rates situated higher than before COVID-19 first reared its head, when you factor in the rise in costs, this argument doesn’t hold weight. We are starting to see what this relentless pressure on small carriers can do to supply. As we look at trucking authorities’ net revocations, we set a new record last month – one that eclipsed the previous record by more than double, which was just set in April.

The Takeaway? Get Comfortable in Current Conditions

There is no crystal ball on how the remainder of the year will affect freight markets, but it’s becoming clear that the current conditions are likely here to stay. Contractual freight will continue to be accepted at high rates, which will lead to lower spot rates. Expect contract rates to also decline in the coming months. However, there are wild cards that could put a different spin on the market.

This past weekend, Tropical Storm Alex reminded us that we are approaching hurricane season. As we all know, major storms can lead to large and rippling effects on supply chains, and this year is predicted to be an above-average season for hurricanes.

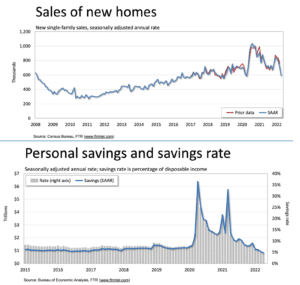

Also, it’s important to keep an eye on economic trends and consumer spending at large, as various economic sectors can drive volume into the freight markets. Recently, for example, new home sales dropped 17% in April, and the personal savings rate fell to the lowest level in nearly 14 years.

The movement of freight is changing in every mode, as shippers do their best to keep up with record demand while fighting congestion at multiple points throughout the supply chain. Shippers who think forward, use data and think outside the proverbial box on solutions, while partnering with companies such as Transfix, will come out of this ongoing freight rally in a better position and well ahead of competitors. The one huge win through this pandemic has been speeding up the digital transformation of the transportation industry.

With the uncertainty and volatility surrounding the U.S. economic recovery, shippers need a partner that can help them adapt and excel — no matter the circumstance. Shippers turn to Transfix for our leading technology and reliable carrier network. As volumes drive higher, we are here to help: Learn more about our Core Carrier program and Dynamic Lane Rates. As part of our ongoing market coverage, we’ll continue to provide breaking news, resources and insight into emerging trends and the pandemic’s impact on the transportation industry.

Disclaimer: All views and opinions expressed in this blogpost are those of the author and do not necessarily reflect the views or positions of Transfix, Inc. or any parent companies or affiliates or the companies with which the participants are affiliated, and may have been previously disseminated by them. The views and opinions expressed in this blogpost are based upon information considered reliable, but neither Transfix, Inc. nor its affiliates, nor the companies with which such participants are affiliated, warrant its completeness or accuracy, and it should not be relied upon as such. In addition, the blogpost may contain forward-looking statements that are not statements of historical fact. All such statements are based on current expectations, as well as estimates and assumptions, that although believed to be reasonable, are inherently uncertain, and actual results may differ from those expressed or implied. All views, opinions, and statements are subject to change, but there is no obligation to update or revise these statements whether as a result of new information, future events, or otherwise.