The midweek market update is a recurring series that keeps shippers and carriers informed with market trends, data, analyses, and insights.

Transfix Take Podcast |2023 Kicks Off with Declining Diesel Rates & Tight Midwest Market

Transfix Take Show Notes

Jenni: Hello and welcome to an all new episode of the Transfix Take podcast, where we are performance driven. Each week, we deliver news, insights and trends for shippers and carriers from our market expert Justin Maze. Maze, it is the first episode of the year. Happy New Year!

Happy 2023! What’s going on?

Maze: Hey, Jenni, it’s great to be back with you as well this year as we kick off 2023. I hope you had an amazing holiday and new year.

Jenni: Absolutely. Now, I know we have a lot to talk about and I’m excited to get into everything trucking, but Maze, I left you high and dry at the end of the year. I feel like there’s something that you’ve got to talk about.

Maze: Oh, Jenni, I was hoping for quite an easy last two weeks at the office as we closed out 2022 and started really thinking about how we were going to continue to navigate through 2023. But I was thrown a wrench as markets became very unpredictable and turned heavily into carriers’ favor for a short time.

Jenni: Well, something tells me it has a little bit to do with the winter weather that we weren’t really expecting that hit the East Coast. Is that right, Maze?

Maze: That’s right, Jenni. The wrench for my plans came from a pretty historic winter weather event that disrupted the entire nation– that bomb winter event that we witnessed right after the Christmas week. Normally, capacity is tight going into the holidays, but this year it was significantly tighter than most expected given how soft the market was leading up to the holiday week.

Jenni: And so here was one of the black swan events that we absolutely did not see coming, but affected the spot market significantly.

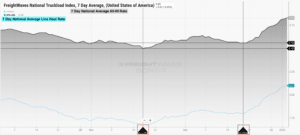

Maze: Jenni, we witnessed spot rates increase by over 10%. And looking at line hauls, we saw line hauls jump 17% due to fuel prices continuing to decline. This is pretty crazy to see these differences from December 15 to January 1. Now, this definitely puts a damper on it for shippers, but this will most likely be reversed come this week.

Source: FreightWaves

Jenni: And I think we’re starting to head back into that cycle of the trucking industry becoming more of an ebb and flow as opposed to flowing solely on the shipper side, which we experienced largely in 2022. But Maze, what area was hit the hardest?

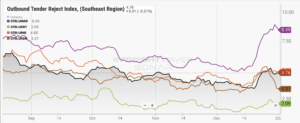

Maze: The Midwest definitely got hit the hardest. I mean, come on. The weather was well below freezing, and most states in the Midwest saw temperatures dip below -10. So not only did the winter weather have an impact in the Midwest, it also had an impact in just about every large market, including Dallas and Atlanta. But the Midwest definitely saw the largest impact, with tender rejections going as high as 9%. Although they have come back down slightly to 8%. The rest of the nation saw a national average of 5% with tender rejections this past week.

Source: FreightWaves

Jenni: And based on your observations, Maze, I’d love to hear: where do you think there is going to be the biggest change that we see relative to either carriers or shippers? But I think I heard you say it a little bit before when you were talking about fuel. Is that what we’re getting into?

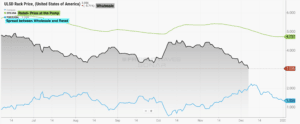

Maze: We’ve continued to see now consistently for seven weeks that diesel rate decline, and we are starting to see, for the benefit of smaller carriers, wholesale and retail fuel prices close that gap that we were talking about previously, which benefited larger carriers.

Source: FreightWaves

Jenni: So we’ll definitely continue to keep an eye on that. And particularly good news because carriers have been struggling with this for the last three years, it seems, since the pandemic in 2020. And now that I’ve got you, what are some market indicators or shifts that you’re looking at that we should be paying close attention to?

Maze: Well, Jenni, barring any large, significant winter weather in the coming weeks, we should really expect rates and rejections to continue a decline after this week. The Midwest market will most likely be the most stubborn and difficult to bring down rates as fast as the Southeast and South, but I don’t doubt that we will continue to see rates decline in the coming weeks as we drive through Q1. The question will jump back to where we left ’22 with, and that’s how low will rates go? And to be honest, Jenni, demand is just not popping its head back up as the volume of imported TEUs continue to see a downward trend coming into 2023. And we are approaching the Chinese New Year, when we traditionally see a slump of imports to begin with.

Jenni: This has largely become the most popular question here at Transfix, and I’m imagining for all of our listeners: when will rates bottom out? So, Maze, I’ve got to ask, what are some key indicators that you think we should be following to know when they will?

Maze: That’s a great question, Jenni. Some of the core things I would definitely keep an eye on in the coming months to gauge where this market may bottom out or start turning upward is A) Where the large carriers can build up their capacity – signaling that smaller carriers are just deciding to sit out or park their trucks and run under these larger carriers. B) Contract rates, and if the contract rates continue to decline, closing the gap between spot and contract. And lastly, produce season – I don’t believe produce season will have much of an impact in overall capacity or rates, but it is always a possibility to turn the tables for carriers.

Jenni: I don’t know, Maze, based on how New Year’s Eve, Christmas, and all the other holidays that we celebrate around December came about, it looks like things are heading back to normal. And I can easily see there being an influx of summer parties for produce season. So we’ve got to keep an eye on it. Now, any other key indicators before we wrap up for 2023? I know you’ve got them.

Maze: I would say that there are some policies that will continue to receive attention through this year that we’re going to keep an eye on from above, and those policies range from parking and restroom access for drivers to speed limiters and possibly adjusting the truck size and weight restrictions across the country.

Jenni: If that happens, that is going to be a significant change in the market. What else have we got?

Maze: And of course the laws around autonomous trucks, because in the past two to three years this has become a large interest for many people in and outside the industry.

Jenni: Well, as to be expected, 2023 is going to be nothing short of an exciting year.

Maze: As always Jenni, it was great to kick off 2023 with you and I look forward to next week when we check under the hood of contract rates to see if there’s any telling changes coming to the freight markets.

Jenni: What are your big bets, Maze?

Maze: If I was a betting man, I would definitely put my money on the fact that rates are going to continue to decline, tender acceptance will rise back up to all-time highs, and we most likely won’t see a significant market shift until either late second quarter or early third quarter. Right around the back-to-school peak season.

Jenni: Well, I guess we’ll just have to wait and see.

Maze: Have a great week Jenni.

Jenni: You as well my dear friend, and we’ll see you next week with an all new episode of the Transfix Take podcast. Until then, as always, drive safely.

DISCLAIMER: All views and opinions expressed in this podcast are those of the speakers and do not necessarily reflect the views or positions of Transfix, Inc. or any parent companies or affiliates, or the companies with which the participants are affiliated and may have been previously disseminated by them. The views and opinions expressed in this podcast are based upon information considered reliable, but neither Transfix, Inc. nor its affiliates, nor the companies with which the participants are affiliated warrant its completeness or accuracy and it should not be relied upon. As such, all views and opinions are subject to change.