Pre-Summer Heat on its Way for Freight

National average rates have been holding steady for the past 10 days or so, but many signs point to a potential drive-up in rates in the coming weeks. Produce season is well on its way, and southeast and border states are starting to draw in more capacity. These markets will only see increases in freight, rates and load-to-truck ratios.

“As we head into May, the freight market is heating up, and we could be in for a wild start to the summer,” says Justin Maze, Transfix’s senior manager of carrier account management. “Last week, we talked about the many ports throughout the U.S. that have set import records. There is no sign imports will slow down, and all this freight needs to be moved relatively soon. Retail inventory levels are still struggling to gain ground and keep up with demand, as strong consumer buying continues.”

“We could see volumes hold strong for months, putting pressure on rates and tender acceptance, with imports moving over the road to their destinations,” Maze says. “Again, this displaces capacity, with surges coming from both produce and imports inflating volume in multiple regions around the country at once. Shippers face another roadblock to capacity: Flatbed and specialty trailer volumes and rejections are beginning an uphill climb, which could take drivers out of van and reefer capacity.”

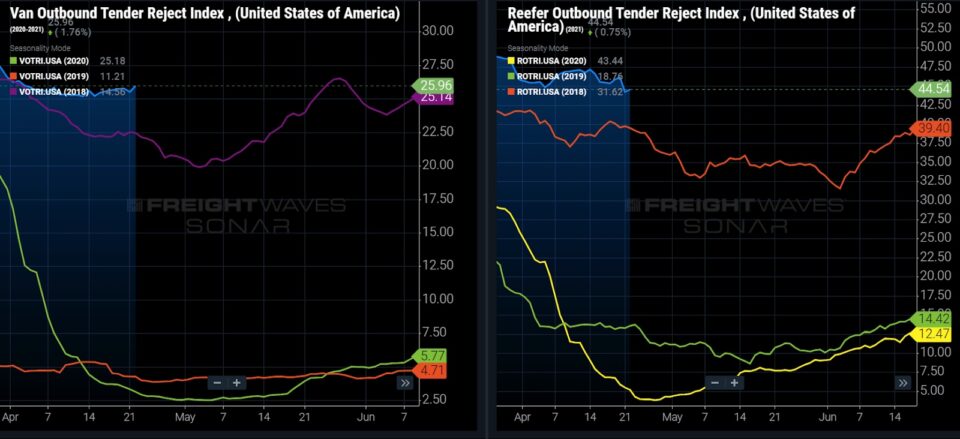

According to FreightWaves, the National Outbound Tender Reject Index (OTRI) did not move much this past week, continuing to hover just below 26%. Dry van comes in at 25.96%, while reefer sits at a sky-high 44.54%.

As we’ve been reporting for many months, the biggest issue for carriers that are trying to build capacity remains filling their seats with drivers. “Many of our carrier partners say they have too much of their fleet sitting idle,” Maze says. “They are struggling to seat their trucks and turn them into revenue producers. Lack of drivers and driver turnover is hurting small and medium fleets, and they are competing with large fleets, which are able to offer pay increases, bonuses and new equipment to entice drivers. Many people in the industry continue to point to new truck orders as a sign of relief; I have serious questions about this, as so many trucks are already sitting without drivers. The industry really needs support on driver recruitment and retainment.”

March SA Truck Tonnage Index Down Year Over Year

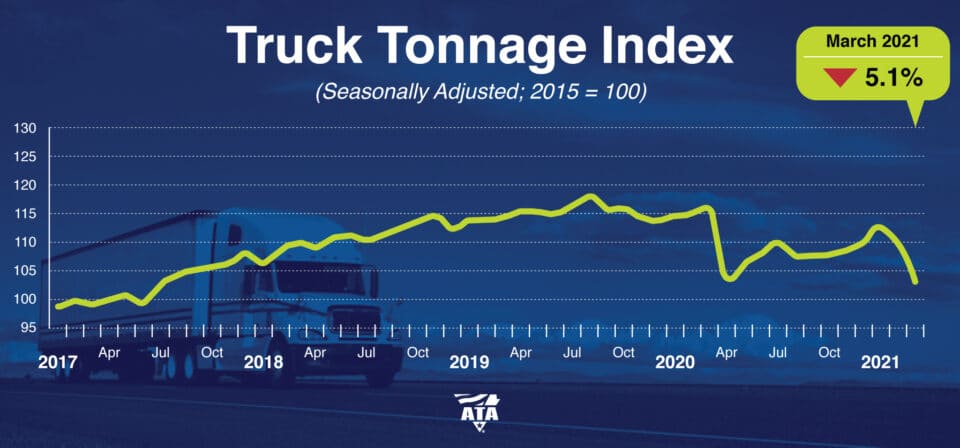

American Trucking Associations’ (ATA) advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index decreased 5.1% in March after falling 2.3% in February. In March, the index equaled 106.8 (2015=100), compared with 112.5 in February.

“March’s drop comes as somewhat of a surprise,” said ATA Chief Economist Bob Costello. “I certainly heard from many fleets that the end-of-quarter rush was good, but early March was soft. Truck freight volumes were also negatively impacted by supply chain issues from the lack of microchips and other inputs. That said, this surprise to the downside does not change my positive outlook going forward. Household spending power is strong, and I believe there is plenty of pent-up demand for consumer spending. Single-family home construction and stronger manufacturing output, even with the supply chain issues, will help support tonnage through this year and beyond.”

Compared with March 2020, the SA index fell 9.5%, which was preceded by a 3.8% year-over-year decline in February. During the first quarter, seasonally adjusted tonnage fell 0.4% from the final quarter of 2020 and declined 5% from a year earlier.

It’s important to note two things, however: First, March’s unadjusted index, which represents the change in tonnage actually hauled by the fleets, was 8.9% above the February level. Second, ATA’s For-Hire Truck Tonnage Index is dominated by contract freight, as opposed to spot market freight.

With the uncertainty and volatility surrounding the U.S. economic recovery, shippers need a partner that can help them adapt and excel — no matter the circumstance. Shippers turn to Transfix for our leading technology and reliable carrier network. As volumes drive higher, we are here to help: Learn more about our Core Carrier program and Dynamic Lane Rates. As part of our ongoing market coverage, we’ll continue to provide breaking news, resources and insight into emerging trends and the pandemic’s impact on the transportation industry.