Transfix Take Podcast | Ep. 49 – Week of May 5

The Rate Decline Is Slowing: What’s Causing It?

Over the past seven days, carriers have experienced relief in some markets as rates held flat. The South, Southeast, and even parts of the West Coast have seen rates nudge higher than the previous week, including the likes of Atlanta, GA, Ontario, CA, Miami, FL, and Lakeland, FL.

However, the remaining markets in the country are seeing a slowing decline of rates, which suggests we’re closing in on the bottom. In the Midwest and Northeast, shippers remain in the driver’s seat regarding pricing power. Still, surprisingly, one of the largest truckload markets, Harrisburg, PA, caught a very slight increase in rates week-over-week.

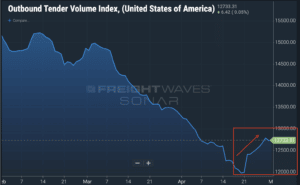

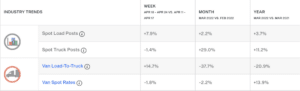

A recent increase in spot volume is most likely the culprit for the market shifting, leading to spot rates declining at a slower pace than previous weeks.

DAT’s load-to-truck ratios from last week also revealed a shift – a reverse in spot load postings and spot truck postings – increasing the overall load-to-truck ratios for the first time since mid-February.

Don’t Sweat It, Shippers

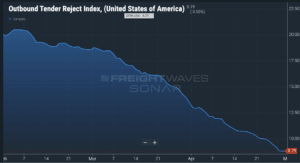

Tender rejections continue to decline, which is good news for shippers. Right now, only 8% of contracted loads are getting rejected by carriers for higher spot market rates. Traditionally, the trend is opposite, where spot volumes and tender rejections move in the same direction. Still, with such a sharp decline in the past two months, a slight uptick in spot volumes does not have enough power to stop the deterioration of rejections yet.

Next week, we’ll do a deeper dive into what’s happening with contract rates, as shippers are pushing against and renegotiating current contracts in light of spot rates’ significant drop over the past 45 days. We’ll discuss what implications are in place for shippers who are reacting too fast to force renegotiations, as well as how it affects carriers of all sizes.

International Road Check Week Is Back: What to Expect

I believe the market is seeing a plateau as we head into busier months. However, the spot market will likely heat up in the next few weeks, especially as we drive through the “International Road Check” week, which takes place May 17-19th. This 72-hour period of a road-check blitz often pulls carriers off the road for the week to prevent citations or fines.

Prior to COVID-19, road check week would tighten capacity and cause spot volume and rates to jump. We’ll keep a close and curious watch on what happens this year, as carriers may attempt to leverage this week-long opportunity to increase spot rates. In the past two years, road check week simply didn’t happen or its effect was less apparent as the market was already battling rate hikes and volatility.

Year after year, May and June have traditionally experienced increases in volumes from Q1. As we observed in the past two years, “traditional” is beginning to look unfamiliar. That said, I believe we are approaching a flat point in spot rates, as volumes are increasing going further into Q2. However, all of this could be reversed due to the lockdowns occurring in China.

How Will Chinese Lockdowns Affect Truckload Volumes?

If I were a betting man, I’d put money on the hypothesis that in the coming months, import congestion will be back in primetime news – that is, if COVID-19 lockdowns continue to spread throughout China.

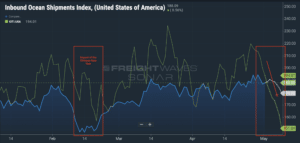

China’s container volumes make up 16% of U.S. truckload volumes, and an even more significant portion of dry van freight moved within the country. It’s abundantly clear that what happens further up the supply chain in China directly impacts the U.S., as we witnessed throughout the pandemic. The current lockdowns in China will likely create more bottlenecks than most are currently noticing.

As some of China’s largest cities and ports have been under lockdown for several weeks, the output of exports from China has continued to slow. Imports into the U.S. will likely see a dramatic slowdown.

Even as major ports are not at a standstill, supply chains face multiple issues, from labor shortages at factories to drivers struggling to navigate routes and factories experiencing shortages of inventory and supplies.

Below you can see the expected drop and slowdown of imports to the U.S. in the coming weeks. This alone could impact freight markets beyond May. Not only will volumes likely decrease, but looking further into the future, we can predict the rapid increase in volumes after China opens up, leading to bottlenecks and a flip in the U.S. market.

All supply chain professionals should closely monitor this scenario as we unravel its delayed effects in the U.S.

With the uncertainty and volatility surrounding the U.S. economic recovery, shippers need a partner that can help them adapt and excel — no matter the circumstance. Shippers turn to Transfix for our leading technology and reliable carrier network. As volumes drive higher, we are here to help: Learn more about our Core Carrier program and Dynamic Lane Rates. As part of our ongoing market coverage, we’ll continue to provide breaking news, resources and insight into emerging trends and the pandemic’s impact on the transportation industry.

Disclaimer: All views and opinions expressed in this blogpost are those of the author and do not necessarily reflect the views or positions of Transfix, Inc. or any parent companies or affiliates or the companies with which the participants are affiliated, and may have been previously disseminated by them. The views and opinions expressed in this blogpost are based upon information considered reliable, but neither Transfix, Inc. nor its affiliates, nor the companies with which such participants are affiliated, warrant its completeness or accuracy, and it should not be relied upon as such. In addition, the blogpost may contain forward-looking statements that are not statements of historical fact. All such statements are based on current expectations, as well as estimates and assumptions, that although believed to be reasonable, are inherently uncertain, and actual results may differ from those expressed or implied. All views, opinions, and statements are subject to change, but there is no obligation to update or revise these statements whether as a result of new information, future events, or otherwise.