Could a New Strike Mean Challenges Down the Road?

Welcome to the week of September 20th edition of the Transfix Take! Gear up for the latest updates and trends in the trucking industry. In this issue, we're revving up with industry news, sprinting through regional breakdown highlights, and putting the spotlight on what's on the horizon for truckers.

Industry Insights: Unpacking the Road Ahead

While this week, at a macro level seems stagnant, there is a lot to talk about when it comes to what’s going on in the market. We delved into the current dynamics of the trucking industry, revealing essential takeaways:

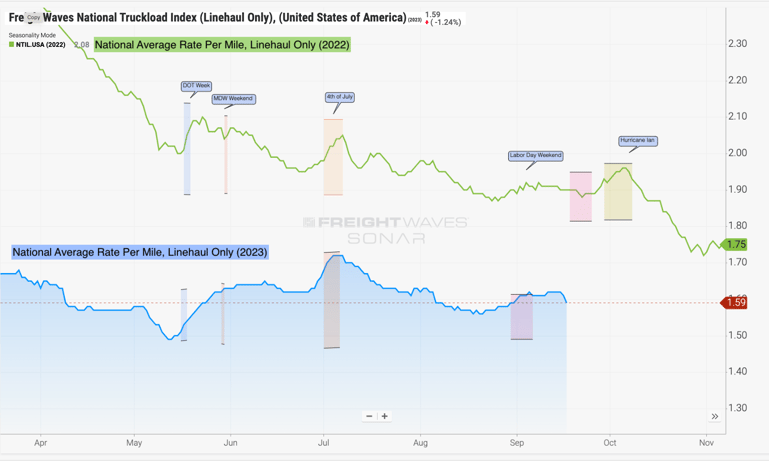

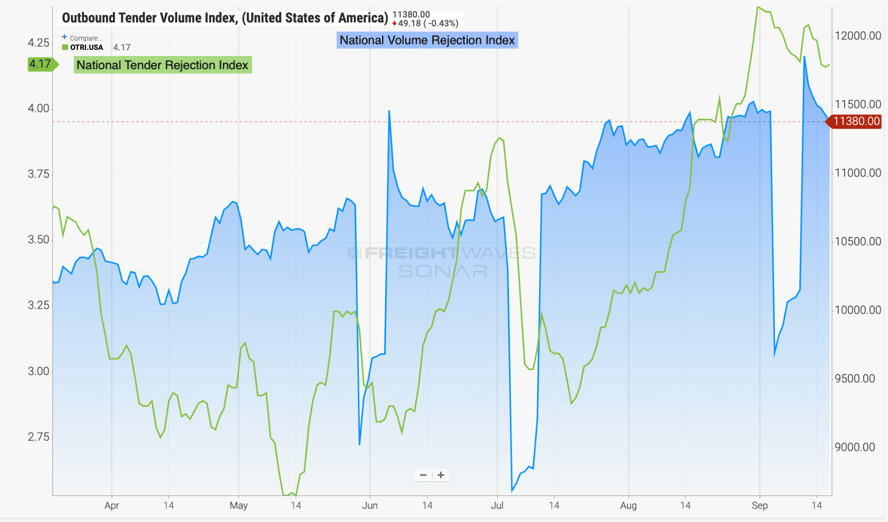

Market Softening: We highlighted a slight drop in the national average line haul rate coming in at just under $1.60/per mile, largely driven by lower volumes post-holiday weekend. Despite this, the industry still maintains above 4% tender rejections. This is being driven by tender rejections on the reefer side, which is still around 9%. On the dry van side, we're below 4%, right around 3.74%.

Source: Freightwaves

Source: Freightwaves

Auto Workers Union Strike: The ongoing strike by the Auto Workers Union is a potential source of volatility, particularly in the Midwest should drivers and carriers decide to go off the road in solidarity. This union is demanding, among other things, a four-day workweek with no pay cuts, a 36% pay raise, and increased job security, making it one of the most significant strikes in recent history.

Capacity Availability: While some market segments experienced softening, overall capacity remains ample due to low demand in the economy. Supply chains continue to absorb challenges efficiently, maintaining industry stability.

