Fuel Hurting the Small Carriers’ Bottom Line

Welcome to the week of August 16th edition of the Transfix Take! Gear up for the latest updates and trends in the trucking industry. In this issue, we're revving up with industry news, sprinting through regional breakdown highlights, and putting the spotlight on what's on the horizon for truckers.

Industry Insights: Unpacking the Road Ahead

Fuel Volatility and Market Shifts

Fuel costs continue to play a key role in shaping the trucking industry's landscape. Each of the last few weeks has seen a 14-cent increase in the average price per gallon of diesel fuel week over week – a four-week increase totaling fifty-seven cents. As fuel costs increase, small and midsized carriers' operating margins are being squeezed, potentially impacting their business viability. The ongoing fuel volatility underscores the need for accurate fuel cost considerations to maintain profitability.

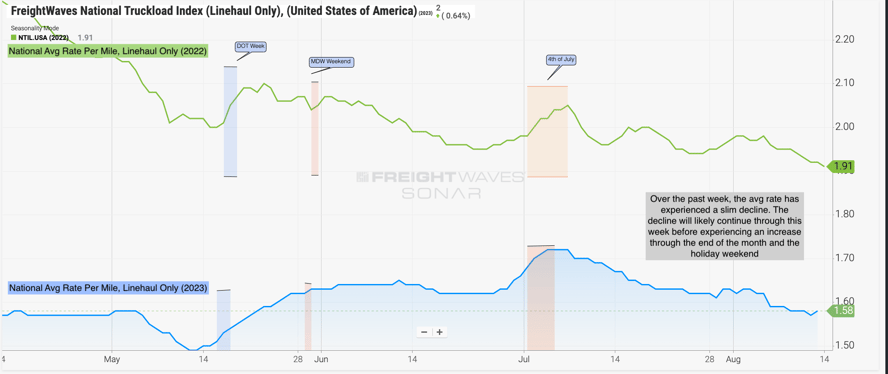

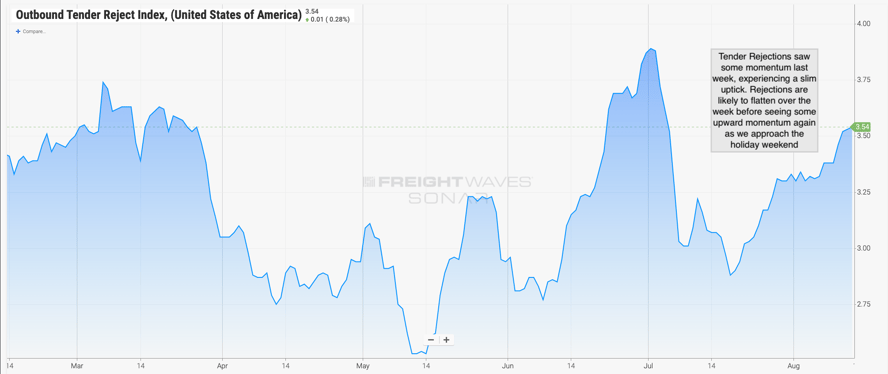

Tender Rejections and Rate Dynamics

Tender rejections are a key indicator of market health, and their recent movements are shedding light on the road ahead. While tender rejections continue to sit around 3.5% and have been gradually increasing, rates have experienced a decline with the national average currently at $1.58 per mile. While tender rejections may see a temporary fall or stagnation in the near term, they are likely to rise again as we approach the Labor Day weekend. Yet, with capacity continuing to remain strong, we may not see the usual increase in spot market rates typically seen around this time.

Regional Roadmap: Where the Rubber Meets the Road

Source: FreightWaves

Source: FreightWaves

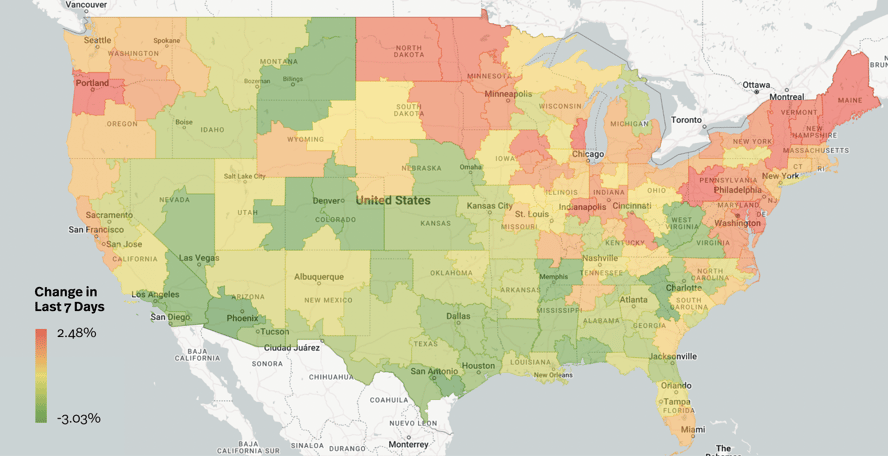

Northeast and Midwest

As we navigate the second half of August, the freight landscape in the Northeast and Midwest is undergoing a familiar shift. Capacity is tightening, and average rates for originating freight are on the rise, aligning with the seasonal trend. This trend is expected to continue as we move into the fall and winter months.

South and Southeast

On the flip side, the South and Southeast regions are witnessing a decline in rates. However, this decline seems to be moderating, suggesting that the upcoming holiday week could prevent further significant decreases. The Southeast is already showing signs of this decline slowing down, hinting at a potentially flat market in the near future.

West Coast

The West Coast remains a volatile market, with both increases and decreases in rates. The larger markets in Southern California, which had been experiencing rate increases, have now shifted to decreases. Meanwhile, northern markets like Stockton and Fresno are following the Pacific Northwest's pattern of capacity-related rate increases. As we progress into the produce season for this region, rates are expected to continue their upward trajectory.

Source: Transfix Internal Data

On the Horizon: What Lies Ahead in the Trucking Terrain

As we approach the holiday season, the trucking industry is poised for a critical period, particularly for smaller carriers and owner-operators. The interplay of factors such as consumer spending, student loan payments, and broader macroeconomic conditions will determine the market's direction. Seasonal trends are evident across regions, with rates showing both increases and decreases. The post-Labor Day period, historically busier due to holiday spending, could provide further insight into market dynamics.

That's the wrap for this edition of the Transfix Take Newsletter. We'll continue to keep you in the driver's seat with the latest news, trends, and insights in the supply chain. Until the next pit stop, drive safe and stay ahead of the curve!

Drive safely!

DISCLAIMER: All views and opinions expressed in this podcast are those of the speakers and do not necessarily reflect the views or positions of Transfix, Inc., or any parent companies or affiliates or the companies with which the participants are affiliated and may have been previously disseminated by them. The views and opinions expressed in this podcast are based upon information considered reliable but neither Transfix Inc. nor its affiliates nor the companies with which the participants are affiliated warrant its completeness or accuracy, and it should not be relied upon. As such, all views and opinions are subject to change.