The Transfix Take Podcast: Week of July 12

No Surprises Following Fourth of July

The week following the July 4 holiday ushered in some relief in the overall freight market, following near-record highs in tender rates, rejections and volume.

“We expected the days immediately following the holiday weekend to be tight, as some shippers chose to push volume past the end of month and holiday to save costs and try for better capacity,” says Justin Maze, Transfix’s senior manager of carrier account management. “That is exactly how it played out. The latter half of the week showed even more signs of loosening capacity, as the market starts to soften ahead of the middle weeks of July. The Southeast has been tight since produce season began a couple of months ago, driving into record imports throughout multiple ports of entry, and particularly high demand in Georgia. We are finally seeing signs of relief.

“This week, we should start seeing more relief in most of the southeast markets, though the largest markets of Atlanta and Savannah will continue to have capacity issues. Shippers should enjoy a few weeks of capacity softness throughout the country (pending weather events). In addition to looser capacity in the Southeast, they may get lucky and start seeing meaningful capacity relief in the South, as well. The top freight markets by volume continue to be tight, along with some of the markets around larger U.S. ports. Shippers should try to take advantage of the available relief and monitor what will come next. We’ll likely see traditional tightening in the Midwest at the end of the summer.”

It’s interesting to note that the national average shipping rate was very slightly lower in June than it was in May — we traditionally see significantly higher rates in June. The same factors we’ve been calling out week after week haven’t changed on the demand side: Imports continue to show signs of extreme strength on both coastlines, and sales-to-inventory ratios remain low. And as we noted last week, even though the U.S. may be inching back to normal after the pandemic, other parts of the world are showing troubling signs that could affect the freight market.

Diesel Prices Soar

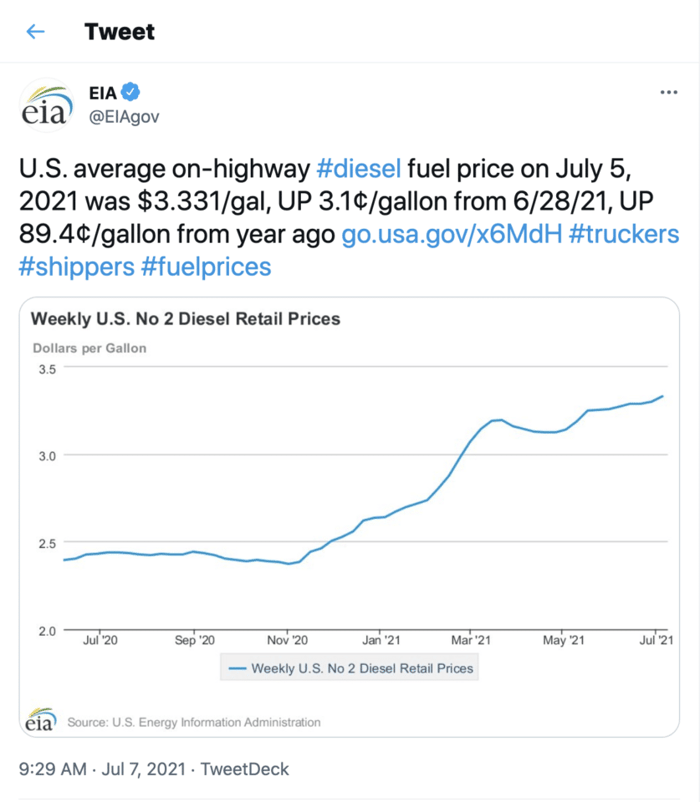

The national average price for a gallon of on-highway diesel fuel hit $3.331 last week, marking the highest price since November 2018. According to the Energy Information Administration, the price of trucking’s main fuel has increased for 10 consecutive weeks and now costs 89.4 cents more than it did at the same time last year.

Highway Bill With Insurance Mandate Increase Passes House

Earlier this month, the U.S. House of Representatives “passed a highway reauthorization bill that includes a provision to raise trucking insurance liability from $750,000 to $2 million, mandates automatic braking on new trucks and increases scrutiny of truck dispatch services,” FreightWaves reports.

While industry representatives came down on both sides, if the bill eventually becomes law with the insurance-increase provision intact, it will have a big effect on small-business truckers. It could be a catalyst for rate increases, and it could even push smaller owner-operators off the road.

With the uncertainty and volatility surrounding the U.S. economic recovery, shippers need a partner that can help them adapt and excel — no matter the circumstance. Shippers turn to Transfix for our leading technology and reliable carrier network. As volumes drive higher, we are here to help: Learn more about our Core Carrier program and Dynamic Lane Rates. As part of our ongoing market coverage, we’ll continue to provide breaking news, resources and insight into emerging trends and the pandemic’s impact on the transportation industry.