Transfix Take Podcast | Ep. 64 – Week of August 24

Loose Markets, Inventory Right-Sizing, and the “Length of Haul” Equation

After nearly two years of the truckload market being in “overload” mode, we’re seeing some change. In the two weeks since our last update, we’ve taken the market’s pulse and found that its heartbeat continues to stagnate or slow. Everyone’s top-of-mind questions are still “How much further can truckload rates fall,” and “where will demand be in Q4, given that it’s traditionally peak season for the shipping industry?”

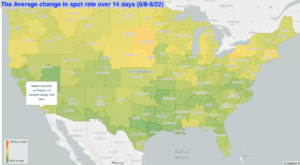

The country’s markets continue to cool as carriers accept nearly all of the contract volume that gets sent their way. As for the spot market: as we roll through the final weeks of summer, reduced demand is driving rates on a downward path. Generally, due to seasonal trends like back-to-school shopping, one would expect to find tight capacity in the Northeast and Midwest markets– but, because of a loose national trucking market, there are currently no meaningful markets that stand out in terms of volume.

Source: Transfix

Carriers may get lucky in remote markets with low volume, leading to spot market opportunities. But carriers should know that these markets are also traditionally risky and volatile since they have less consistent freight moving in and out of them. Most markets are seeing little to no change. Looking back at the previous two weeks, markets in the southern part of the country are still seeing the largest decline. Still, we find that market conditions are not significantly different in most markets, regardless of region.

A few months ago, we examined “length of haul” to provide a deeper dive into some of the drivers of loosening capacity. Specifically, while demand for local runs has continued to be strong, demand for longer lengths of hauls has not increased even as imports remain strong. A variety of factors could be driving this difference: shippers may have inventory levels that don’t require longhaul shipping, so it’s possible that the freight that’s moving is just being shuffled around in closer warehousing markets.

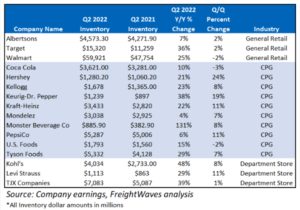

Source: Information collected by FreightWaves based on publicly reported financial information

Inventory levels have been making headlines for a few months, especially at several large retailers. Last week, Walmart took center stage when they announced that they were canceling billions of dollars’ worth of orders to “right-size” and get on track with current demand. This is in sharp contrast to a time not long ago, when many retailers were struggling to get inventory on the shelves. It was only a year ago that so many headlines lamented retailers’ struggles to maintain inventory to accommodate their demand. The notable thing that jumped out at me is the time it will apparently take for Walmart to right-size: not just months, but several quarters. And it isn’t just Walmart experiencing excessive inventories; a number of other large retailers have reported a similar situation.

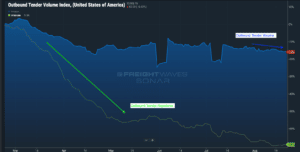

Source: FreightWaves, SONAR

How Loose Can the Truckload Markets Get?

As we approach peak retail season, many carriers are hoping for an increase in volumes. While shippers may also be preparing for an increase in volumes, many shippers are also hopeful that capacity will continue to be as cost effective as it has been through the second half of summer. No one has a crystal ball to answer this, and– even though we can look to historical patterns to predict the future– we have learned during the past few years that volatility can strike without warning.

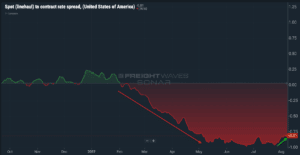

As I look to refine my predictions, I’m drawn back to a point I raised several times through the spot market downfall we witnessed over the past few months. Shippers will likely take this opportunity to reverse the tables and reprice contract rates, just as carriers chose to do earlier in the pandemic when the spot market was jumping off the rails.

Let’s look at two key measures that stand out: linehaul spot rates (where the rate decline has been slowing) and contract linehaul (where the decline in rates has been accelerating). It seems that shippers have been very successful in repricing and driving down contract costs. The closer spot and contract rates become, the potential for additional freight moving via the spot market climbs. I wouldn’t be too worried on that point, though. Thus far, we haven’t seen an increase of contract freight being pushed into the spot market. Peak season is right around the corner and yes, we should expect some volatility . . . but I wouldn’t be surprised if the truckload market manages to absorb the holiday volume surge without a desperate race to find trucking capacity.

Source: FreightWaves, SONAR

The Long and the Short of Length of Haul

How might this impact truckload markets? Retail goods make up a large portion of volume moved on trucks, and with such high inventories and slowing consumer demand, this will spill over to truckload markets– in fact, it already has. My earlier callout (re: length of hauls) is one correlation, as shippers seem to be repositioning inventory or moving imported goods to nearby warehousing markets. This is the opposite of what we saw when inventory levels were low and shippers were leaning heavily on over-the-road carriers to move goods as quickly as possible. Keep in mind: the shorter the haul, the less time a driver is attached to one shipment. A driver can do multiple local runs in a day, or one cross-country load over five days . . . an equation that is one of the most significant drivers of capacity.

Volatility can be around any corner, especially as we enter the height of hurricane season. Weather events that cause natural disasters– such as the deep freeze in the south during Q1 of 2021– can dramatically shift supply chains and turn freight markets upside down. Even as most predict a less demanding peak season for over the road, supply chain constraints at ports or on the rails might leak over to the truckload sector.

The movement of freight is changing in every mode, as shippers do their best to keep up with record demand while fighting congestion at multiple points throughout the supply chain. Shippers who think forward, use data and think outside the proverbial box on solutions, while partnering with companies such as Transfix, will come out of this ongoing freight rally in a better position and well ahead of competitors. The one huge win through this pandemic has been speeding up the digital transformation of the transportation industry.

With the uncertainty and volatility surrounding the U.S. economic recovery, shippers need a partner that can help them adapt and excel — no matter the circumstance. Shippers turn to Transfix for our leading technology and reliable carrier network. As volumes drive higher, we are here to help: Learn more about our Core Carrier program and Dynamic Lane Rates. As part of our ongoing market coverage, we’ll continue to provide breaking news, resources and insight into emerging trends and the pandemic’s impact on the transportation industry.

Disclaimer: All views and opinions expressed in this blogpost are those of the author and do not necessarily reflect the views or positions of Transfix, Inc. or any parent companies or affiliates or the companies with which the participants are affiliated, and may have been previously disseminated by them. The views and opinions expressed in this blogpost are based upon information considered reliable, but neither Transfix, Inc. nor its affiliates, nor the companies with which such participants are affiliated, warrant its completeness or accuracy, and it should not be relied upon as such. In addition, the blogpost may contain forward-looking statements that are not statements of historical fact. All such statements are based on current expectations, as well as estimates and assumptions, that although believed to be reasonable, are inherently uncertain, and actual results may differ from those expressed or implied. All views, opinions, and statements are subject to change, but there is no obligation to update or revise these statements whether as a result of new information, future events, or otherwise.