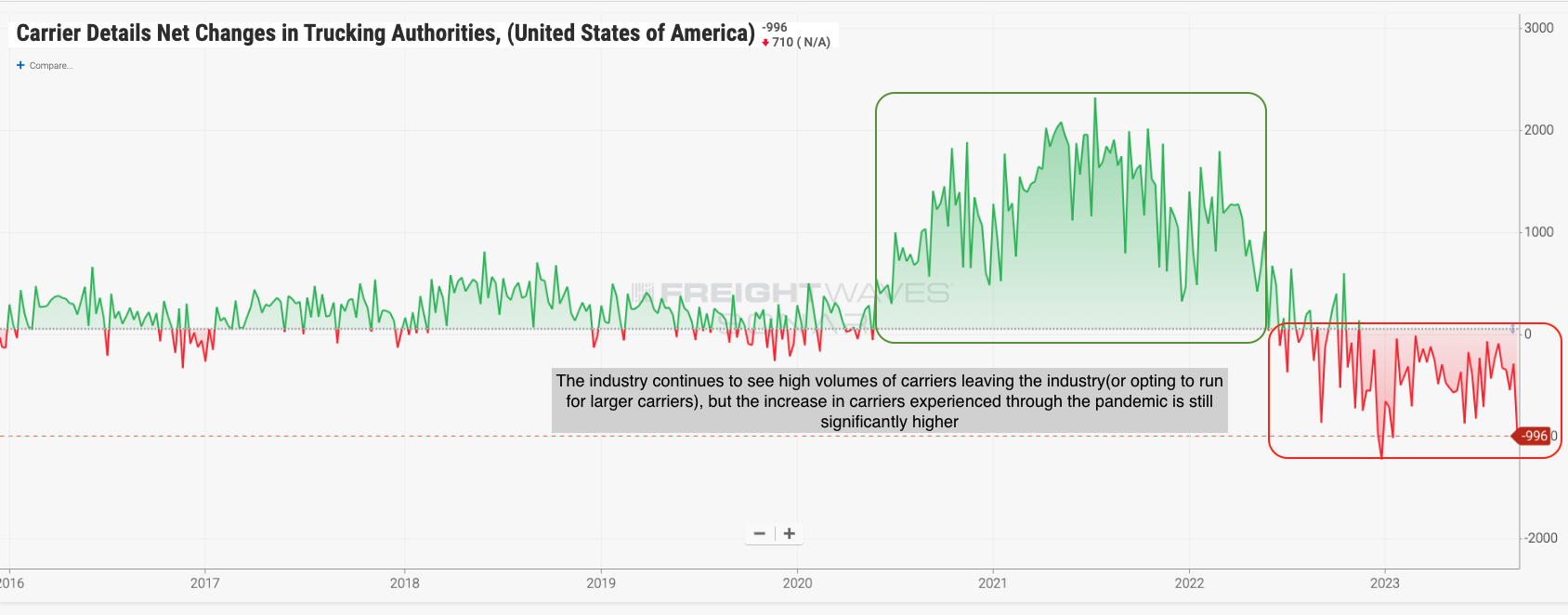

Carrier Population: Carriers continue to exit the market, but there are still more carriers than pre-pandemic levels in 2019. However, the industry faces a gradual reduction in capacity over time.

Source: Freightwaves

Regional Roadmap: Where the Rubber Meets the Road

Discover the latest trends in key regions as we explore the dynamics across the nation:

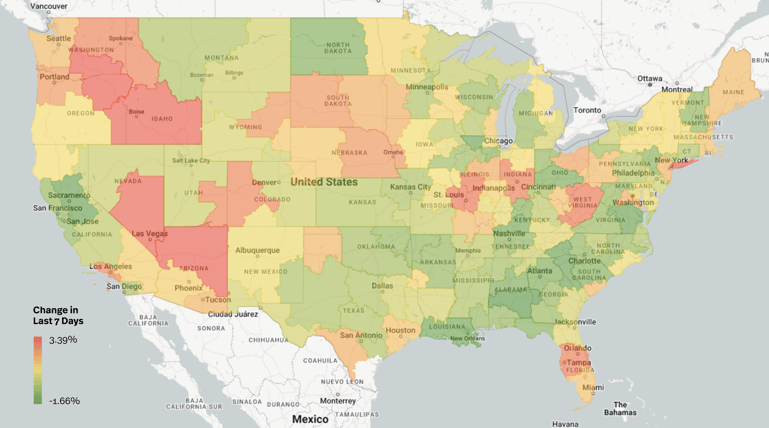

Source: Transfix Internal Data

Midwest: Despite the Auto Workers Union strike potentially causing volatility, most markets in the Midwest remain steady. Over the last 30 days, some markets are seeing slim rate increases, while others are experiencing mild declines. Favorable carrier rates can be found when heading back to the West Coast or down to the Southeast.

The Northeast: Rates in the Northeast are on the rise, with strong demand leading to tightening capacity. Rates are anticipated to continue increasing through the beginning of October, particularly in city and local runs.

West Coast: The West Coast, primarily driven by seasonal trends in the Pacific Northwest, is experiencing rate increases across various markets. Even markets like Southern California, Las Vegas, and Phoenix show consistent rate upticks. City and local runs contribute to this trend.

The South: Markets in the Southern region are exhibiting mixed rate changes, with some markets increasing while others decline. Texas markets like Laredo and Houston showed mild rate increases, but rates may vary based on destination.

The Southeast: Except for Florida, rates are generally declining across Southeastern markets. The state of Florida experienced slight rate fluctuations, likely due to recent hurricane-related volatility.

Coastal Region: Shippers in coastal areas have the opportunity to negotiate favorable rates as rates have decreased recently, and volume remains low. Carriers may want to consider heading to the Northeast for more lucrative opportunities nearby.

On the Horizon: What Lies Ahead in the Trucking Terrain

As we look ahead, two crucial factors will shape the trucking industry:

Holiday Season: Despite initial expectations of a capacity crunch during the holiday season, Maze suggests that demand remains low, likely continuing into Q2 or Q3 of 2024. However, if demand surges in the coming months, it could change the market landscape positively for carriers.

2024 Outlook: While the industry continues to experience gradual capacity reduction, Maze does not anticipate a significant shift in the market dynamics for the remainder of 2023. Carriers may have to wait well into the new year for further clarity to gauge when market conditions may favor them.

That's the wrap for this edition of the Transfix Take Newsletter. We'll continue to keep you in the driver's seat with the latest news, trends, and insights in the supply chain. Until the next pit stop, drive safe and stay ahead of the curve!

Drive safely!

Disclaimer:

The views and opinions expressed in this newsletter are based upon information considered reliable, but Transfix, Inc. does not warrant its completeness or accuracy, and it should not be relied upon. All views and opinions are subject to change and should not be interpreted as specific advice of any nature. Any reproduction or distribution of the content of this newsletter is prohibited without the explicit written consent of Transfix, Inc.