The midweek market update is a recurring series that keeps shippers and carriers informed with market trends, data, analyses, and insights.

Transfix Take Podcast | A Surprising Coastal Shift Ahead of 3-Day Weekend

Jenni: Hello and welcome to an all-new episode of the Transfix Take podcast where we are performance-driven.

It's the week of May 24, and we are bringing you news, insights, and trends for shippers and carriers from our market expert Justin Maze.

Maze, last week was a doozy. How are you doing?

Maze: Hey, Jenni, great to be back with you again this week as well, especially after last week, which was definitely a tough week, brought on by more than anticipated disruption due to the DOT Blitz week.

Jenni: Oh, yeah, and we are definitely going over the impact on that. But you know what? There's another big event coming up.

Maze: Exactly, Jenni. We're not completely out of the weeds just yet. We also have the Memorial Day weekend coming up, which also creates some capacity issues combined with the end of the month as we continue to roll out of May and head into June.

Jenni: And with June comes hotter weather. But are the trucking markets starting to heat up? Maze, I know you've got the scoop.

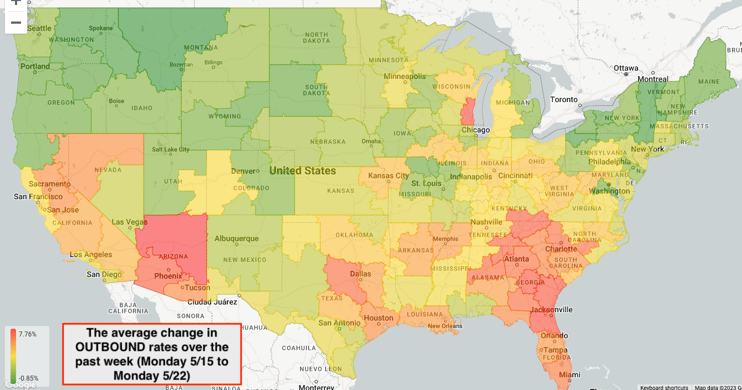

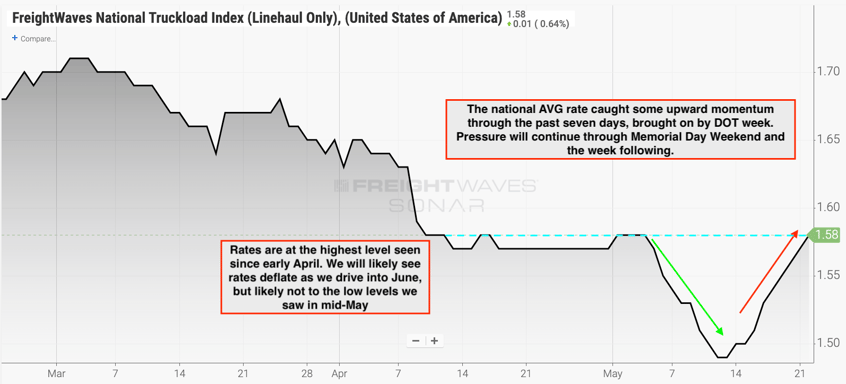

Maze: That's right, Jenni. The weather in Atlanta last week wasn't the only thing hot. The freight markets were certainly hot last week for the first time in quite a while for carriers. In fact, we saw costs shift higher than I would have originally anticipated at a national level, right around 6%.

Jenni: And do you think that'll continue through this week or what do you think we'll see?

Maze: We're continuing to see pressure, Jenni, with costs still remaining higher than where we were heading into DOT week. And this pressure will continue throughout the week, although will pick up toward the end as we head into the Memorial Day weekend. And Jenni, as you know, going into next week, we're going to continue to see pressure as that freight has a hangover going into the end of the month.

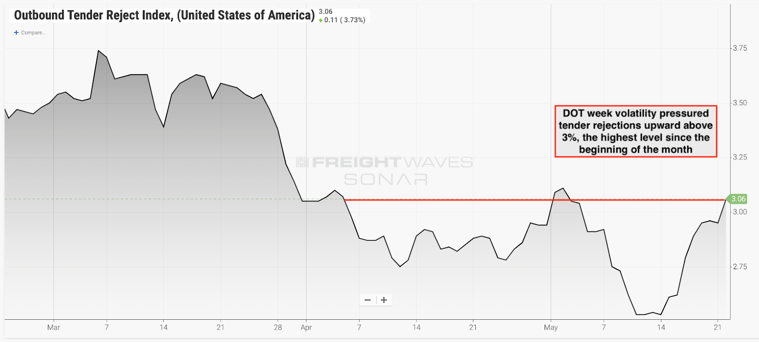

Jenni: That's right, a big advantage for carriers as we drive through the rest of the month. Now, in my experience, when rates go up, so do tender rejections. Do we see the same thing happen here as we saw a shift in the balance of power?

Source: Transfix

Maze: That's right, Jenni. It wasn't just rates we saw increase. As we commonly point out, rates generally shift in the same pattern as tender rejections. Now, tender rejections have not been seen to go above 3% since the beginning of May, but this week we have already seen tender rejections creep above that 3% mark.

Source: FreightWaves

Jenni: And so where are we sitting at right now with tender rejections, Maze?

Maze: Well, Jenni, right now we are just around the same levels where we entered May on rates and tender rejections. So we lost all that downward momentum we saw throughout May. In fact, Jenni, rates and tender rejections right now are at levels that are higher than we saw most of April. So we are in a more favorable market for carriers, if they would let me say that, which I don't think they would, because it's still not a super favorable market for them. And it's not going to be long-lived Jenni. We are, like I said, going to see continued pressure for the next week and a half. But going into June, everyone in this industry knows rates generally trend downward unless you are in specific seasonal markets that are heavy with produce.

Source: FreightWaves

Jenni: And we'll get to that in a second. But, first, why don't we get right into it? Let's go with the regional breakdown. Where do you want to start off first?

Maze: Let's start off in the Northeast. Again, we saw pressure on tender rejections throughout the entire country, upwards to right around 5% on that national level. But this pressure was caused by outside factors like DOT week. And we're going to continue to see these pressures. We are seeing more pressure in the larger markets like Harrisburg, Pennsylvania and Elizabeth, New Jersey. We saw rates on average raise only about a percent and a quarter outbound from the Northeast. Now, this was heavily seen on shorter lengths of haul like city and local and short hauls. Other than that, Jenni, the Northeast is certainly going to turn right back around. It's really that freight heading into the Midwest, which continues to be a problem.

Jenni: Well, now that we're here, why don't we get right into it? What is happening in the Midwest?

Maze: Last week, of course, we also saw an average increase in rates on freight leaving the Midwest. This was again heavily seen on freight remaining in the Midwest, on city and local, and short hauls. Freight heading out to the West Coast down to the Southeast continued to see decreases as those are extremely favorable markets for carriers.

Jenni: And I don't think that'll change anytime soon. What's going down in the Coastal region?

Maze: This region actually caught me by surprise. We saw a pretty significant increase in rates throughout the Coastal region. On average, about three and a half percent rate increase. Now, again, it's driven by DOT week, but looking a little deeper into it, we saw some of the larger markets like Charlotte and Columbia, see just about 5% increases. I don't think we're going to see these rates go down enough in the next two weeks to go back to where we were before DOT week.

Jenni: Not a development that I was expecting, but why don't we talk about what's going on in the Southeast region?

Maze: Now, the Southeast saw an average rate increase of 5% last week. This is on every length of haul. And contrary to what we saw in the Midwest and Northeast, longer lengths of haul, especially in that mid-haul to the long-haul range, saw greater increases. In fact, Jenni, long hauls out of the Southeast saw an increase of almost 9%. Now, a lot of this freight is most likely going up to the Northeast and Midwest, which explains why. You're taking carriers out of the best market and putting them in the worst markets. It's also important to call out. Yes, the entire state of Florida is hot, not just weather-wise, but the freight markets. But so is Georgia, and Georgia is continuing to heat up. In fact, the Atlanta, Georgia market, which is the highest volume market on the East Coast right now, saw rates trend more than 6% upwards in the last seven days.

Jenni: Which is no surprise there as we know that Georgia is one of the largest market drivers of produce season. But why don't we shift gears over to the West Coast?

Maze: It's not a different story. We still saw the average rate increase, but only about 2.5%. I would have actually anticipated higher increases out of the West Coast, but then again, we are including a lot of lanes out of the Pacific Northwest where rates are decreasing. Now, particularly out of the larger volume markets like Southern California - Ontario market in particular saw increases of just about 5%, along with other larger markets that are being really impacted the last couple of weeks, such as San Diego, Los Angeles, and Phoenix. Now I think it's important to call out here the West Coast is going to continue to be hot, all because we're out of DOT week - doesn't mean rates are just going to start trending downward. Freight is picking up out there. Signs of produce, yes, but also some signs of imports. And overall, rates are moving upward if it's leaving the West Coast. So carriers are starting to really identify that, and that's why you see other regions on the East Coast find rates decreasing if it's destined to the West Coast.

Jenni: Further testament to the fact that the West Coast is a hot market now for carriers. Why don't we close out with the Southern region?

Maze: The South will turn back to the trends we saw prior to DOT week, in my opinion. We're going to continue to see slim declines, but with pockets of tightness, especially in some of the border markets in the coming weeks. Now it's important to call out here as well that we saw the largest increases in those local-to-city hauls. Other than that, I really do believe freight heading out of the South will start seeing a downward trend in the next couple of weeks.

Jenni: So we'll definitely keep an eye on those states. And in the meantime, Maze, why don't we get into the impact of DOT week going into this week when it comes to capacity?

Maze: That's right, Jenni. Last week, capacity was definitely more volatile than I thought it was going to be originally, especially when you compare it to last year. Last year, yes, we saw rates increase by around 5%, but capacity was not an issue. This year, that was a different story. Capacity definitely showed signs of volatility, especially in markets that have continued to trend upwards on the West Coast and Southeast. And that's probably why we didn't see it so much last year, because those seasonality trends weren't so much in play. Hopefully, it's not like it was last year because we actually saw rates at a national level increase greater through the Memorial Day weekend. I don't think we're going to see that yet again this year. But Jenni, I was wrong last week where I did not think we're going to see such a big shift in capacity.

Jenni: Well, given the state of the market this year and its lack of predictability, we will give you one pass for being wrong. Always want to be transparent when we are. That said, Maze, I feel like the overall thesis of this week is a little bit of relief.

Maze: That's right, Jenni. Even though we're only a day into this week, we've already started seeing relief for rates and capacity for the most part. There's definitely still some tightness in the Southeast and West Coast, but again, nothing like last week. I do think this is going to change as the week goes on. Rates are still going to have pressure throughout the week. We're not going to see them drop back to where they were pre-DOT week. And especially towards the end of this week, we're going to see that pressure really hit the board starting Thursday afternoon.

Jenni: Which will eventually lead us into Memorial Day weekend. So a couple of things about Memorial Day weekend ahead. It not only brings tightness and volatility to the market, but without planning ahead, it can create disruptions to deliveries and end up being more costly to hold the freight and end up driving up rates, which we'll see probably sometime in the beginning of June or the middle of June. And we're likely to have what's called a "holiday hangover" where there's an increase of freight being pushed out in a smaller time frame than usual over a week due to those shippers trying to work around facility closures. Now, Maze, do you think that we're going to see anything different? Any big callouts for the weekend ahead or the long weekend ahead, I should say?

Maze: I don't think we're going to see too much change, but I do believe that we're going to see at a national level, rates and tender rejections trend back downward. But there may be some carriers out there that are a little more optimistic than me because of different signals that they see. Volumes are still remaining stronger in the last 30 days than we saw the rest of 2023. Additionally, we just saw a seven-month high in import bookings. Now, this is freight that hasn’t yet hit our shores but will soon. And the question is, where is this headed? Is it headed to the West Coast? Is it going to keep pressure on rates out there, and will that have a domino effect in other markets? Now, I'm not trying to get ahead of myself because I don't think we're going to see too much of a shift. And I think it's going to be quite a few more months, if not quarters, before we see some meaningful shift in rates in the carrier's favor, but there is some optimism out there for carriers as some signals they could say are moving in their direction.

Jenni: We will find out in no time. With that, we will see you next week with an all-new episode of the Transfix Take Podcast, and until then, have a great long weekend and drive safely.

DISCLAIMER: All views and opinions expressed in this podcast are those of the speakers and do not necessarily reflect the views or positions of Transfix, Inc. Or any parent companies or affiliates or the companies with which the participants are affiliated and may have been previously disseminated by them. The views and opinions expressed in this podcast are based upon information considered reliable, but neither Transfix, Inc. Nor its affiliates, nor the companies with which the participants are affiliated warrant its completeness or accuracy and it should not be relied upon as such. All views and opinions are subject to change.